LLP Act, 2008: Key Sections, Rules, Schedules & Features

While starting a business, entrepreneurs often face the dilemma of choosing between a traditional partnership and a private limited company. But what if there was a way to combine the best of both? The LLP Act 2008 brought that solution to life. It offers a hybrid structure that blends the simplicity and flexibility of a partnership with the limited liability protection.

Whether you’re an aspiring entrepreneur or a business enthusiast, understanding the LLP Act 2008 is essential to making an informed decision for your business. This blog explores how this game-changing law works, its key provisions, and why it could be the ideal choice for your business.

What is the LLP Act 2008? Key Features & Rules

The Indian government enforced the Limited Liability Partnership (LLP) Act 2008 on March 31, 2009. Through this Act, it introduced the Limited Liability Partnership (LLP) as a new business structure. The LLP improves upon the traditional model governed by the Indian Partnership Act of 1932.

Unlike partnerships under the 1932 Act, LLPs offer limited liability protection to partners while retaining the operational flexibility of a partnership. This law governs the incorporation, regulation, compliance, and dissolution of LLPs across India. The meaning of the LLP Act 2008 lies in its ability to combine limited liability protection with partnership flexibility in a new structure.

Interestingly, the LLP Act 2008 defines an LLP as a body corporate. Unlike traditional partnerships, an LLP is a separate legal entity. It can own property, sign contracts, and sue in its own name. This means if a partner leaves or passes away, the LLP continues to exist. This feature is known as “perpetual succession.”

The best feature of an LLP is the absence of mutual agency. In a standard partnership, one partner’s mistake can ruin everyone and everything. In an LLP, a partner is only an agent of the firm, not of other partners. This means you aren’t responsible for another partner’s wrongful business decisions.

Key Sections and Rules You Must Know

To fully understand how the LLP Act 2008 works, here are some essential sections and rules:

- Section 6 of the LLP Act 2008: This section mandates that an LLP must have at least two partners. If the number of partners falls below two for more than six months and the LLP knowingly carries on business, the remaining partner becomes personally liable for all debts.

Section 7 of the LLP Act 2008: It mandates appointing at least two Designated Partners (DPs) to an LLP, with one being a resident of India. These DPs handle legal filings and paperwork. - Section 13 of the LLP Act 2008: Every LLP must have a registered office. You must notify the Registrar if you move. The business address can also be a virtual office, as long as it is used for official communication.

- Section 16 of the LLP Act 2008: Explains how to reserve a name for your business. Rule 16(2) of the LLP Act 2008 allows the Registrar to reserve a name for three months. If the LLP fails to complete registration within three months, the Registrar cancels the reservation, making the name available to others.

- Section 17 of the LLP Act 2008: If your LLP name is too similar to another company or trademark, the government can order a name change. Rule 17(1) explains the procedure for this rectification.

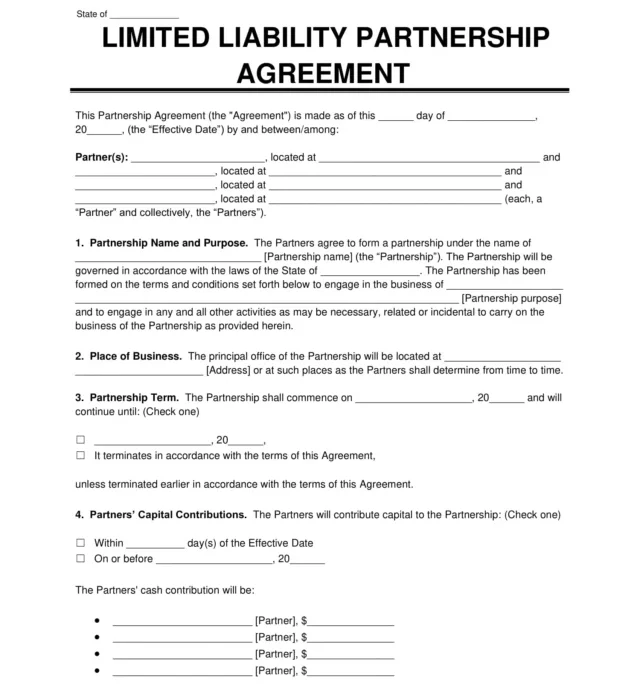

- Section 23 of the LLP Act 2008: This section mandates that an LLP agreement is required to define the roles and rights of each partner. If you don’t have an agreement, Schedule 1 of the LLP Act 2008 applies by default. A change in the LLP Agreement must be duly notified to the Registrar for legal recognition.

The LLP Agreement: Your Business Constitution

The LLP Agreement clearly defines the rights, duties, roles, and responsibilities of all partners and governs how the LLP operates. If you do not have an agreement, Schedule 1 of the LLP Act 2008 automatically applies. This schedule outlines default rules for profit-sharing and management.

When admitting a new partner, Section 25 of the LLP Act 2008 requires you to notify the Registrar within 30 days. If a partner wants to leave, Section 24 of the LLP Act 2008 outlines the process.

