How Much Does it Cost to Register a Company in Dubai?

Setting up a business in Dubai has become one of the most attractive opportunities for Indian and international entrepreneurs, especially for those seeking a low-cost business setup. However, before you set up a business in UAE, one of the first questions every entrepreneur should ask is:

“How much will I need to spend to set up a company in Dubai?”

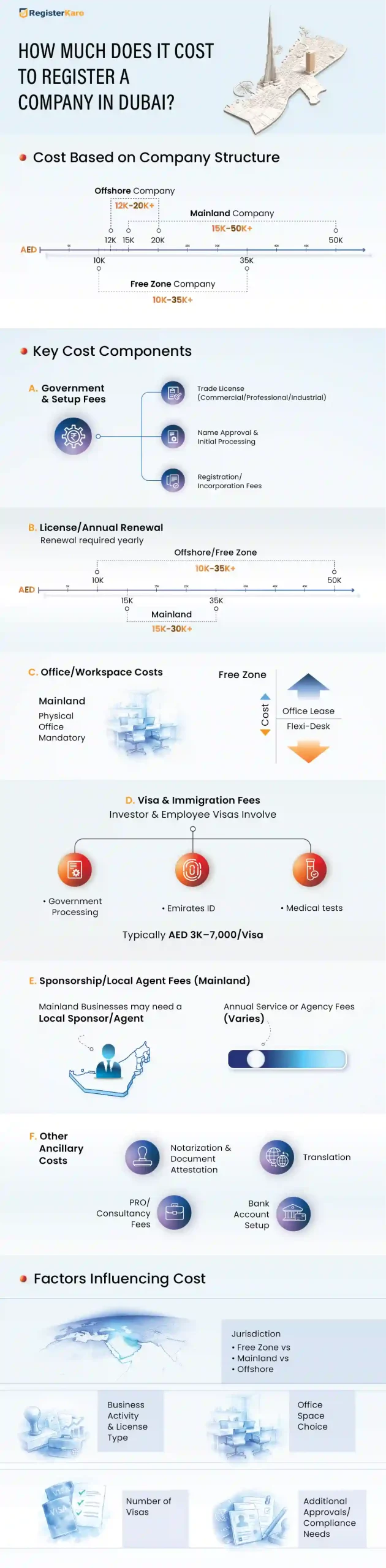

The truth is, company registration costs in Dubai can vary widely depending on several factors. Whether you choose a Mainland, Free Zone, or Offshore setup, expenses will fluctuate based on your business activity, license type, and ancillary requirements such as office space, employee visas, and other regulatory fees.

This guide provides a comprehensive overview of Dubai company registration fees in 2025, helping Indian and other international entrepreneurs plan their budget effectively. We’ll break down costs by zone and business structure, offering a clear roadmap for a smooth business journey.

What are the Key Components of Dubai Company Registration Costs?

When planning a low-cost business setup in Dubai, it’s important to know how the company registration fees are structured. Here’s a detailed breakdown of the main cost components:

1. Registration / Incorporation Fee (One-Time): This one-time fee is paid during company formation. For example, the DMCC registration fee is AED 9,020, covering initial documentation, name approval, and incorporation formalities.

2. License Fee (Annual): Every business in Dubai must obtain and renew a trade license annually to operate legally.

- Free Zone License: Ranges between AED 10,000–50,000, depending on the zone, business activity, and license type (commercial, professional, or industrial).

- Mainland License: Typically costs between AED 15,000–30,000, influenced by the Emirate, office size, and business sector.

3. Office / Flexi-Desk Space Cost: Many Free Zones require an office or flexi-desk setup. Costs vary based on location, type of office, and included amenities.

4. Visas & Immigration Costs: The number of investor, partner, and employee visas directly impacts the business setup in Dubai costs, as each visa involves government and administrative fees.

5. Local Sponsorship / Agent Fees (Mainland): Mainland companies often require a local sponsor or agent, which may involve annual service fees or profit-sharing arrangements.

6. Renewal / Ongoing Compliance Costs: Annual renewals for licenses, visas, and other regulatory compliance are recurring expenses to account for.

