Many people start a business with their friends or family. But what happens when decisions clash, or profits don’t match? This is where a partnership deed steps in to save the relations. Understanding the different types of partnership deeds can protect your business from conflicts and confusion.

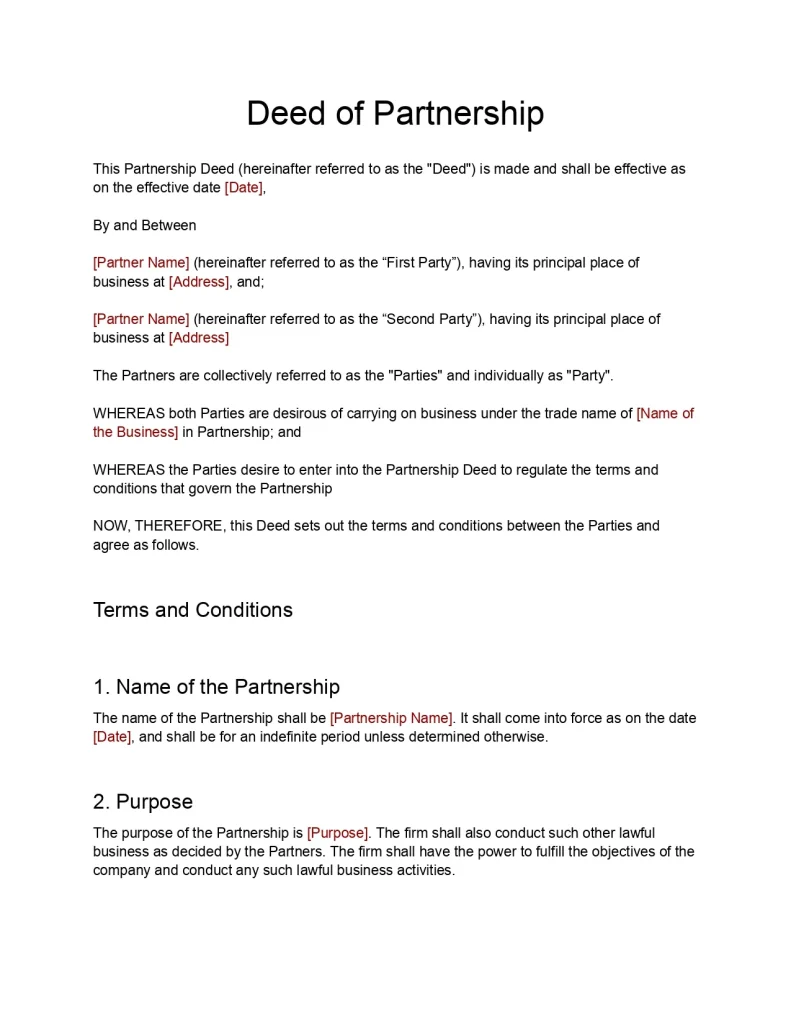

A partnership deed is a legal agreement that clearly defines each partner’s role, responsibilities, and share of profits. It protects partners from disputes, sets rules for decision-making, and outlines liability in a partnership firm.

In simple terms, a partnership deed turns a verbal agreement into a clear, enforceable contract. Whether you form a partnership firm, LLP, or joint venture, a well-drafted deed ensures smooth operations and legal protection.

Some famous partnership deed examples are the early agreements of HP, Ben & Jerry’s, and the Wrigley Company. These clearly defined roles, profit-sharing, and responsibilities to avoid conflicts and support business growth.

In this blog, we’ll break down the different partnership deed types and their features. By the end, you will be able to pick the right one for your business with confidence.

What Does a Typical Partnership Deed Contain?

A partnership deed is the backbone of any partnership. A well-drafted deed protects partners from disputes and legal issues. Most agreements follow a standard partnership deed format to ensure clarity and legal enforceability. Some partnership deed clauses are:

- Names and Details of Partners: Lists all partners with their addresses and identification.

- Business Name and Purpose: Defines the firm’s name, nature of business, and objectives.

- Capital Contribution: Specifies each partner’s investment in cash, assets, or property.

- Profit and Loss Sharing: Explains how profits and losses will be distributed.

- Roles and Responsibilities: Details each partner’s duties, powers, and obligations.

- Decision-Making Process: Outlines how business decisions are made and voting rights.

- Dispute Resolution: Sets procedures for handling conflicts, such as mediation or arbitration.

- Duration and Termination: Mentions the partnership’s duration and conditions for dissolution.

- Admission or Exit of Partners: Explains how new partners join, or existing partners leave.

- Interest on Capital or Loans: Specifies interest terms if partners contribute loans or capital.

- Salary or Remuneration: States any payments to partners for managing or working in the business.

- Withdrawal of Funds: Rules for partners to draw money from the business.

- Duties on Death or Insolvency: Defines procedures if a partner dies or becomes insolvent.

- Non-Compete and Confidentiality Clauses: Prevent partners from competing with the business or sharing sensitive information.

- Books of Accounts and Audit: Explains record-keeping and auditing requirements.

