What are the Advantages and Disadvantages of One Person Company?

Starting a business alone doesn’t always mean working without legal protection. The process of One Person Company incorporation lets solo entrepreneurs run their venture with full control and legal backing. Knowing clearly the advantages of a One Person Company and its disadvantages will help entrepreneurs to evaluate whether this structure fits their long-term goals. It offers:

- Credibility

- Limited liability

- A clear identity in the market

OPC offers control, protection, and recognition, but also comes with certain compliance and growth limitations. Knowing both sides supports better planning and risk-aware decision-making.

What is a One Person Company?

A One Person Company (OPC) is a type of business entity in India designed for solo entrepreneurs. It allows a single individual to own, manage, and operate a company with full legal recognition.

Unlike a Sole Proprietorship registration, an OPC has a separate legal identity from its owner. This means the owner’s personal assets are protected from business liabilities. It also allows the company to enter into contracts, own property, and raise funds in its own name.

OPCs are ideal for small businesses, startups, and individual professionals who want control, credibility, and limited liability while keeping operations simple.

Key Features of an OPC:

- Single Shareholder: An OPC can be formed and owned by just one individual.

- Nominee Shareholder: The sole owner must nominate another person to take over in case of death or incapacity.

- Limited Liability: Liability of the owner is limited to the company’s share capital.

- Separate Legal Entity: The company can own assets, sue, and be sued independently of the owner.

- Mandatory Incorporation: OPCs must be registered with the Ministry of Corporate Affairs (MCA).

- Compliance Requirements: OPCs follow fewer regulatory requirements than private limited companies, but must file annual returns and maintain accounts.

Before deciding on a business feature, it’s crucial to understand the One Person Company Advantages and Disadvantages.

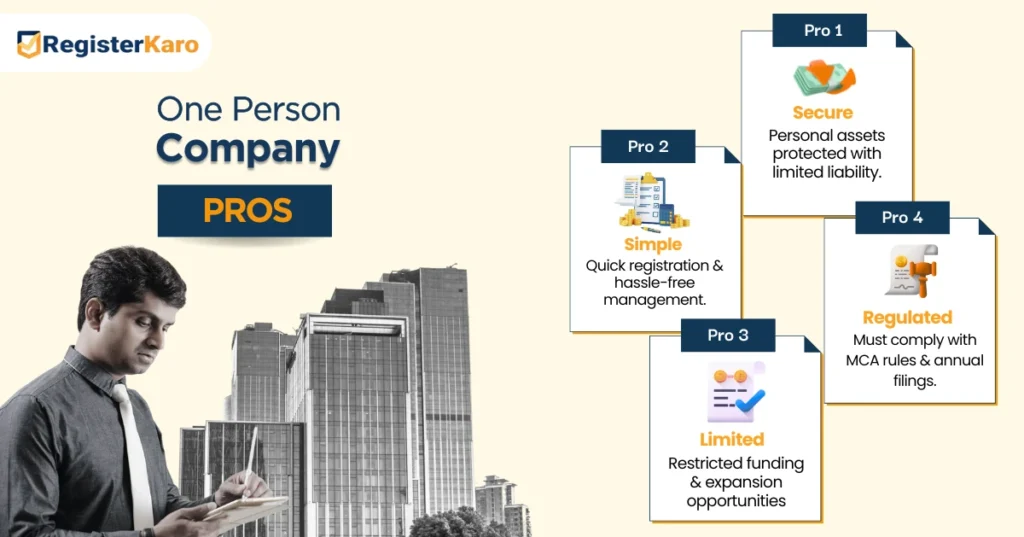

Advantages of a One Person Company in India

Here are some key benefits of the One Person Company structure to consider:

1. Limited Liability Protection

- Personal Asset Safety: The biggest advantage of an OPC is the protection of personal assets. Liability is limited to the company’s invested capital, reducing personal financial risk.

- Ease of Management: With a single owner in charge, decisions are quick and efficient. This agility is especially useful in fast-changing markets.

2. Enhanced Credibility and Funding

- Corporate Image: Converting a business into an OPC boosts credibility. Banks and investors often prefer dealing with incorporated entities rather than sole proprietorships.

- Funding Opportunities: OPCs are viewed as more stable, making it easier to secure loans and attract investors, even if startup funding can still be challenging.

3. Regulatory Simplicity and Tax Benefits

- Simple Compliance: OPCs face simpler compliance requirements compared to Private Limited Companies, easing administrative burdens.

- Tax Advantages: Depending on turnover and profits, OPCs can enjoy favorable tax treatment, making them financially attractive. For details, refer to MCA guidelines on OPC turnover limits and tax benefits.

4. Operational Autonomy

- Complete Control: As the sole owner, full control over business decisions stays with you. This autonomy ensures operations align with your vision.

