When it comes to securing property or loans, a Deed of Trust plays a crucial role. It’s a legally binding document that establishes the trust between the borrower, lender, and trustee. But what does a Trust Deed represent, and why should you care about it?

In India, trust registration is often a key concern for property transactions. Whether you’re dealing with a family trust deed or an educational one, knowing the necessary clauses is essential. Have questions about the modification of the deed of trust or the amendment clause? We’ve got you covered.

This blog covers how to make a trust deed in India and amend a trust deed, along with the related legalities.

What is a Deed of Trust and Its Components?

A Trust Deed is a legal agreement used in property transactions. It involves transferring property ownership to a neutral third party, known as the trustee, to secure a loan or debt. This concept is often used in the US for property loans. However, in India, property loans are secured through mortgages, charges, or hypothecation, not through trustee-based foreclosure.

In the event the borrower fails to repay, the trustee has the right to sell the property and use the proceeds to pay the lender (beneficiary). It’s a way to ensure the lender’s protection.

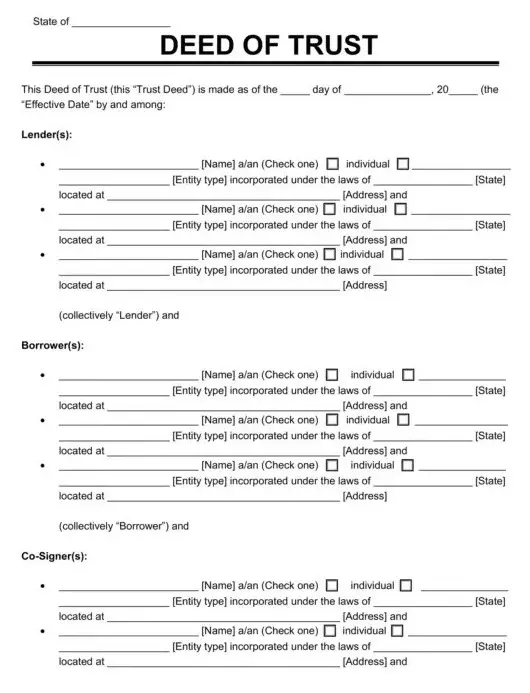

There are three main components in a Trust Deed:

- Trustor (Borrower): The person who takes out the loan and transfers the property title to the trustee.

- Trustee (Third Party): The neutral party who holds the legal title to the property until the loan is repaid.

- Beneficiary (Lender): The lender who benefits from the deed, receiving repayment in case of default.

Trust Deeds in India are used for:

- Private Trusts: These are created for personal purposes, usually for managing family assets.

- Family Trusts: Established to manage and protect family wealth for future generations.

- Charitable Trusts: Created to serve charitable purposes, typically focused on supporting social, educational, or religious causes.

- Educational/Religious Trusts: Used to manage assets for educational or religious purposes, often benefiting communities or institutions.

In simple terms, a Trust Deed functions much like a safety net. It’s commonly used in real estate deals to guarantee repayment and offer clear legal pathways if something goes wrong. Without this legal document, lenders face higher risks, and borrowers might struggle with securing loans.

How a Trust Deed Operates in India: A Step-by-Step Process

The trustee acts as an intermediary, holding the title to the property until the borrower repays the loan. Here’s how the process unfolds:

1. Execution Process

The process begins when the borrower takes out a loan to purchase property.

- The borrower receives funds from the lender to purchase property.

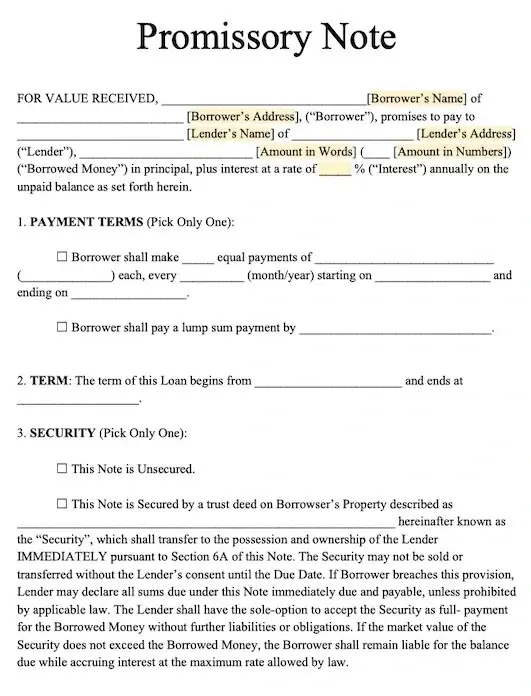

- The borrower signs a promissory note outlining the loan terms and repayment agreement.