7. Hidden / Ancillary Costs: Additional costs may arise during setup, including name approval, Tasheel registration, MOA notarization, and other miscellaneous fees.

By knowing these components, entrepreneurs can better estimate the Dubai company registration fee, ensuring a well-planned and budget-friendly business setup.

Breakdown of Dubai Company Registration Costs by Business Zone

The cost of company registration in Dubai can vary widely depending on the type of business setup you choose. This variation arises because each setup, Mainland, Free Zone, or Offshore, offers different ownership structures, trading rights, visa benefits, and compliance requirements tailored to specific business needs.

Here’s a detailed breakdown of the typical Dubai company registration fees for each setup type, with special considerations for Indian entrepreneurs:

1. Free Zone Company

A Free Zone company is ideal for entrepreneurs who want 100% foreign ownership, quick setup, and minimal compliance, provided they don’t need to trade directly in the UAE Mainland. They are generally the most cost-efficient option for a low-cost business setup in Dubai.

- Sample Costs: Free Zone setup starts from approximately AED 10,000.

- DMCC Example: Registration + license + other applicable fees may increase the total, depending on business activity.

- For Indian Users: With the current exchange rate (~1 AED ≈ ₹22.8), budget planning in INR helps simplify financial planning.

Key Message: When you set up a Free Zone company in Dubai, you benefit from quick incorporation, tax advantages, and full ownership, making it the most affordable choice if local trading is not required.

2. Mainland Company

Mainland companies allow direct trading in the UAE market, but involve higher Dubai company registration fees due to additional requirements.

- Sample Costs: Costs usually start from AED 15,000 to AED 50,000, depending on business activity, office location, and license type.

- Cost Breakdown: Includes office space, trade license, local sponsor fees, and visas.

- For Indian Entrepreneurs: Check local sponsor/shareholding requirements carefully, as these can affect both cost and compliance.

Did You Know? As of 2025, most Mainland businesses in Dubai can enjoy 100% foreign ownership, removing the need for a local sponsor in many sectors.

3. Offshore Company

Offshore companies offer a lower-cost entry point but are limited to international business; they cannot conduct trading within the UAE.

- Sample Costs: AED 12,000–20,000 for minimal offshore setup.

- Key Consideration: While cheaper upfront, offshore companies are restricted to global business and investment activities.

Additional Note: Offshore companies, such as those registered in RAK ICC or JAFZA Offshore, are best suited for international trade, asset holding, or investment purposes, but they cannot issue UAE residence visas or operate locally.

Here’s a quick comparison table to help you understand how costs and conditions differ across each Dubai business zone:

| Jurisdiction | Typical Entry Cost (AED) | Ownership Conditions | Trading Rights | Office Requirement |

| Free Zone | AED 10,000+ | 100% foreign ownership allowed | Mostly international trade; local trading limited | Flexi-desk or office varies by Free Zone |

| Mainland | AED 15,000–50,000+ | 100% foreign ownership possible for many activities; local sponsor may be required for others | Full local and international trading permitted | Physical office required |

| Offshore | AED 12,000+ | Usually 100% foreign ownership | No UAE local trading allowed; export/international activities only | Minimal or no office needed |

Dubai Company Setup Cost: Real-Life Case Study Examples

To make budgeting easier for Indian entrepreneurs planning to expand, let’s look at real-life scenarios showing the approximate cost in Dubai. These examples highlight the first-year expenses, including license, office, visa, and other key components.

Scenario 1: Free Zone Company

Free Zone companies are ideal for those who do not plan to trade in the UAE Mainland. They offer a low-cost business setup in Dubai while still providing a professional license and visa options.

Cost Components (Approximate):

| Component | AED | ₹ (~1 AED = ₹22.8) |

| Registration / Incorporation Fee | 9,020 | ₹2,12,000 |

| Free Zone License (Year 1) | 12,000 | ₹2,82,000 |

| Flexi-Desk Office | 5,000 | ₹1,17,500 |

| Investor Visa | 3,500 | ₹82,250 |

Total First-Year Cost: AED 29,520 ≈ ₹6,93,750

Key Insight: Free Zone setup offers a cost-efficient way to start a business in Dubai, particularly if you do not need Mainland trading.

