What is Form 8 for LLP in India and Why Does It Matter?

Form 8 is an important compliance document that every Limited Liability Partnership (LLP) in India must file with the Ministry of Corporate Affairs (MCA). It gives a clear picture of the LLP’s financial health, including its assets, liabilities, and ability to meet debts. With over 3.6 lakh active LLPs on the MCA register as of 2025, ensuring timely filing helps your business stay compliant and avoid penalties.

Filing Form 8 is crucial because it confirms the LLP’s solvency and financial standing to the Registrar. Even if your LLP has no significant business activity or minimal revenue, submitting Form 8 every year is mandatory to maintain legal compliance.

To successfully incorporate an LLP, one must file Form 8 by October 30. Late filing attracts penalties: small LLPs pay 1×–15× the fee, while other LLPs pay 1×–30× plus daily charges after 360 days. Timely filing demonstrates annual compliance with LLP requirements.

So partners should file carefully and on time. This blog explains the filing process, key requirements, and best practices for Form 8 LLP.

Definition & Legal Framework for Form 8 in LLP

LLP Form 8 is the Annual Return that every Limited Liability Partnership (LLP) in India must file with the Ministry of Corporate Affairs (MCA) each financial year. It provides a snapshot of the LLP’s partners, contributions, and financial status, ensuring transparency and compliance with the law.

If you wish to file LLP Form 8, it’s important to understand the rules and laws behind it. Here’s a simple guide to what governs it and what you need to know.

1. Statutory Basis: LLP compliance, including Form 8 filing, is governed by the Limited Liability Partnership Act, 2008, and the LLP Rules, 2009. Specifically, the following sections are relevant:

- Section 33: Requires LLPs to prepare and submit annual accounts and statements of account & solvency.

- Section 34: Mandates the filing of annual returns with the Registrar.

- Rule 11 of LLP Rules, 2009: Details the filing process, due dates, and format for Form 8.

These laws define an LLP’s obligations, operational guidelines, and the importance of timely filings.

2. Relevant Sections & Provisions: Certain sections under the LLP Act guide the filing of Form 8 in LLP. These include requirements for annual returns, financial statements, and deadlines for submission. Knowing these sections helps avoid a penalty for late filing.

3. Compliance Calendar: Every LLP must follow a compliance calendar set by the Ministry of Corporate Affairs (MCA). LLP Form 8 must be filed within 30 days after six months of the financial year end. Filing on time keeps your LLP compliant and avoids penalties.

4. MCA Portal Filing: The MCA LLP Form 8 is submitted online through the MCA portal (mca.gov.in). It requires basic details about the LLP, partners, and financial statements. Filing it correctly keeps the LLP in good standing.

Who Needs to File Form 8 in an LLP?

Form 8 shows the LLP’s financial position and confirms its ability to pay debts. Here’s who must file it:

- All LLPs are required to file: Every LLP, regardless of its size, turnover, or profit, must file Form 8 every year. This rule applies to LLPs that are actively running businesses as well as those that have minimal or no income.

- Dormant or Inactive LLPs: Dormant LLPs (not carrying out any business activity) or newly formed but not yet operational must submit Form 8. In these cases, the form will report that there was no business activity during the year.

Why Filing Is Important: Filing Form 8 on time avoids penalties and late fees. It also helps maintain the LLP’s credibility with banks, investors, and business partners. Non-filing can attract notices from the MCA and may create problems in future filings.

Special Situations:

- LLPs that have closed their operations temporarily still need to file.

- LLPs with zero turnover must also submit the form, as every LLP must have at least one designated partner.

This ensures that the Ministry of Corporate Affairs (MCA) has accurate information about the LLP.

In short, Form 8 is mandatory for all LLPs, and timely filing shows that the business is organized, solvent, and legally compliant.

Key Details & Documents Required for Form 8 LLP P

Before filing, ensure you have all the documents required for Form 8 LLP ready. Missing even one item can delay the process or lead to errors.