- The borrower then transfers the legal title of the property to the trustee as collateral.

2. Legal Title vs. Equitable Title

The legal and equitable titles distinguish the rights of the borrower and the trustee.

- The trustee holds the legal title, meaning they have official ownership of the property.

- The borrower holds the equitable title, which gives them the right to possess and use the property.

- Once the loan is paid in full, the title reverts to the borrower.

3. Foreclosure Process

In case of default, the trustee has the right to take action and initiate foreclosure.

- If the borrower defaults on the loan, the trustee has the right to initiate a non-judicial foreclosure.

- The trustee cannot sell the property without court approval in India.

In conclusion, understanding the Trust Deed process helps clarify the roles and responsibilities of each party involved.

Legal Framework for Deeds of Trust in India

In India, property financing is traditionally based on mortgages and charges under the Transfer of Property Act, 1882. Unlike the Deed of Trust used in countries like the U.S., Indian law focuses on mortgages for securing loans. India follows its own framework for creating and managing trusts governed by laws such as the Indian Trusts Act, 1882, the Indian Succession Act, 1925, and the Income Tax Act, 1961.

The Indian Trusts Act, 1882 establishes the foundation for creating and managing private trusts. It clearly defines the roles of trustees and beneficiaries. The Act also specifies the rights and duties of each party involved. Trusts formed under this Act are mainly for private purposes. They must comply with legal requirements such as stamp duty and registration on non-judicial stamp paper.

The Indian Succession Act, 1925, governs the administration of estates, including the probate process. This is important for trusts involving deceased estates. On the other hand, the Income Tax Act, 1961, addresses tax exemptions for charitable trusts. It also establishes reporting requirements for income earned by trusts.

Do Indians Use Deeds of Trust?

Indians do not commonly use Deeds of Trust for property financing. However, they widely practice trust creation. People use trusts to manage estates, charities, or family assets. The trust deed format in India follows specific guidelines to ensure transparency, fairness, and legal compliance.

For example, debenture trust deeds and charitable trust deeds cater to specific needs. Debenture trust deeds secure loans issued through debentures. Charitable trust deeds manage assets meant for charitable purposes. Whether it’s a family trust deed sample or a public trust deed, each type has its own set of requirements and purposes. Trust registration is necessary to ensure the document’s legal validity.

How to Draft a Trust Deed in India?

When drafting a trust deed in India, it’s crucial to ensure that the document is clear, legally compliant, and meets all requirements. Here’s how to create a solid trust deed format:

- Identification of Parties: Clearly define the Settlor, Trustee(s), and Beneficiaries. Provide detailed personal information for each party involved. This eliminates any potential confusion later.

- Description of Trust Property: List all assets included in the trust. Include immovable property, bank accounts, investments, or any other assets that the trustee will manage.

- Terms of the Trust: Specify the rules under which the trust will operate. Include how the trustee will distribute assets, the trust’s duration, and any specific instructions from the Settlor. The trust deed must clearly state when and how the trustee will use assets according to the trust’s objectives.

- Powers of the Trustee: Define the trustee’s powers. This includes managing, investing, and distributing assets. Clearly outline what actions the trustee can take on behalf of the trust.

- Legal Compliance: Legal compliance depends on the state. Ensure the deed complies with the Indian Trusts Act and Income Tax Act. Follow legal requirements such as stamp duty and trust deed registration to ensure validity.

- Witnesses and Signatures: The Settlor, Trustee(s), and at least two witnesses must sign the trust deed. Execute the deed on non-judicial stamp paper to ensure legal validity.

A properly drafted trust deed protects both parties and the assets within the trust. Always ensure that the trust deed format aligns with legal requirements to avoid complications down the line.