Crucial Terms in the LLP Act: Legal Definition

To fully understand the workings of the LLP Act 2008, it’s important to grasp the definition of some key terms related to the structure.

- Partner: A partner in an LLP is an individual or entity that contributes to the LLP and shares its profits and losses.

- Designated Partner: A Designated Partner (DP) is responsible for managing the LLP’s compliance with legal and regulatory requirements.

- Financial Year: The financial year in an LLP typically runs from April 1 to March 31 of the following year, as per Section 2(12) of the Income Tax Act.

- Foreign LLP: A foreign LLP is an LLP registered outside India, which may establish a place of business in India under the LLP Act 2008.

Registration and the Startup Process Under LLP Act

The process for LLP registration is now completely online. You can register your LLP through the FiLLiP form on the MCA website (mca.gov.in). During registration, you must follow Rule 20(1) of the LLP Act 2008, which specifies the electronic filing process for documents.

After your documents are submitted and approved, the Registrar issues a Certificate of Incorporation, officially establishing your LLP. This document is proof that your business is legally recognized.

Taxation and Annual Compliance Under LLP Act

The LLP Act requires that all LLPs maintain transparent financial records. According to Section 34(4), LLPs must follow clear rules for keeping accounts. An audit is necessary only if the turnover exceeds ₹40 lakh or the capital contribution is greater than ₹25 lakh.

LLP annual compliance involves filing two forms:

- Form 11 is the annual return, which details the partners and their contributions.

- Form 8 is the statement of accounts and solvency, which outlines the LLP’s financial health.

If an LLP faces legal issues, Section 60 addresses compromises or arrangements between partners and creditors. Additionally, if fraud is suspected, Sections 63 and 75 deal with investigations and penalties, respectively.

In terms of taxation:

- LLPs are subject to a Flat 30% income tax on their profits.

- There is no dividend distribution tax (DDT) on profits.

- Minimum Alternate Tax (MAT) is applicable at 18.5% if the LLP’s total income is lower than the base tax rate.

- LLPs incur no tax on profit distribution to partners.

Schedules of LLP Act, 2008

The LLP Act, 2008 includes four key schedules that define the default rules, forms, and legal consequences applicable to LLPs in India when partners do not specify terms separately.

Schedule 1 of LLP Act, 2008

This schedule outlines the default mutual rights and duties of partners and the LLP when no LLP Agreement exists or when the agreement is silent on specific matters. It covers profit-sharing, management participation, decision-making, indemnity, and partner obligations.

Schedule 2 of LLP Act, 2008

The Second Schedule explains the conversion of a partnership firm into an LLP, detailing eligibility conditions, procedural requirements, effects of conversion, and the transfer of assets, liabilities, and legal proceedings to the LLP.

Schedule 3 of LLP Act, 2008

This schedule governs the conversion of a private limited company into an LLP, specifying the conditions to be met, documents required, legal impact of conversion, and continuation of contracts, assets, and liabilities after conversion.

Schedule 4 of LLP Act, 2008

The Fourth Schedule deals with the conversion of an unlisted public company into an LLP, laying down compliance requirements, procedural steps, and the legal consequences of such conversion.

Together, these schedules ensure clarity, continuity, and legal certainty in the formation, operation, and conversion under the LLP Act, 2008.

Conversion, Restructuring, Winding Up, and Dissolution Under LLP Act

The LLP Act 2008 outlines the process for conversion, restructuring, winding up, and dissolution of an LLP. If you wish to convert a Private Limited Company into an LLP, the Act provides a clear procedure under Schedule 3 and Section 55. Schedule 3 of the Act facilitates this transition, while Section 55 outlines the conversion process.

This allows businesses to switch from a private company to an LLP while retaining flexibility and limited liability protection.

Restructuring involves changes to the LLP’s structure, including partners or their contributions. You can dissolve an LLP voluntarily or through legal proceedings. The dissolution process requires settling all liabilities, notifying the Registrar, and filing the necessary documents to close the LLP.

Final Thoughts

The LLP Act 2008 of India provides the perfect solution for small businesses and startups. It offers the legal protection of a company and the flexibility of a partnership. For entrepreneurs, professionals, and small business owners, this structure strikes the ideal balance.

Whether you are reading LLP Act 2008 notes for academic purposes or looking at the LLP Act 2008 PDF to start your business, the key takeaway is that LLPs offer a modern, flexible, and cost-effective solution. By adhering to rules like Section 19 of the LLP Act 2008 (regarding the right to information) and staying current with LLP annual compliance, you can build a trustworthy business that investors and banks will be happy to support.

Frequently Asked Questions

The LLP Act 2008 provides a framework for creating a hybrid business structure combining limited liability and partnership flexibility. It defines an LLP as a body corporate, separate from its partners. LLPs are treated as independent entities and can own property, sign contracts, and engage in legal actions. This structure protects personal assets and ensures perpetual succession, even when partners change.