Closing a company sounds simple until compliance comes knocking. Many businesses simply stop operating yet remain legally active, triggering annual filings, late fees, and unwanted notices from the Ministry of Corporate Affairs (MCA). This silent exposure often goes unnoticed until penalties pile up. That is where the STK-2 Form becomes essential.

When filed correctly at the appropriate time, it helps promoters exit responsibly and reduce long-term compliance risk. This blog explains when STK-2 applies, the conditions a company must meet, and how to complete the filing process correctly from start to finish.

What is the STK-2 Form?

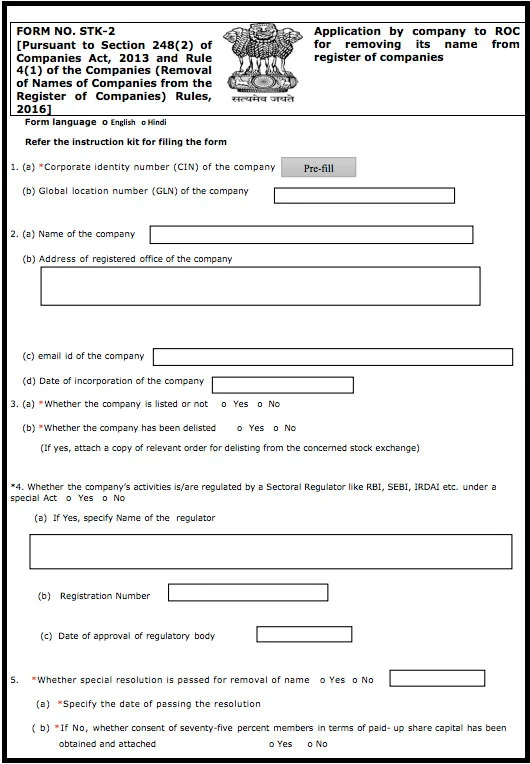

Companies file the statutory Form STK-2 with the MCA to voluntarily strike off their name and wind up a company that is inactive or no longer required. They file it under Section 248(2) of the Companies Act, 2013, along with the relevant MCA rules and notifications. Businesses use this form when they want to formally close an inactive or defunct company in a legally compliant manner.

You typically file the MCA STK-2 Form to:

- Apply for voluntary strike-off of an inactive or non-operational company

- Avoid continued statutory filings and late fees

- Close a company that has no assets or liabilities

- Ensure a clean and lawful exit under the Companies Act, 2013

Filing STK-2 allows a company to notify the Registrar of Companies (ROC) that it has ceased operations or does not intend to carry on business. Once the ROC approves, it removes the company’s name from the MCA records.

Submitting the STK-2 Form correctly also helps companies:

- Eliminate future compliance burdens and penalties

- Prevent regulatory notices for non-filing

- Maintain proper closure records for promoters and directors

- Reduce legal and financial risks after business closure

A properly filed STK-2 application ensures transparency in the company strike off in India and protects directors from future compliance issues.

Who Needs to File the STK-2 Form?

Not every company is eligible to file the STK-2 Form. It is used when promoters or directors decide that the company should no longer continue its operations.

Companies that may file STK-2 include:

- Private Limited Companies that are inactive, non-operational, or no longer required.

- Public Limited Companies that meet the eligibility conditions for voluntary strike-off.

- Section 8 Companies, subject to additional approvals from the relevant authorities.

Situations that commonly trigger STK-2 filing are:

- The company has not commenced business since its incorporation.

- The company has ceased business activities for a prolonged period (at least two continuous financial years).

- The company has no assets and no liabilities.

- Promoters wish to close an inactive or dormant company to avoid ongoing compliance.

However, a company cannot file STK-2 if it:

- Has pending litigation or regulatory proceedings.

- Has outstanding liabilities, loans, or creditor dues.

- Has carried out business activity in the preceding year prescribed by law.

- Is under inspection, inquiry, or investigation by any authority.

By filing the STK-2 Form correctly and after meeting all eligibility conditions, companies can achieve a clean and compliant exit.

Documents Required to File STK-2 Form

Before filing the STK-2 Form, a company must ensure that all prescribed documents related to voluntary strike-off are properly prepared.

The commonly required documents include:

- Board Resolution approving the voluntary strike-off of the company and authorizing a director to file Form STK-2

- Special Resolution passed by shareholders or consent of at least 75% of members (in terms of paid-up share capital)

- Indemnity Bond (Form STK-3) executed by all directors

- Affidavit (Form STK-4) from all directors confirming the company has no liabilities

- Statement of Accounts showing nil assets and liabilities, certified by a Chartered Accountant, not older than 30 days

- Copy of PAN of the company

- Digital Signature Certificate (DSC) of the authorized director

Depending on the company’s status, additional documents may be required, such as:

- Approval from regulatory authorities (to strike off Section 8 companies or regulated entities)

- No Objection Certificate (NOC), if applicable

Companies should carefully review all attachments to ensure consistency between the form and supporting documents. Accurate documentation is critical, as any discrepancy may lead to rejection or resubmission by the ROC.