- Flexible Structure: OPCs are designed for a single entrepreneur, keeping business operations nimble, adaptive, and easy to manage.

5. Separate Legal Identity

- Independent Entity: An OPC has a distinct legal identity separate from the owner. It can enter into contracts, own property, and be sued independently.

- Continuity: The company continues to exist even if the owner faces incapacity, ensuring business stability.

6. Easier Expansion

- Scalable Business: OPCs can later convert into a private limited company or public limited company, allowing growth and investment opportunities.

- Attractive for Investors: The clear ownership structure makes it easier to bring in partners or investors in the future.

7. Minimal Compliance Burden for Small Businesses

- Simplified Record-Keeping: OPCs require fewer formalities compared to larger companies, which is ideal for small entrepreneurs.

- Annual Filing Made Simple: Maintaining accounts and filing returns is straightforward, reducing time spent on administrative tasks.

In summary, the benefits of an OPC include flexibility, legal protection, credibility, and room for growth. It’s a practical choice for solo entrepreneurs seeking control and stability.

Professional guidance can simplify the OPC registration and ensure a smooth start to your business journey. Contact RegisterKaro today!

Disadvantages of OPCs in India

While an OPC offers many benefits, it also comes with certain limitations. Understanding these disadvantages of OPCs helps entrepreneurs make informed decisions, avoid pitfalls, and plan effectively for growth and compliance.

1. Compliance and Regulatory Burdens

- Increased Compliance Requirements: While simpler than a private limited company, an OPC must comply with the Companies Act, 2013. Regulatory adherence can be time-consuming.

- Periodic Filings: Annual returns, financial statements, and other statutory filings are mandatory. These tasks often require professional assistance, adding to operational costs.

2. Limited Expansion Opportunities

- Funding Constraints: Despite being more credible than sole proprietorships, OPCs may struggle to attract substantial funding compared to companies with multiple shareholders.

- Growth Limitations: The single-owner structure can restrict bringing in additional investors or partners, potentially limiting expansion and scaling opportunities.

3. Operational Limitations

- Single Decision Maker: Relying on one person for all decisions can be risky. Business continuity may be affected if the sole owner is unavailable due to illness or other reasons.

- One Person Company Turnover Limit: OPCs face turnover restrictions under the Companies Act. Crossing these limits may require conversion into a private or public company, which involves additional compliance.

4. Perception and Credibility Issues

- Market Perception: Some stakeholders may view an OPC as less robust than companies with multiple directors. This perception can influence relationships with banks, investors, large clients, or government entities.

- Limited Networking: Solo ownership can limit strategic input from multiple perspectives, potentially reducing business insights and opportunities.

- Mandatory Conversion: If the OPC exceeds the prescribed turnover or paid-up capital thresholds, it must convert into a private or public limited company. This can bring added compliance and restructuring challenges.

Even with these disadvantages, many entrepreneurs choose OPC because its control, protection, and simple setup outweigh the challenges.

Legal Framework and Case Precedents for OPC

A One Person Company operates under a defined legal structure created by the Companies Act, 2013. Entrepreneurs need to evaluate the advantages of an OPC and the limitations that come with a single-owner company. These provisions ensure compliance, protect the owner, and support smooth business operations.

Some key provisions under the Companies Act, 2013, include:

- OPC Section: Specific sections cover formation, management, and dissolution of OPCs. These rules ensure that even a single-member company follows strong corporate governance standards.

- Limited Liability: The Act enforces limited liability, ensuring that the personal assets of the sole owner remain protected.

- Nominee Requirement: Every OPC must nominate a person to take over in case of the owner’s death or incapacity. This ensures continuity of the company.

- Conversion Requirement: OPCs must convert into a private or public limited company if paid-up capital exceeds ₹50 lakh or annual turnover exceeds ₹2 crore.

- Annual Filing and Compliance: OPCs must file annual returns and financial statements with the MCA. A statutory audit may be required if turnover exceeds prescribed limits.

- Restriction on Number of Companies: An individual can form only one OPC at a time to prevent misuse of the structure.

- Name Approval Rules: OPC names must follow MCA naming guidelines. Certain words require prior approval.

- Business Activity Limitations: Some sectors, such as banking or insurance, require special approvals and cannot always operate as an OPC.

- Minor Shareholder Restriction: Minors cannot be shareholders; only individuals above 18 years can form an OPC.

These provisions provide a robust legal framework. They guide business decisions, clarify potential risks, and ensure that OPCs operate with transparency and compliance.

Frequently Asked Questions

A One Person Company (OPC) is a business structure under the Companies Act, 2013 that allows a single entrepreneur to establish and operate a corporate entity.

- It offers limited liability protection, meaning the owner’s personal assets are safeguarded.

- It also provides the benefits of a structured company setup with greater credibility and recognition.