“Digital trust is the new currency of the online world.” You experience it every time you file taxes, submit business documents, or bid for government tenders. A Digital Signature Certificate (DSC) builds that trust. It serves as your secure digital identity, protecting your documents from tampering. Understanding the difference between Class 2 and Class 3 digital signature certificates helps you choose the right security level.

This blog explains how Class 2 and Class 3 DSCs work, recent regulatory changes, and the purpose of using them. It also shows why Class 3 has become the preferred option for most online processes. By the end, you will know exactly which DSC fits your needs and how to choose it confidently.

What are the Different Classes of DSCs?

Digital Signature Certificates in India come in different “classes,” based on the level of identity verification and security. The Controller of Certifying Authorities (CCA) defines these classes and sets their guidelines.

Historically, India had three classes of DSCs:

- Class 1 DSC verified only basic user details, such as name and email. It offered the lowest level of security.

- Class 2 DSC verified the user’s identity using government-issued documents, such as PAN and Aadhaar. It worked for filings, registrations, and general online authentication.

- Class 3 DSC offered the highest security. It required strict verification and supported high-risk activities, such as e-tendering and e-procurement.

However, the system has changed. The CCA has phased out Class 1 and Class 2 in January 2021 for most official purposes. This shift was a part of a nationwide upgrade to strengthen digital security and reduce the risk of misuse. These older classes used moderate verification methods, which were no longer sufficient for modern high-risk portals.

Class 3 now serves as the standard for nearly all secure government and business transactions.

1. Class 1 DSC

Class 1 DSC verified basic user details, such as name and email. It provided the lowest level of security and worked for minimal authentication tasks. The CCA discontinued this DSC in January 2021 to strengthen digital security across high-risk online portals.

2. Class 2 DSC

Class 2 DSC verified the identity of individuals or businesses using PAN, Aadhaar, and other government documents. It provided moderate security for routine compliance tasks. The CCA discontinued Class 2 DSC on 1 January 2021. Existing certificates remained valid until expiry, after which users had to shift to Class 3 DSC.

3. Class 3 DSC

Class 3 DSC verifies identities using strict Aadhaar e-KYC, document checks, and mandatory video verification. It provides the highest security and supports both low- and high-risk online transactions, including e-tendering, MCA filings, GST, and income tax submissions.

Class 3 DSC now serves as the standard DSC for all secure government and business activities in India.

Key Differences Between Class 2 and Class 3 DSCs

Class 2 and Class 3 DSCs served different security needs, verification levels, and use cases. Understanding Class 3 vs Class 2 DSC differences helps users choose the right certificate.

| Feature | Class 2 DSC | Class 3 DSC |

| Purpose / Use Cases | Basic and moderate-risk online filings such as ITR, MCA, GST, PF, ESIC, and trademark filing | High-security and high-value transactions, including e-tendering, e-procurement, DGFT, ICEGATE, MCA, GST, and audits |

| Verification / KYC | Database-based verification using PAN, Aadhaar, and OTP; occasional video verification | Strict verification with Aadhaar e-KYC, document checks, and mandatory video verification |

| Security Level / Encryption | Moderate encryption, suitable for low-risk portals | Highest encryption, suitable for both low- and high-risk portals |

| Storage / Token | USB token or software-based storage | USB token or hardware-based secure storage |

| Accepted Portals | MCA, Income Tax, GST, PF, ESIC, trademark portals | All government and high-security portals, including e-tendering, e-auctions, ICEGATE, and DGFT |

| Cost | Lower cost, affordable for routine compliance | Higher cost due to advanced security and strict verification |

| Validity & Renewal | Usually 1–2 years; cannot renew after expiry (discontinued since 1 Jan 2021) | 1–3 years; renewable before expiry; currently issued and valid |

| Legal Validity / Implications | Legally valid when issued, but phased out; cannot be used after expiry | Legally recognized under the IT Act, 2000, it ensures enforceable signatures for all secure digital transactions |

| User Base | Individuals and organizations performing routine compliance | Individuals, organizations, vendors, professionals, and anyone accessing secure online systems |

| Risk / Misuse | Higher risk due to moderate verification | Very low risk due to strict verification and identity checks |

These differences make Class 3 DSC the only reliable and future-ready option for all secure digital filings and high-value online transactions in India.

Which Digital Signature Certificate Do You Need Today?

