Important Partnership Deed Clauses in a Firm Explained

Partnership Deed Clauses are written legal terms that define the rights, duties, and roles of partners in a firm. It also outlines key points, including capital contributions, profit-sharing ratios, and partners’ decision-making power. While the Indian Partnership Act, 1932, does not mandatorily require a written Partnership Deed, having one in place helps avoid confusion and future disputes.

In this blog, you will learn in detail about the essential partnership deed clauses and how they provide stronger protection for firms.

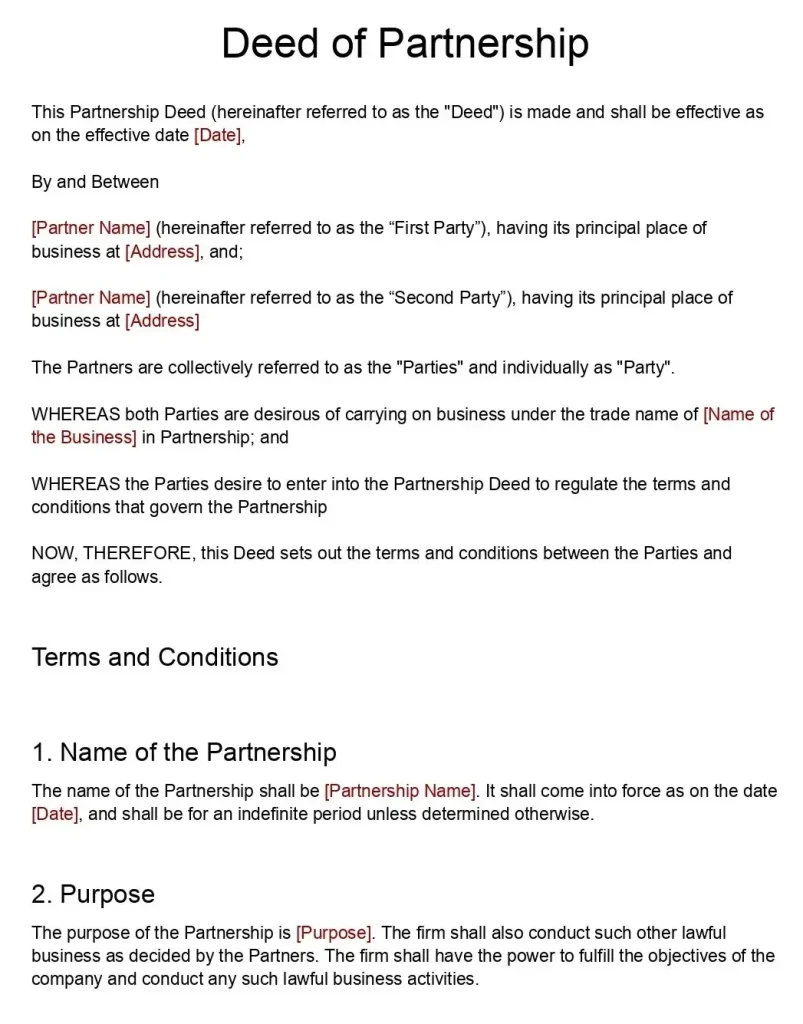

What is a Partnership Deed? Why is a Deed Clause Crucial?

A Partnership Deed sets clear expectations and ensures smooth operations of a partnership firm. Businesses draft a partnership deed to clearly define the rights, duties, roles, and responsibilities of partners. If partners do not create a written deed, the Indian Partnership Act, 1932, applies automatically.

In such a case, its standard provisions may not align with the partners’ specific understanding. Hence, a well-drafted deed can provide enhanced flexibility and legal clarity for partnership firms.

The provisions of a partnership deed apply to both registered and unregistered partnership firms. However, a registered firm enjoys better legal protection, including the right to file a suit against third parties. Therefore, you should register your partnership firm to avail important tax and legal benefits.

Importance of Partnership Deed Clauses

Clear Clauses in a Partnership Deed protect partners’ interests and ensure smooth business operations. Below are the key reasons why partnership deed clauses are important:

- Protect Rights of Partners: Partnership deed clauses clearly define the rights and duties of partners in a partnership firm. This prevents misuse of power and ensures smooth business operations

- Avoid Disputes: When decision-making powers, financial responsibilities, and operational rules are clearly defined, the likelihood of conflict decreases significantly. Written clauses act as a reference point during disagreements.

- Define Profit Sharing & Liabilities: The deed clearly specifies financial terms, maintains transparency, and prevents future financial disputes.

- Legal Validity and Enforceability: In case of disputes, a partnership deed serves as written evidence under the Indian Partnership Act, 1932. This legal backing protects both the firm and its partners.

In conclusion, partnership deed clauses are not just formalities. They safeguard rights, ensure clarity, and provide legal security for the long-term success of a partnership firm.

Check out Why a Partnership Deed is Essential for a detailed understanding of the partnership deed.

Mandatory Partnership Deed Clauses in a Firm

A well-drafted partnership deed must include certain core clauses to ensure clarity, transparency, and legal protection. These essential terms define how the partnership firm will operate and how partners will manage responsibilities.

