Growing your business often means increasing your company’s share capital. However, are you aware of the official process for doing this legally? Filing Form SH-7 is the key to improving or altering share capital. Governed by the Companies Act 2013, this form serves as an official notice to the Registrar of Companies (ROC) when your company alters its share capital. Whether it’s for increasing the authorized share capital or complying with a government order, the SH-7 form is the key document.

When you expand your business and bring in new investors, you may need to increase your authorized share capital. Form SH-7 enables this change legally. The costs of SH-7 are determined based on the company’s authorized share capital and must be paid through the MCA portal. It’s vital for ensuring compliance with the MCA regulations.

In this guide, we’ll explain everything, from the SH-7 form download process to the necessary documents for filing. If you’re wondering whether your company needs to file it or when SH-7 is filed, you’re in the right place. Stay with us as we break down the steps clearly and concisely.

Who Must File Form SH-7?

As per the Companies Act, 2013, the following company types must file Form SH-7 when they increase their share capital:

a. Private Limited Companies: Private limited companies must file Form SH-7 to register any increase in share capital or changes in shareholding. This ensures compliance with the Companies Act, 2013.

b. Public Companies: Public companies are required to file SH-7 when they increase their authorized capital or make significant changes to their share capital structure. This ensures transparency and legal compliance.

c. One Person Company and Small Companies: One Person Companies (OPCs) and small companies must file Form SH-7 when altering their share capital. These entities must also adhere to ROC filing requirements, even with simpler structures.

d. Section 8 Companies (Non-Profit Organizations): Section 8 companies (non-profit organizations) must file Form SH-7 for any capital increase or share structure changes. This ensures proper registration of the capital alteration with the ROC.

In summary, Form SH-7 is mandatory for all company types when altering share capital. This helps ensure legal compliance and proper company registration with the Registrar of Companies (ROC).

When is Form SH-7 NOT Required?

Form SH-7 is not required in the following cases:

- No alteration in share capital: If the company does not change its share capital, you do not need to file SH-7.

- Internal transfers: If shares are transferred internally between existing shareholders and no change in authorized share capital occurs, SH-7 is not needed.

- No government order or Tribunal order: If there’s no external mandate requiring capital increase or alteration, SH-7 is not necessary.

SH-7 Due Date & Penalty

Filing Form SH-7 is mandatory within 30 days of passing the resolution for capital alteration, as per Section 64(1) of the Companies Act, 2013. Delayed filing can result in penalties, which are imposed under Section 64(2) and Section 454 of the Companies Act.

The SH-7 penalty for delay is as follows:

- ₹500 per day of delay.

- The maximum penalty is ₹5 lakh for the company and ₹1 lakh for the officer in default.

- If the company qualifies as a small company, penalties are reduced. ₹2 lakh for the company and ₹1 lakh for the officer.

Ensure timely filing of SH-7 to avoid unnecessary penalties and maintain compliance.

Step-by-Step Procedure for Filing eForm SH-7 on the MCA Portal

Filing eForm SH-7 through the MCA portal is an essential process for companies altering their share capital. Here’s how you can follow the step-by-step process correctly:

Step 1: Log in to the MCA Portal

Visit the official MCA portal and log in with your credentials. Make sure you have all the required documents ready for filing Form SH-7. This ensures a smooth and efficient filing process.