With Class 2 DSC discontinued, Class 3 DSC has become the standard for all digital authentication needs in India. The right certificate depends on your role and the type of tasks you handle.

1. For Individuals

If you file Income Tax returns, submit GST forms, or handle MCA, PF, or ESIC filings, you need a Class 3 DSC. It ensures secure authentication and legal validity of your digital signatures. Without it, you cannot access these portals or submit official documents online.

2. For Businesses

Companies participating in e-tendering, e-procurement, or online bidding must use a Class 3 DSC. This certificate offers the security and verification needed for high-value transactions and government portals. All business filings and contracts now rely on Class 3 signatures for legal compliance.

3. For Professionals

Chartered accountants, company secretaries, tax consultants, and other professionals must use Class 3 DSC. It helps them file client returns, handle MCA documents, and manage secure business approvals. Class 3 DSC builds trust and reduces the chance of rejection on official platforms.

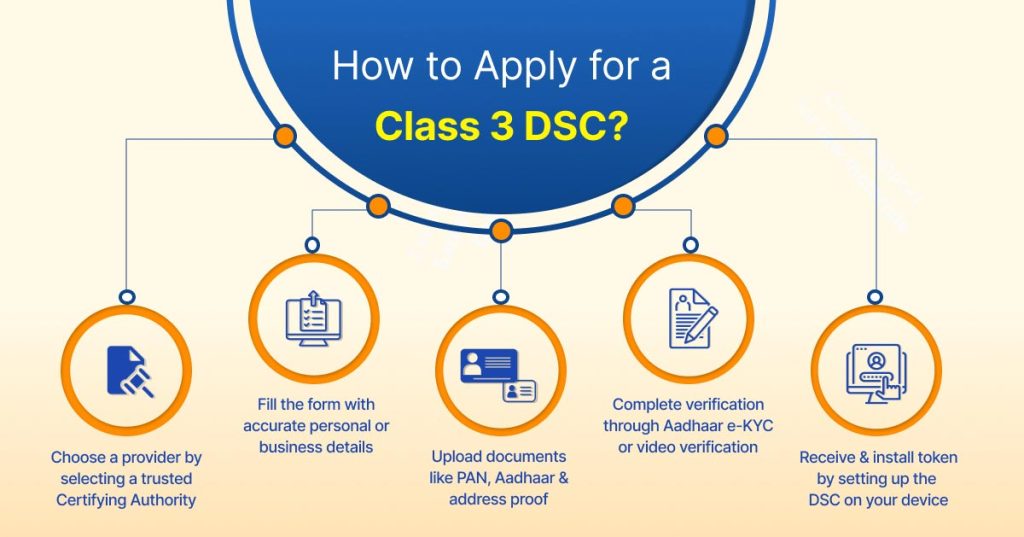

How to Apply for a Class 3 DSC?

Applying for a Class 3 DSC is simple if you follow the correct steps:

- Choose a provider: Select a trusted Certifying Authority or service like RegisterKaro.

- Fill the application: Complete the online DSC application form with accurate personal or business details.

- Upload documents: Submit identity proof (PAN, Aadhaar), address proof, and any business documents if applicable.

- Complete verification: Finish Aadhaar e-KYC, OTP confirmation, or live video verification as required.

- Receive the token: After approval, receive the USB token or secure software-based DSC.

- Install DSC: Follow instructions to install the DSC on your computer or browser.

Renew your Class 3 DSC before it expires to maintain access to all portals. Submit updated documents if needed and complete e-KYC or video verification. Once approved, you receive the renewed token or certificate.

Tips for Smooth Application

- Complete the video KYC carefully to avoid delays.

- Ensure all documents are valid and legible.

- Apply well before deadlines for MCA, GST, or tax filings.

- Avoid mistakes in personal or company details, which may cause rejection.

Final Thoughts

Class 3 DSC now serves as the standard for all digital signatures in India. It offers strong security, legal validity, and broad acceptance across government and business portals. Understanding DSC Class 2 and Class 3 differences helps users make the right choice. Whether you are an individual, business, or professional, using a Class 3 DSC ensures safe, reliable, and legally recognized online transactions.

Frequently Asked Questions

A Digital Signature Certificate (DSC) is an electronic proof of identity used to sign documents digitally. It ensures data integrity, authentication, and non-repudiation. DSCs are mandatory for filing Income Tax, GST, MCA forms, and participating in e-tendering or online bidding in India.