- Amendments: Defines how changes to the deed are made.

Including all these clauses ensures clarity, avoids misunderstandings, and protects both the business and its partners. A thorough partnership deed acts as a solid reference in every situation.

Types of Partnership Deed

Choosing the right type of partnership deed is essential for smooth operations and legal protection. Each type has unique features, liability structures, and use cases. Here’s a detailed breakdown:

1. General Partnership Deed (GP)

The General Partnership Deed is the most common type. All partners actively manage the business and share equal responsibility.

Key Features:

- Clearly defines the roles and duties of all partners

- Outlines profit-sharing ratios

- Sets rules for decision-making and dispute resolution

- Easy to form and provides clear management responsibilities for all partners

Liability:

- Partners are jointly and severally liable

- Personal assets can be used to cover business debts

Limitations:

- Unlimited liability puts personal assets at risk.

- Disagreements between partners can disrupt operations.

- Raising large-scale external funding can be difficult.

This type of partnership works best for small shops, consultancies, and family-run businesses.

2. Limited Partnership Deed (LP)

The Limited Partnership Deed includes general partners who manage the business and limited partners who contribute capital only.

Key Features:

- Defines roles for general and limited partners

- Specifies profit-sharing for both types of partners

- Limits management rights for limited partners

- Allows passive investors to participate financially without daily involvement

Liability:

- General partners have unlimited liability

- Limited partners’ liability is restricted to their capital contribution

Limitations:

- Limited partners cannot influence management decisions

- General partners carry full risk

- More complex to draft than a general partnership deed

This type of partnership works best for businesses seeking external investors without giving them operational control.

3. Limited Liability Partnership (LLP) Deed

The LLP Deed combines partnership flexibility with the protection of a separate legal entity.

Key Features:

- Defines partner roles and profit-sharing ratios

- Recognized as a separate legal entity

- Allows flexible management structures

- Protects personal assets from business liabilities

Liability:

- Partners’ liability is limited to their capital contribution

- Personal assets are generally protected

Limitations:

- Requires formal registration

- Has compliance and reporting requirements

- Not suitable for very small informal businesses

This type of partnership works best for startups, professional services, and firms needing risk protection.

4. Project-Based Partnership Deed

This type of partnership forms for a specific project or objective and usually has a fixed duration.

Key Features:

- Defines project scope, objectives, and duration

- Sets profit-sharing and responsibilities for the project

- Dissolves automatically after project completion unless extended

- Provides clarity and structure for temporary partnerships

Liability:

- Liability is usually limited to project obligations

- Partners are accountable only as defined in the agreement

Limitations:

- Exists only for a specific period or project

- Not suitable for long-term business operations

- Partners have limited flexibility beyond the project scope

This type of partnership works best for construction projects, IT collaborations, events, or one-time business initiatives.

5. Fixed-Term Partnership Deed

This type of partnership is created for a specific, pre-agreed period. It automatically ends when the term expires unless partners agree to extend it.

Key Features:

- Defines a fixed duration for the partnership

- Outlines profit-sharing and roles during the term

- Provides clarity for temporary collaborations

- Includes clear rules for voluntary termination or winding up of a company

Liability:

- Partners have unlimited liability

- All partners share responsibility for debts and obligations

Limitations:

- Cannot continue beyond the agreed term without renewal

- Planning for long-term projects can be challenging

- Unexpected early exits can disrupt operations

This type of partnership works best for time-bound projects, seasonal businesses, or collaborations with a fixed timeline.

6. Partnership with Special Rights Deed

This type grants certain partners unique powers or responsibilities, such as managing or sleeping partners.

Key Features:

- Defines special roles, rights, and responsibilities

- Specifies profit-sharing and liability for different partner types

- Allows some partners to invest without managing daily operations

- Balances control and investment opportunities efficiently

Liability:

- Active partners carry full liability

- Sleeping partners often have unlimited liability under traditional partnership law, unless structured otherwise

Limitations:

- A complex structure can cause confusion

- Risk of conflicts between active and passive partners

- Requires careful drafting to avoid disputes

This type of partnership works best for businesses where some partners invest but do not participate in daily operations.

7. Partnership Deed Under Contractual Variations

This type is highly customizable to suit unique business needs.

Key Features:

- Includes buyout clauses, exit strategies, and special conditions

- Allows flexible profit-sharing arrangements

- Provides custom decision-making powers

- Protects the interests of all partners in complex setups

Liability:

- Defined according to partner roles in the contract

- Partners’ responsibilities vary as per the agreement

Limitations:

- More expensive and time-consuming to draft

- It can be difficult to enforce if overly complex

- Requires strong legal guidance

This type of partnership works best for complex businesses with multiple stakeholders or non-standard operational requirements.

Understanding the types of deeds helps you anticipate future changes and recognize when you might need to change the partnership deed.

How to Choose the Right Type of Partnership Deed?