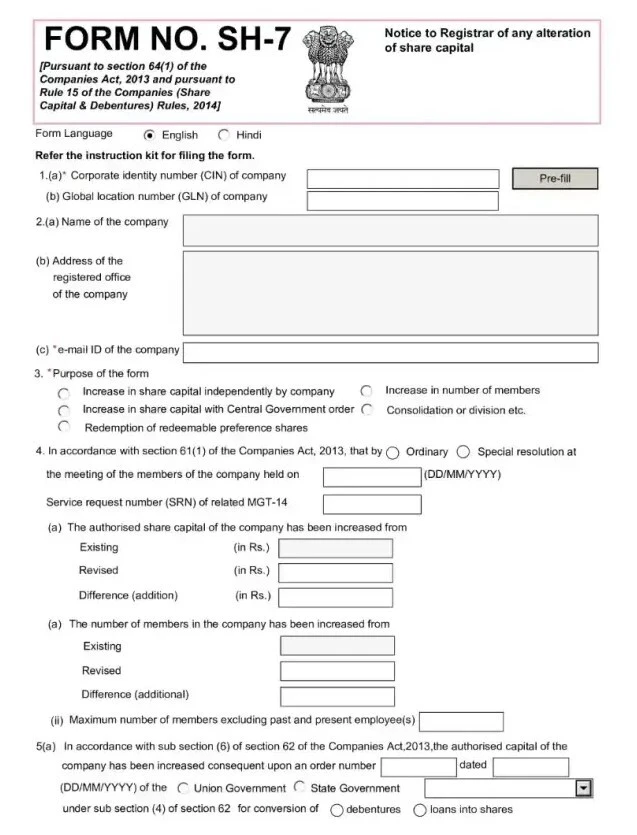

Step 2: Enter the CIN of the Company

Next, input the valid Corporate Identity Number (CIN) of the company. Click on Pre-fill to automatically populate the company’s name, registered office address, and email ID. If the email ID has changed, update it accordingly.

Step 3: Select the Purpose of Filing the Form

Choose the appropriate SH-7 form purpose from the dropdown options. If none of the listed options match, specify the purpose in the description box.

Step 4: Provide Details of Alteration in Authorized Capital

Fill in the details about the alteration in authorized capital. This includes specifying whether the increase is independent, due to a Central Government order, or involves share consolidation.

Step 5: Enter the Board Resolution Details

Enter the details of the Board Resolution that authorizes the capital alteration. Include the resolution’s date and the Service Request Number (SRN) from eForm MGT-14, if applicable.

Step 6: Specify the Break-Up of Additional Capital

Provide the breakdown of additional capital if the form relates to an increase in authorized capital. Specify the amount of equity shares and preference shares.

Step 7: Increase in Number of Members (if applicable)

This step is only applicable to companies that are not limited by shares. Enter the revised number of members and the difference in the number of members after the increase.

Step 8: Details of Share Consolidation or Division

For companies that have consolidated or divided shares, enter the date of this action and any relevant details.

Step 9: Redemption of Redeemable Preference Shares

If the form pertains to redeeming preference shares, provide the required details, such as the description of the shares, issue date, and redemption date.

Step 10: Payment of Stamp Duty

The MCA portal will automatically calculate the stamp duty based on the state rules. You can then proceed to pay the form SH-7 fees electronically.

Step 11: Declaration and Digital Signature

Select the appropriate option for the declaration and digitally sign the SH-7 form. If the signer is a director, enter their DIN (Director Identification Number). If the signer is a company secretary, include the membership number. Ensure that the digital signature is attached.

Note: Follow these steps within 30 days of the capital alteration for timely filing of eForm SH-7 through the MCA portal.

Need assistance with filing Form SH-7 or increasing your authorized capital? Contact RegisterKaro. We manage complete MCA filings, documentation, and fee calculations accurately and efficiently.

Documents Required for Filing Form SH-7

When filing the Form SH-7, companies must attach the appropriate documents to ensure the process complies with legal standards. Here’s a breakdown of the key documents required for Form SH-7:

- Board Resolution for Capital Alteration: A certified true copy of the resolution is necessary when altering the share capital, especially if the company increases it independently.

- Government Order: If the increase in share capital is due to a Central Government order, you must attach a copy of this order.

- Tribunal Order: If the capital increases as per a Tribunal order, you must include a copy of the Tribunal’s order.

- Board Resolution for Redemption: When redeeming redeemable preference shares, a certified true copy of the board resolution authorizing this action is mandatory.

- Altered MOA: Attach the updated Memorandum of Association (MOA) when there is an increase in share capital.

- Altered AOA: If the company’s articles are altered, a certified true copy of the updated Articles of Association (AOA) must be included.

- Calculation Working: In cases of share conversion, attach calculations for conversion ratios. This is required if the increase in share capital is due to a Central Government order.

By submitting these documents with eForm SH-7, companies can fulfill their legal obligations under the Companies Act 2013. It ensures a smooth process for any capital changes or share-related updates.

Applicable Fees for Filing eForm SH-7

The fees for filing eForm SH-7 vary based on the nominal share capital of the company. Below is a breakdown of the applicable fees for form SH-7:

| Nominal Share Capital | Other than OPCs and Small Companies | OPC and Small Companies |

| Up to ₹1,00,000 | ₹5000 | ₹2000 |

| More than ₹1,00,000 up to ₹5,00,000 | ₹5000 + ₹400 per 10,000 or part thereof | ₹2000 |

| More than ₹5,00,000 up to ₹10,00,000 | ₹21,000 + ₹300 per 10,000 or part thereof | ₹2000 |

| More than ₹10,00,000 up to ₹50,00,000 | ₹36,000 + ₹300 per 10,000 or part thereof | ₹2000 + ₹200 |

| More than ₹50,00,000 up to ₹1,00,00,000 | ₹156,000 + ₹100 per 10,000 or part thereof | N/A |

| More than ₹1,00,00,000 | ₹206,000 + ₹75 per 10,000 or part thereof | N/A |

If the company falls under the category of an OPC or small company, the filing charges are considerably lower.