Here’s what you’ll need:

| Category | Details Required | Why It Matters |

| LLP Information | – Name of the LLP – Registered office address – LLP Identification Number (LLPIN) – Police station jurisdiction of the registered office | These basic details help MCA locate and verify your LLP |

| Financial Details | – Statement of assets and liabilities (as of 31st March) – Statement of income and expenditure – Changes in contribution or capital – Turnover exceeding Rs 40 lakhs – Contribution obligation exceeding Rs 25 lakhs | Gives a clear view of your LLP’s financial health and forms the main part of Form 8 |

| Solvency Declaration | Confirmation that the LLP can meet its liabilities in the normal course of business | Shows that the LLP is financially stable and able to pay its debts |

| Contingent Liabilities | Pending obligations, guarantees, or legal claims that could affect finances | Ensures transparency and compliance for any unexpected liabilities |

| MSME Disclosure | Mandatory disclosure under the Micro, Small, and Medium Enterprises Development Act, 2006, for delayed payments | Shows accountability to suppliers and follows MSME rules |

| Attachments | – MSME disclosure statement (mandatory) – Statement of contingent liabilities (if applicable) – Optional supporting documents | These LLP Form 8 attachments provide proof for the details, reduce errors, and help avoid penalties |

Pro Tip: Don’t wait until the last minute to gather these papers. Scrambling at the deadline often leads to mistakes and penalties. Keep your documents ready in advance to file the MCA LLP Form 8 smoothly and stress-free.

Who Needs to Sign and Certify Form 8 in LLP?

When filing MCA LLP Form 8, certain signatures and certifications are required to make the form valid. Here’s a breakdown:

- Designated Partners’ Signatures: At least two designated partners must sign the form. This confirms that the information provided in the form is true and correct.

- Professional Certification: If the LLP exceeds certain thresholds (like capital contribution or turnover limits), a Chartered Accountant (CA), Company Secretary (CS), or Cost Accountant must certify the form. This ensures accuracy and compliance with accounting standards.

- Digital Signature Requirement: Designated partners must sign the form using their digital signatures, enabling secure online submission through the MCA portal.

These steps make sure that the Form 8 LLP filing is legally valid, accurate, and accepted by the authorities.

How Do You File Form 8 of an LLP?

Filing Form 8 of LLP is not very hard, but it needs careful attention and correct information. Here’s a step-by-step guide to help you do it easily:

Step 1: Go to the MCA Portal

- Open the official MCA portal in your browser.

- Make sure you have your login ID and password ready. If you don’t have an account, you need to register first.

- The portal is the official site for all LLP filings, so always use it to avoid mistakes.

You can also get assistance with registration and required documents from RegisterKaro.

Step 2: Find the LLP e-Filing Section

- Under the LLP tab, click on e-Filing.