Scenario 2: Mainland Company

Mainland companies are suitable for entrepreneurs who want to trade directly in the UAE market. However, this comes with higher Dubai company registration fees and additional compliance obligations.

Cost Components (Approximate):

| Component | AED | ₹ (~1 AED = ₹22.8) |

| Registration / Incorporation Fee | 10,000 | ₹2,35,000 |

| Mainland Trade License | 25,000 | ₹5,87,500 |

| Small Office Rent | 10,000 | ₹2,35,000 |

| Investor Visa | 3,500 | ₹82,250 |

| Local Sponsor / Agent Fee | 5,000 | ₹1,17,500 |

Total First-Year Cost: AED 53,500 ≈ ₹12,57,250

Key Insight: Mainland setup allows local trading but comes with higher costs and additional requirements, such as office space and a local sponsor.

Note: Indian entrepreneurs must also comply with the RBI’s Liberalised Remittance Scheme (LRS) when transferring investment funds to Dubai for company formation and operational expenses.

Why Does the Cost of Business Setup in Dubai Vary?

If you’re exploring a low-cost business setup in Dubai, it’s important to understand that not all expenses are fixed. The Dubai company registration fee and overall business setup cost in Dubai can vary widely depending on several key factors. Here’s what drives the differences:

1. Jurisdiction/Zone: Mainland vs Free Zone vs Offshore: The choice of business zone is a major cost determinant. Mainland, Free Zone, and Offshore setups have different fee structures, licensing requirements, and legal obligations. For instance, Mainland companies may require a local sponsor or physical office in some emirates, whereas Free Zones (DMCC, JAFZA) often include virtual or flexi-desk options.

2. Business Activity / Licence Type: Your business activity, such as trading, services, or industrial operations, affects the type of license required and its fees. Certain activities may attract higher registration costs due to additional regulatory requirements.

For example:

- A General Trading License (for import/export businesses) can cost between AED 15,000 – 25,000, depending on the Free Zone.

- A Professional/Service License (for consultancy or IT services) may cost around AED 10,000 – 15,000.

3. Office Space or Virtual/Flexi-Desk Requirement: Depending on the zone, you may need a physical office or opt for a virtual office/flexi-desk setup. This choice impacts the overall Dubai company registration fee.

4. Number of Visas Required: The number of investor and employee visas required directly influences the business setup in Dubai cost, as each visa has processing and government fees.

5. Additional Approvals and Requirements: Other factors that influence the overall cost include special approvals, bank account requirements, and local sponsorship (if applicable). While minimum share capital requirements have been removed in most Free Zones and Mainland setups, business bank accounts in Dubai typically require a minimum balance of AED 25,000–50,000, which many first-time Indian entrepreneurs overlook when budgeting.

6. Renewal Fees vs One-Time Fees: Some expenses are recurring annually, like licenses or visa renewals, while others, such as incorporation, are one-time costs. Knowing the difference helps plan a sustainable budget for your low-cost business setup in Dubai.

How Can You Save on Dubai Company Registration Cost & Optimize Your Budget?

Setting up a business in Dubai doesn’t have to be expensive; strategic planning and smart decision-making can help you minimize expenses without cutting corners on quality or compliance. Whether you’re an Indian entrepreneur or an international investor, knowing where to save can make your Dubai company registration more cost-efficient and sustainable.

Here are some practical ways to reduce your overall Dubai company registration cost and get maximum value for your investment:

1. Choose the Correct Zone: Select a Free Zone if you don’t need to trade in the UAE Mainland. Free Zones typically offer lower company registration costs in the Dubai Free Zone and simpler compliance procedures.

2. Use Flexi-Desk / Virtual Office: Opt for a flexi-desk or virtual office (if permitted by your chosen zone) instead of a full office space. This helps reduce Dubai company registration costs while maintaining a professional business address.