Choosing the right partnership deed sets the foundation for smooth business operations and protects partners from future disputes. Here are some tips that can help you choose the right partnership deed:

- Identify your business type and size

- Decide how much liability you and your partners can take

- Determine whether all partners will actively manage the business

- Consider whether the partnership is temporary or long-term

- Check if investors will join without management involvement

- Review regulatory, compliance, and administrative overhead

- Assess your future growth plans and funding needs

- Choose a deed that clearly defines roles, responsibilities, and profit-sharing

Ready to start your partnership on the right foot? Register your partnership deed with RegisterKaro and ensure your business is legally protected from day one. Contact us today!

Registered vs Unregistered Partnership Deed

Under the Indian Partnership Act, 1932, partnerships can be registered or unregistered. Understanding the difference is crucial for legal protection and smooth business operations.

| Feature | Registered Partnership Deed | Unregistered Partnership Deed |

| Legal Status | Officially filed with Registrar of Firms; legally recognized | Not filed; still valid, but limited legal enforceability |

| Right to Sue | Partners can enforce the deed and sue third parties in court | Partners can only sue among themselves; they cannot sue third parties |

| Banking & Funding | Easier to open bank accounts and secure loans | May face difficulties in obtaining funds or formal recognition |

| Dispute Resolution | Provides stronger legal backing for resolving conflicts | Limited legal protection; disputes harder to enforce |

| Proof of Existence | Acts as official proof of partnership | Relies on internal records and agreements |

In short, registered deeds give legal protection and credibility, whereas unregistered deeds offer flexibility but involve higher risks. Choosing the right type ensures smooth business operations.

What Happens if There is No Partnership Deed or if It’s Poorly Drafted?

Not having a partnership deed or having a poorly drafted one can create serious problems for the partnership firm. Conflicts and confusion can arise over profit-sharing, roles, or decision-making. Without clear rules, even small disagreements can escalate into legal disputes.

A vague or missing deed can also lead to regulatory penalties if your business doesn’t meet legal requirements.

Key consequences include:

- Disputes between partners: Partners argue over roles, powers, and profit-sharing, harming relationships.

- Personal liability exposure: Partners may pay business debts from personal assets.

- Difficulty raising funds: Banks and investors hesitate to work with a firm without a proper deed.

- Unclear liability: Partners cannot gauge their personal risk, putting assets at stake.

- Complications in partner changes: Adding new partners, handling exits, or transferring ownership becomes costly and complex.

- Operational confusion: Lack of clarity slows decisions and creates miscommunication.

- Regulatory penalties: Authorities can impose fines or legal action for non-compliance.

A well-drafted partnership deed resolves these issues. It clarifies roles, protects partners, and keeps business operations smooth.

How to Draft a Partnership Deed in India?

Drafting a partnership deed is a crucial step to ensure smooth operations and avoid disputes among partners. While drafting, make sure to include all the key provisions of the partnership deed. These include capital contribution, profit-sharing, roles, liability, decision-making, dispute resolution, and exit strategies.

Here’s a step-by-step guide:

- Define the partnership: Specify the name, address, and nature of your business.

- List all partners: Include full names, addresses, and roles of each partner.

- Decide capital contribution: State how much each partner invests and the method of contribution.

- Specify profit-sharing: Clearly define how profits and losses are distributed among partners.

- Assign roles and responsibilities: Mention who will manage daily operations and who will be passive.

- Detail liability: Specify the extent of liability for each partner.

- Set rules for decision-making: Include voting rights and authority limits.

- Include duration and exit strategy: Define whether the partnership is fixed-term, project-based, or at will. Include rules for exit, retirement, or death of a partner.

- Address admission of new partners: Define conditions and approval process for adding new partners.

- Plan for disputes: Include a dispute resolution mechanism like mediation or arbitration.

- Mention regulatory compliance: Include registration details, tax obligations, and reporting responsibilities.

- Sign and notarize: Ensure all partners sign the deed. Notarization makes it legally enforceable.

Following this process to draft a partnership deed provides legal clarity, protects personal assets, and ensures smooth business operations.

Best Practices to Adopt for Drafting a Partnership Deed

- Keep the language clear and simple to avoid confusion.

- Review and update the deed periodically as the business grows.

- Include clauses for unexpected events, like partner exit, death, or insolvency.

- Ensure all partners read and understand the deed before signing.

- Seek professional legal guidance to make the deed compliant with laws.

- Keep multiple signed copies for reference and future disputes.

Don’t leave your partnership to chance. Get your partnership deed registered with RegisterKaro and secure your business legally in just a few steps.

Conclusion

A partnership deed protects your business and partners. It clarifies roles, responsibilities, and profit-sharing. It reduces disputes and secures personal assets. Choosing the right type of deed ensures smooth operations and legal compliance.

Draft it carefully, follow best practices, and update it as your business grows. A strong partnership deed sets the foundation for long-term success.

Frequently Asked Questions

Every partnership benefits from a deed because it clearly defines roles, responsibilities, profit-sharing, and liability. A deed prevents disputes and protects partners. Registration is not mandatory for a general partnership in India, but registering the deed gives legal recognition, helps in bank transactions, and secures the firm in case of legal issues.