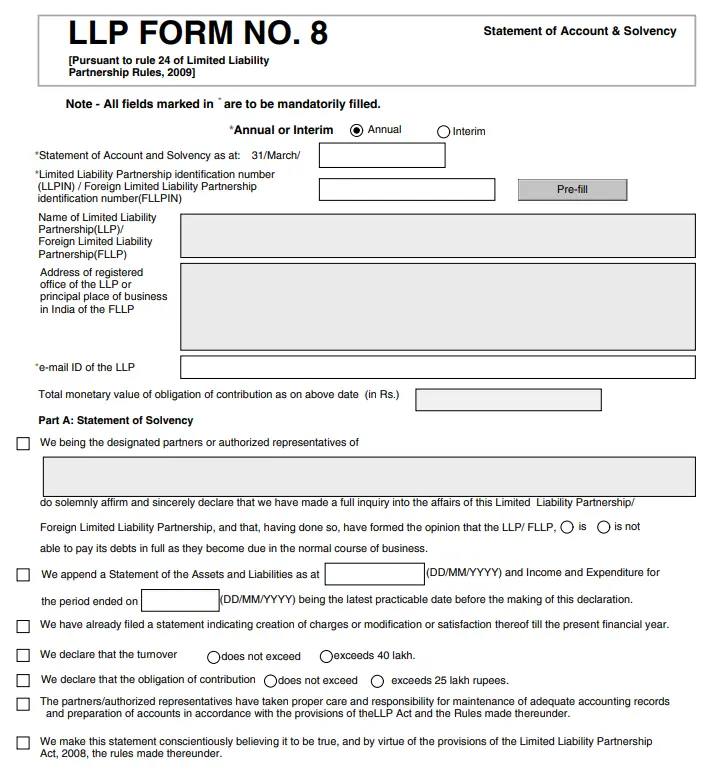

- Look for Form 8 – Statement of Account & Solvency. This is the form required for annual filing.

- Make sure you select the correct financial year for which you are filing.

Step 3: Fill in the Details

- Enter your LLP Identification Number (LLPIN) correctly.

- Provide financial information: assets, liabilities, income, and expenditure.

- Mention any changes in partners’ contributions or capital during the year.

- Declare solvency: confirm that your LLP can pay its debts and meet obligations.

Fill every field carefully, as missing or incorrect information can lead to rejection.

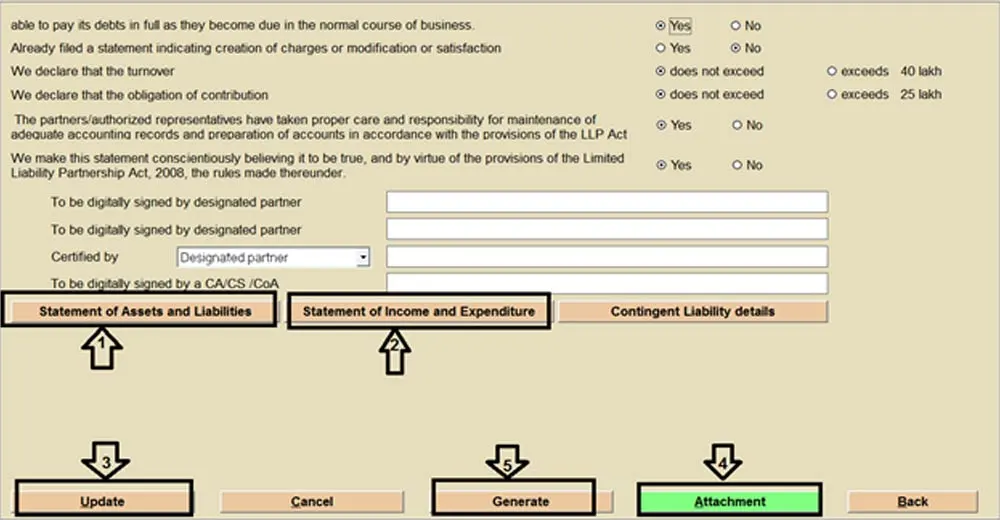

Step 4: Add the Required Documents

Upload all necessary LLP Form 8 attachments:

- MSME disclosures (if needed)

- Statement of contingent liabilities (if any)

- Any other supporting documents for your LLP

Step 5: Apply Digital Signatures

- Two designated partners must sign the form digitally.

- If turnover is more than ₹40 lakh or capital contribution is more than ₹25 lakh, a CA, CS, or Cost Accountant must certify the form.

- Digital signatures make the submission secure.

Step 6: Submit and Pay the Fee

- Check all details carefully before submission.

- Pay the filing fee according to your LLP’s contribution slab.

- After submission, you will get an acknowledgment from MCA.

Pro Tip: Check all numbers and information before signing. Mistakes can lead to fines or extra work, which is avoidable if done correctly the first time.

Form 8 LLP Due Date: 2025 Update

The Form 8 LLP due date for filing the Statement of Accounts & Solvency for 2025 is October 30th. This applies to all LLPs, even if they have not started business yet. Filing on time is not just a legal requirement; it also shows that your LLP is organized, financially healthy, and transparent.