How to File the STK-2 Form?

Closing a company through the STK-2 Form is not a single-step action. It follows a defined MCA process that validates eligibility, documents, and intent before approval.

Here is the step-by-step process to file the STK-2 form:

Step 1: Ensure Eligibility for Strike-Off

Confirm that the company:

- Has not commenced business or has ceased operations

- Has no assets and no liabilities

- Is not involved in any litigation, inspection, or investigation

- Has completed all pending statutory filings up to the date of closure

Step 2: Pass Board and Shareholder Resolutions

- Convene a Board Meeting to approve the strike-off proposal and authorize a director to file Form STK-2

- Obtain approval of shareholders by passing a Special Resolution in accordance with Section 114 of the Companies Act, 2013. You can also do it by securing the consent of at least 75% of members (based on paid-up share capital)

Step 3: Prepare Required Documents

Arrange all mandatory attachments, including:

- Indemnity Bond (Form STK-3)

- Affidavit (Form STK-4)

- Statement of Accounts certified by a Chartered Accountant

- Certified copies of resolutions and other supporting documents

Refer to the “Documents Required to File STK-2 Form” section above for the complete list and specific requirements.

Step 4: File Form STK-2 on MCA Portal

- Log in to the MCA portal using valid credentials.

- Select Form STK-2 from the e-Forms section.

- Enter the Company Identification Number (CIN) and other required details.

- Upload all prescribed documents in the correct format.

Step 5: Pay the Prescribed Fees

- Pay the prescribed Form STK-2 fees as specified by the MCA.

- Ensure successful payment before submission.

Note: The prescribed government fee for Form STK-2 filing is ₹10,000 for companies, including private limited companies. Ensure you check the MCA portal for any updates or exceptions before submission.

Step 6: Submit and Track the Application

- Submit the form using the DSC of the authorized director.

- After submission, the ROC examines the application and raises queries if needed.

Step 7: Publication and Final Strike-Off

- If satisfied, the ROC publishes a public notice on the MCA website and in the Official Gazette.

- After the notice period, the ROC strikes the company’s name off the Register of Companies.

In certain situations, stakeholders can strike-off a company and restore it by applying to the National Company Law Tribunal (NCLT) if they meet the statutory conditions for restoration.

Following this process carefully ensures a smooth and compliant closure of the company. Any errors or missing documents may delay approval or lead to rejection of the STK-2 application.

Common Mistakes While Filing STK-2 Form and Tips to Rectify Them

Filing the STK-2 Form may appear straightforward, but even minor errors, like a mismatch in dates, can result in objections, delays, or rejection by the Registrar of Companies (ROC). Understanding common mistakes helps ensure a smooth and compliant company strike-off process.

- Filing Without Meeting Eligibility Conditions: Companies often apply for STK-2 without confirming eligibility, such as having pending liabilities, active bank accounts, or ongoing litigation. Always ensure the company meets all strike-off conditions before filing.

- Submitting Incomplete or Incorrect Documents: Missing or wrongly executed documents like Form STK-3, Form STK-4, or the Statement of Accounts can lead to rejection. Use a checklist and verify that all documents are properly signed, notarized, and dated.

- Statement of Accounts Not Certified or Outdated: The statement of accounts must be certified by a Chartered Accountant and should not be older than the prescribed period. Submitting outdated financials is a common reason for ROC objections.

- Mismatch in Dates or Information Across Documents: Inconsistencies in dates mentioned in resolutions, affidavits, and the STK-2 Form create red flags during scrutiny. Ensure all details align across documents before submission.

- Non-Closure of Bank Accounts and Liabilities: Failing to close bank accounts or settle dues before filing STK-2 may result in rejection. Confirm that the company has no assets or liabilities at the time of application.

- Skipping Final Review Before Submission: Overlooking minor errors in form fields or attachments often leads to resubmission. Conduct a thorough final review to ensure accuracy and completeness.

RegisterKaro’s professionals use a proven STK-2 filing approach based on real MCA and ROC experience. Our team prepares applications the way authorities expect them, which reduces objections and avoids resubmissions. This hands-on expertise ensures faster approval and a fully compliant company strike-off.

Frequently Asked Questions

The STK-2 Form allows voluntary strike-off of a company and allows it to legally remove its name from the Ministry of Corporate Affairs (MCA) records. Filing ensures that the company exits cleanly, avoids future compliance obligations, and prevents penalties for inactivity. By submitting the form correctly, companies maintain transparency and fulfill statutory requirements under the Companies Act, 2013.