Partnership firm registration establishes the foundation for your business, while MSME registration for partnership firm elevates it by providing access to government tenders, affordable loans, and enhanced business credibility. These benefits pave the way for faster and more substantial growth. Explore how these opportunities can drive your business forward.

The Union Budget 2025-26 has opened new doors for small businesses. With all the incentives—better investment and turnover thresholds—MSMEs now get higher credit guarantee cover. Most importantly, they get much easier access to working capital through Udyam Credit Cards. Partnership firms now have every reason to formalize their business through MSME registration.

MSME registration for partnership firm is no longer just an option — it’s a powerful gateway to growth, funding, and government support in India’s booming economy. With over 5.93 crore MSMEs contributing more than 30% to the GDP and creating 25 crore jobs, the sector is transforming India into a global industrial powerhouse.

What is MSME Registration?

Before we dive deeper into the MSME registration process for the partnership firm, let’s understand the basics. MSME registration refers to the official recognition provided by the government to Micro, Small, and Medium Enterprises under the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006.

Businesses that complete the MSME registration receive a unique MSME Registration Certificate, granting a range of benefits like easy loans, subsidies, and protection against delayed payments.

For partnership firms, partnership firm registration under MSME Act offers a gateway to financial and operational advantages that can help scale faster.

Why MSME Registration for Partnership Firm Matters

This registration brings a competitive advantage in today’s evolving business environment. A few of the important reasons are:

- Access to Finance: Enjoy lower interest rates and easier loan approvals.

- Subsidies and Incentives: Get subsidies on patent registration and barcode registration.

- Protection Against Delayed Payments: MSME-registered firms can easily file complaints against delayed payments.

- Government Tenders: MSMEs get special quotas and preference in many public sector tenders.

If you are running a partnership firm, registering under MSME could be the smartest business move for you.

MSME Registration Process for Partnership Firm

Here are a few simple steps to break down the MSME process for registering a partnership firm:

Step 1: Prepare Required Documents

These are the important documents required for the MSME registration:

- Partnership Deed, the foundation of your partnership

- PAN Card of the firm

- Aadhaar card of one of the partners

- Business address proof (like utility bill)

- Bank details and canceled cheque.

Step 2: Complete Udyam Registration

Udyam registration becomes important for you if you want your partnership firm to be registered under MSME.

Udyam registration formalizes your business as an MSME and enables you to access all government benefits, schemes, and protections designed for small enterprises..

Step 3: Providing Details for the Application Form

You will need to provide the following information to complete your application form:

- Name and type of enterprise

- PAN details

- Bank account details

- Investment and turnover figures.

Step 4: Receiving the MSME Registration Certificate

Once the form is submitted, you’ll receive an immediate acknowledgment. After verification, your MSME Registration Certificate will be issued online. This straightforward process ensures that partnership firm under the MSME Act is quick and hassle-free.

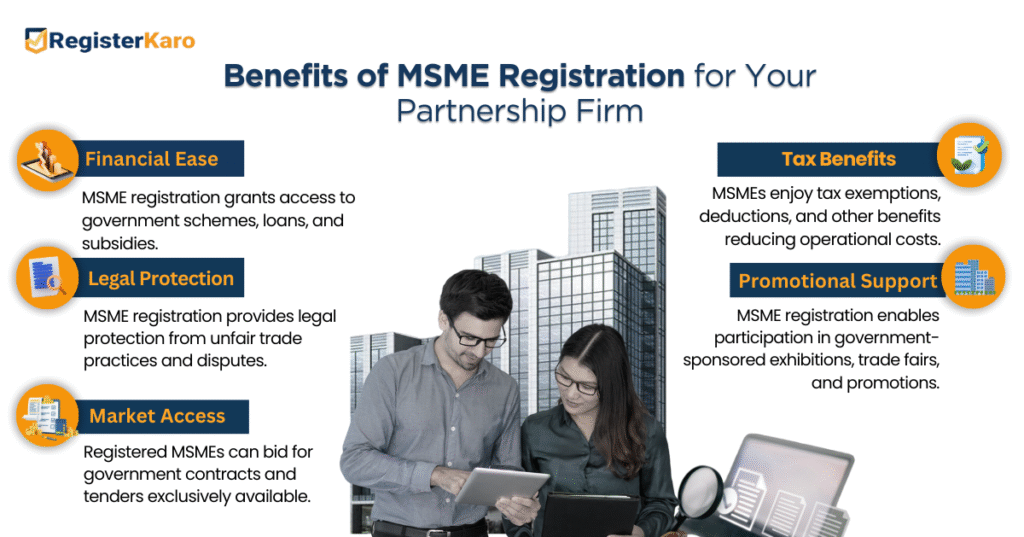

Benefits of MSME Registration for Partnership Firm

Here’s why you should not delay your registration for the firm under MSME:

- Lower Interest Rates: Many banks offer special MSME loan rates that are 1–2% lower than regular rates.

- Collateral-Free Loans: Schemes like CGTMSE provide loans without any collateral.

- Tax Benefits: MSMEs enjoy several tax rebates and exemptions.

- Protection Under MSME Samadhan: In case of delayed payments, registered firms can seek redressal through the MSME Samadhan portals.

- Subsidies for Technology Upgradation: For instance, the Credit-Linked Capital Subsidy Scheme (CLCSS) offers financial support for upgrading machinery and technology.

Example: Thousands of MSMEs received collateral-free loans under the Emergency Credit Line Guarantee Scheme (ECLGS) during the pandemic to sustain their operations. Application for such funds would have been an easy affair if your firm had MSME registration.

MSME registration is an investment in your business’s future. It not only opens doors to government schemes and financial assistance but also enhances your credibility in the market.

Key Features of MSME Registration Certificate

After completing your MSME registration process for the firm, you get an official MSME Registration Certificate. Some important details of the certificate include:

- Unique Udyam Registration Number

- Valid proof of MSME status

- Needed for availing government schemes

- No renewal required — it’s a lifetime valid certificate.

This certificate serves as a gateway to numerous benefits that can elevate your partnership firm and drive its growth to new levels.

Partnership Firm Registration under MSME Act

Here are a few things to remember about partnership firm registration under MSME Act:

- Single Registration: A firm can get only one MSME registration, irrespective of the number of branches.

- Self-Declaration: You do not need to upload any proof initially. However, authorities may verify details later.

- PAN and GSTIN Linked: PAN and GST numbers are mandatory for firms operating beyond the threshold limits, for which you will have to get GST registration.

This simple process ensures that even the smallest partnership firms can take advantage of government recognition.

Common Mistakes to Avoid During MSME Registration for Partnership Firm

Here are a few things you need to keep in check to avoid the common mistakes during the registration process:

- Giving incorrect investment and turnover details

- Using personal PAN instead of firm PAN

- Not updating the registration if your enterprise grows from Micro to Small or Medium

It is important to be careful while filling for the application as these small errors can delay your certification and restrict access to benefits.

Conclusion

As India’s economy charges ahead with MSMEs at the center, getting MSME registration for your firm is not just wise — it’s crucial. The MSME sector has shown unwavering resilience, bouncing back stronger even during global disruptions like COVID-19.

Government initiatives, tax benefits, financial support, and market opportunities are tailored for MSMEs. If you own a partnership firm, this registration is your ticket to securing a stronger, more profitable future.

Take your first step today. Complete your MSME registration for partnership firm and position your business for success in India’s dynamic economy!

Frequently Asked Questions

MSME registration is the government recognition process for Micro, Small, and Medium Enterprises to access benefits like loans, subsidies, and protection.