Note: If you delay filing SH-7 beyond the 30-day window, you may incur penalties (₹500 per day) as per the Companies Act, 2013. Ensure you file within the prescribed timeframe to avoid any compliance issues.

Legal Framework for Filing eForm SH-7

The filing of eForm SH-7 is governed by key sections of the Companies Act, 2013, and the Companies (Share Capital and Debentures) Rules, 2014. Here’s an overview of the relevant sections and updates that determine when and how this form should be submitted.

a. Key Provisions in the Companies Act, 2013

Under Section 64(1) of the Companies Act, 2013, companies must notify the Registrar of Companies (ROC) if they alter their share capital. This includes:

- Increasing the authorized share capital as outlined in Section 61.

- A Central Government order that mandates an increase in the authorized capital.

- The redemption of redeemable preference shares.

According to Section 64(1), the company must submit a notice to the ROC within 30 days of the change, using Form SH-7.

b. Companies (Share Capital and Debentures) Rules, 2014 – Rule 15

Rule 15 of the Companies (Share Capital and Debentures) Rules, 2014, further clarifies the process. It requires companies to file Form SH-7 with the ROC when there is an alteration in the share capital, either through an internal decision or a government order. The form should be filed along with the required fees.

c. Recent Amendments and Updates

In December 2020, the Ministry of Corporate Affairs (MCA) issued an amendment (Notification No. G.S.R. 794(E)) to the Companies (Share Capital and Debentures) Rules, 2014. This amendment introduced a revised eForm SH-7. The revised form now covers additional scenarios, such as the cancellation of unissued shares of one class and their conversion into another class.

Some notable changes in the revised SH-7 form include:

- The inclusion of the cancellation of unissued shares as a valid reason for filing.

- Clarification of the form’s purpose, including an increase in share capital, redemption of preference shares, and consolidation or division of shares.

These updates align the form with the current legal framework, providing clearer guidance on when and how to file Form SH-7.

What Happens After Filing eForm SH-7?

After you file eForm SH-7, the process of filing Form SH-7 moves to the next stage. Below is the breakdown of what happens after your submission:

1. SRN and Email Acknowledgements

Upon successful submission of Form SH-7, the system generates a Service Request Number (SRN). This SRN serves as a reference for future correspondence. You will also receive an email acknowledgement confirming the successful filing. Keep this information safe for tracking the status.

2. ROC Processing Timelines

The Registrar of Companies (ROC) processes your eForm SH-7 once submitted. Processing timelines depend on the nature of the filing and whether the required documents are complete. Keep an eye on the progress using your SRN.

3. Challan Generation

After filing, a challan is generated. The challan contains details of the fees paid for filing the form. This document serves as an acknowledgement of your form SH-7 submission and fee payment. If you opt for electronic stamp duty payment via the MCA portal, the challan will reflect that payment as well. This is an important document for your records.

4. Effect on MCA Master Data

Once the ROC processes the form, it reflects the changes in the MCA Master Data. This includes updates to your company’s share capital, member structure, or other key details. The updated information will be available for public viewing on the MCA portal.

How to Download eForm SH-7?

You can easily download eForm SH-7 from the MCA portal after successfully submitting it. Follow these steps:

- Login to the MCA Portal: Use your credentials to access the Ministry of Corporate Affairs (MCA) portal.

- Navigate to e-Forms Section: Go to the ‘e-Forms’ section on the portal.

- Search for SH-7: Look for the eForm SH-7 under the submitted forms section.

- Download the Form: Click on the download link to get a copy of your filed eForm SH-7.

The form will be available for easy access and future reference. Keep a copy for your records, and ensure all details are correct for compliance.

Frequently Asked Questions

eForm SH-7 is a document used to notify the Registrar of Companies (ROC) about changes to a company’s share capital. Companies must file this form when they alter their capital structure, such as increasing share capital or redeeming preference shares. Filing it ensures compliance with Section 64(1) of the Companies Act, 2013.