How to Amend or Modify a Trust Deed?

Amending or modifying a trust deed in India is possible but requires careful documentation. The process involves several steps to ensure that the changes are legally valid and meet compliance requirements.

- Review the Trust Deed: Before making any changes, carefully review the original trust deed to understand its terms and clauses. This helps in identifying areas that need modification.

- Draft the Amendment: Prepare an amendment to the trust deed. This document must clearly state the changes and specify the reasons for modification.

- Approval by All Parties: All parties involved, including the settlor, trustee(s), and beneficiaries, must agree to the amendments. Their consent is necessary to ensure the legal validity of the changes.

- Legal Compliance: Ensure that the amendment complies with the Indian Trusts Act, 1882. It should also meet other legal requirements, like trust deed stamp duty, if applicable.

- Execution of Amendment: Once agreed, the amendment document should be signed by the concerned parties, and witnesses should be present. Depending on the trust’s nature, you may need to file the amendment with the local sub-registrar.

- Update the Trust Deed: After the modification is executed, update the trust deed to reflect the changes. Ensure the amendment is kept with the original deed for future reference.

Following the proper amendment of trust deed in India ensures that all modifications are legally sound and enforceable.

Key Factors to Consider When Creating a Trust Deed

When creating a trust deed, there are several important factors to consider. Proper planning ensures the trust functions as intended and remains legally valid.

1. Registration

While registration of a trust deed is not always mandatory, doing so with the local sub-registrar can offer legal protection. However, if the trust holds real estate assets, registration is mandatory. This step ensures the trust is legally recognized and protected.

2. Tax Implications

It’s important to understand the tax implications of creating a trust. This includes any exemptions available under the Income Tax Act for charitable or private trusts. Consult with a tax advisor or Chartered Accountant to ensure compliance with tax laws and to make informed decisions.

For personalized support and expert guidance on trust creation and tax compliance, contact RegisterKaro today.

3. Handling Disputes

A well-drafted trust deed can prevent conflicts among beneficiaries or family members. Clearly outlining procedures for handling disputes and any changes to the trust helps avoid legal complications in the future.

4. Review and Update

Regularly reviewing and updating the trust deed is crucial. Changes in personal circumstances, tax laws, or family dynamics may require adjustments to ensure the trust remains effective and valid.

Essential Clauses in a Trust Deed Format

Creating a Trust Deed involves outlining key clauses that ensure the trust operates smoothly and legally. These clauses provide clarity on the roles of all parties involved, the assets in the trust, and the duties of the trustees. Below are the essential clauses in a trust deed:

a. Trust Property and Corpus

This section outlines the key elements that define the assets and initial contributions within the trust.

- Trust Property: The assets included in the trust, which may include cash, real estate, or investments.

- Initial Endowment: The initial contribution made by the settlor to start the trust. This is usually a fixed sum of money or property.

b. Powers, Duties, and Obligations

Here we specify the roles and responsibilities of trustees, along with the rights of beneficiaries.

- Trustee Powers: Trustees have the authority to manage, invest, and distribute the trust’s assets, as outlined in the deed.

- Trust Objectives: Clear definitions of the trust’s purpose and how the assets should be used to fulfill that purpose.

- Beneficiaries’ Rights: Specifies the rights of the beneficiaries, including when and how they can access the trust’s benefits.

c. Term, Revocation, and Termination

This section covers the duration of the trust and the conditions under which it may be terminated.

- Trust Term: Defines the duration of the trust, which may be for a fixed period or until specific conditions are met.

- Revocation and Termination: Outlines how the trust can be revoked or terminated. This may occur upon the settlor’s decision, or if certain conditions are met, such as the fulfillment of the trust’s purpose.

Incorporating these clauses in your trust deed helps to ensure legal clarity and smooth operations. Always ensure compliance with the Indian Trust Act and the Income Tax Act when drafting or amending your trust deed.

Frequently Asked Questions

A Deed of Trust is a legal document used to transfer property ownership to a trustee as collateral for a loan. It involves three parties: the borrower, the lender, and the trustee. The trustee holds the title until the loan is repaid. If the borrower defaults, the trustee can sell the property.