3. Compare Multiple Free Zones & Packages: Different Free Zones have varying packages. Look for early payment discounts or bundled offers; for example, DMCC packages can help reduce total setup costs.

4. Consolidate Visas & Start Minimal: Apply for only the number of visas required initially, consolidating where possible. This approach keeps the initial Dubai company registration cost manageable.

5. Work with Trusted Business Setup Consultants: Consultants like RegisterKaro can help you avoid hidden fees, ensure regulatory compliance, and save time and money during the process.

6. Renew Timely & Consider Longer-Term Payments: Timely renewals prevent penalties, and some zones offer discounts for multi-year license payments, reducing the long-term company registration in the Dubai free zone cost.

What are the Hidden Costs & Key Considerations for Indian Entrepreneurs?

While planning your Dubai company registration budget, it’s important to account for hidden costs and additional considerations impacting your total business setup in Dubai, especially for Indian entrepreneurs. Here are the key points:

1. Currency Fluctuations (AED to INR): The value of AED against INR can fluctuate, which affects budgeting. Always consider a margin for exchange rate variations when calculating the total cost for company registration in Dubai.

2. Banking Minimum Balances / Corporate Account Costs: Opening a corporate bank account often requires a minimum deposit and may involve service fees. These banking requirements can add to your overall Dubai company registration cost.

3. Tax Implications in India: Indian residents holding a Dubai company need to consider the Indian tax implications. Income generated abroad may impact your tax/resident status in India.

4. Additional Approvals for Certain Activities: Specific business activities, such as healthcare, food, or manufacturing, may require extra approvals or certifications, which can increase both initial and ongoing costs.

5. Renewal Years – Budget Beyond Year 1: Don’t focus solely on the first-year costs. Don’t just budget for the first year. License renewals, visa renewals, and office rent recur annually and must be included in long-term financial planning.

6. Compliance & Attestation Costs: Documents issued in India (such as PAN, MOA, or POA) often require Notarization, MEA Attestation, and UAE Embassy Attestation, which can add approximately INR 10,000–20,000 to your total expenses.

By considering these hidden factors, Indian entrepreneurs can better plan for the true company registration in Dubai fees and avoid unexpected financial surprises in subsequent years.

How Can RegisterKaro Help You With Dubai Company Setup?

Setting up a business in Dubai can be complex, especially for Indian entrepreneurs managing costs and local requirements. RegisterKaro simplifies the process by offering end-to-end support and clear guidance.

1. Transparent Cost Counselling: RegisterKaro helps you understand the company registration in Dubai cost upfront. We provide detailed estimates for all major components, license, office, visas, and other fees, so you can plan your budget accurately.

2. Packages for Indian Entrepreneurs: Our services focus on Indian entrepreneurs, factoring in currency conversion, visa planning, and compliance requirements to optimise costs and ensure a smooth setup process.

3. Full-Service Support: From initial registration and licensing to visa processing and corporate bank account setup, RegisterKaro handles the entire process. This includes:

- Registration and incorporation documentation

- Trade license application and issuance

- Investor and employee visa processing

- Bank account assistance

- Renewal and compliance management

4. Updated Cost Quotes: We provide up-to-date fee estimates based on your chosen business activity, license type, and Free Zone or Mainland jurisdiction, ensuring you know the Dubai company registration fees at every step.

5. Free Consultation: RegisterKaro offers a free consultation to assess your business requirements, discuss cost-saving strategies, and advise on the most suitable setup for your objectives.

With RegisterKaro, Indian entrepreneurs can plan a low-cost business setup in Dubai confidently while ensuring compliance and a smooth, stress-free experience.

Frequently Asked Questions

The Dubai company registration fee depends on the business zone and activity you choose. Free Zone setups can start from around AED 10,000 (~₹2.35 lakh) for basic registration, license, and flexi-desk office. Costs increase if you add investor or employee visas, full office space, or premium licenses. Planning ensures you understand the total cost for company registration in Dubai. This helps Indian entrepreneurs budget accurately for a low-cost business setup in Dubai.