To make it easier to understand the consequences of a late filing, here’s a quick overview:

| Aspect | Details | Why It Matters |

| Deadline | October 30, 2025 | Statutory; missing it can trigger late fees |

| Late Fees | Extra fees depending on the delay | Encourages timely filing and avoids penalties |

| Regulatory Risks | Notices, scrutiny, or issues for future filings | Can slow down approvals and affect credibility |

| Legal & Financial Impact | Extra legal costs, compliance problems | Avoidable if you file on time |

| Credibility | Maintains trust with partners, investors, and banks | Shows good financial discipline and transparency |

Even if the MCA extends the LLP Form 8 due date, you should file on time, as timely filing proves that your LLP manages its affairs well, is financially strong, and operates smoothly. Knowing all the mandatory LLP compliances helps you stay ahead and avoid any unnecessary problems.

Filing Fees for LLP Form 8

When filing LLP Form 8, the government follows a “pay according to contribution” rule. This means the fee depends on how much capital your LLP has. Simply put: the higher your LLP’s total contribution, the higher the filing fee.

Here’s the fee chart for easy reference:

| Contribution in LLP | Filing Fee (₹) |

| Up to ₹1 lakh | 50 |

| Above ₹1 lakh up to ₹5 lakh | 100 |

| Above ₹5 lakh up to ₹10 lakh | 150 |

| Above ₹10 lakh up to ₹25 lakh | 200 |

| Above ₹25 lakh up to ₹100 lakh | 400 |

| Above ₹100 lakh | 600 |

How Are Fees Calculated?

- Contribution is the total amount each partner agrees to bring into the LLP. This can include cash, property, services, or other agreed assets.

- The filing fee is a fixed amount based on the slab of your total contribution.

- Think of it like a toll: the bigger your LLP’s capital, the higher the fee.

Pro Tip: Even if your contribution is small, missing the MCA Form 8 due date can lead to penalty fees, which increase quickly over time. Always keep an eye on both the fee slab and the filing deadline.

Penalties for Late Filing of LLP Form 8

Filing Form 8 of an LLP late is like submitting your homework after the deadline; the MCA charges extra fees, and the longer you wait, the more it costs. Here’s a simple guide to the penalty:

| Delay Period | Penalty for Small LLPs | Penalty for Other LLPs |

| Up to 15 days | 1× normal filing fee | 1× normal filing fee |

| 16–30 days | 2× normal filing fee | 4× normal filing fee |

| 31–60 days | 4× normal filing fee | 8× normal filing fee |

| 61–90 days | 6× normal filing fee | 12× normal filing fee |

| 91–180 days | 10× normal filing fee | 20× normal filing fee |

| 181–360 days | 15× normal filing fee | 30× normal filing fee |

| Beyond 360 days | 15× normal filing fee + ₹10/day | 30× normal filing fee + ₹20/day |

Avoid hefty penalties for late filing with RegisterKaro. We help you file on time, prepare accurate attachments, and ensure compliance, making the process seamless and penalty-free.

Final Thoughts

Filing Form 8 for LLP on time is essential to keep your business legally compliant, maintain financial transparency, and avoid penalties. Submitting on time demonstrates that your LLP manages its affairs well, remains solvent, and earns the trust of partners, investors, and banks. Even LLPs with minimal activity or turnover must file every year to stay in good standing with the MCA.

For help with MCA LLP Form 8 filing and accurate document preparation, RegisterKaro makes the process quick and stress-free. Get expert support to file on time and keep your LLP fully compliant.

Frequently Asked Questions

Even if your LLP has no business activity or zero revenue, filing is mandatory. You must submit financial statements declaring that there was no turnover or income during the year. This ensures compliance with the MCA LLP Form 8 rules and avoids penalties. Filing on time shows that your LLP is legally compliant and maintains credibility with banks, investors, and partners.