1. Name of the Partnership Firm: The deed must clearly mention the official name of the partnership firm. The name should qualify the following characteristics:

- It should be a unique and lawful name.

- The name must not violate the Emblems and Names Act, 1950.

- It should not infringe on any existing trademark.

- The name should reflect the nature of the business.

2. Business Purpose: The deed must clearly define the business activities the firm will carry out. A specific business purpose helps prevent confusion and limit unauthorized activities.

3. Principal Place of Business: The partnership deed should mention the complete address of the principal place of business. This clause establishes the firm’s official location for legal notices, registration, and compliance. It also clarifies jurisdiction in case of disputes.

4. Duration of Partnership: The deed should state whether the partnership is for a fixed term or an indefinite period. It defines:

- A fixed-term partnership ends after a specified duration or project completion.

- An indefinite partnership continues until partners mutually decide to dissolve it.

5. Borrowing Clause: A borrowing clause in a partnership deed defines the authority of partners to borrow money on behalf of the firm. It clearly states who can take loans, the borrowing limits, and whether prior consent from other partners is required.

6. Capital Contribution: The deed must specify the amount each partner contributes as capital. It should also define the mode of contribution, such as cash, assets, or property. Clear terms regarding the timing of capital contributions prevent financial disputes later.

7. Profit & Loss Sharing Ratio: The partnership deed must clearly state how profits will be shared. It should also mention how the firm will allocate losses among partners.

8. Interest on Capital & Drawings: The deed should mention whether partners will receive interest on their capital contribution. It must also clarify if the firm will charge interest on drawings made by partners. The clause should define the interest rate and the method of calculation.

9. Partner Salaries/Remuneration: If partners receive salaries or remuneration, the remuneration clause in the partnership deed applies. It should define the amount, payment frequency, and conditions. The clause should also clarify how drawings and remuneration will be treated in the accounts.

10. Partner Duties, Rights & Obligations: The deed must define each partner’s daily operational rights and responsibilities. It should outline decision-making powers, authority to sign contracts, and limits of control.

11. Bank Account Operation: A bank account operation clause in a partnership deed defines how the partnership firm will manage and operate its bank accounts. It clearly states the bank’s name, the account type, and the authorized signatories.

12. Investment Clause: An investment clause in a partnership deed defines how the partnership firm will make investments using its funds. It specifies the types of investments allowed, such as fixed deposits, mutual funds, securities, or other financial instruments.

Including these core partnership deed clauses ensures legal clarity, financial transparency, and long-term stability for the partnership firm.

Additional Partnership Deed Clauses: Highly Recommended

Beyond core clauses, additional partnership deed clauses can also significantly impact business operations. Firms should make sure to include them in the partnership deed tailored to their business requirements. These clauses include:

1. Admission of New Partners: The deed should clearly define the procedure for admitting a new partner. It must specify whether existing partners need to give unanimous consent or majority approval. This clause also outlines the capital contribution and revised profit-sharing ratio after admission.

2. Sleeping Partner Clause: A sleeping partner clause in a partnership deed defines the rights and responsibilities of a sleeping partner, also known as a dormant partner. A sleeping partner invests capital in the firm but does not take part in daily business operations.

3. Retirement/Expulsion of Partner: The deed must specify the conditions under which a partner may retire voluntarily or be expelled. It should define notice requirements, account settlement, and payment of dues.

4. Death or Insolvency of Partner: The clause should explain the process to be followed in the event of a partner’s death or insolvency. It must clarify whether the firm will continue with the remaining partners or dissolve. The deed should also define the settlement and compensation process for legal heirs.

5. Dispute Resolution: This clause defines dispute resolution terms between the partners. A dispute resolution clause enables partners to resolve conflicts efficiently. An arbitration clause in a partnership deed allows partners to settle disputes outside court under the Arbitration and Conciliation Act, 1996. Mediation guidelines can also encourage mutual settlement before legal action.

6. Non-Compete Clause: The deed may include time-bound restrictions preventing partners from starting a competing business during or after the partnership. This clause protects the firm’s goodwill and business interests. The restrictions must remain reasonable to stay legally valid.

7. Confidentiality & Non-Disclosure: This clause protects sensitive business information, including trade secrets, client data, and financial records. It defines the scope of confidentiality and sets limits on disclosure. Clear terms safeguard the firm’s reputation and competitive advantage.

8. Dissolution of Partnership: The deed must specify events that trigger dissolution, such as mutual agreement, completion of the project, insolvency, or a court order. It should also define how partners will distribute assets and settle liabilities. Proper planning ensures the smooth closure of the partnership firm.

Including these clauses strengthens the partnership structure and prepares the firm for both growth and unforeseen challenges.

Difference Between Registered and Unregistered Partnership Firms

A partnership firm in India can operate as either a registered or an unregistered firm under the Indian Partnership Act, 1932. The difference between the two of them is:

| Feature | Registered Partnership | Unregistered Partnership |

| Legal enforceability | Can enforce contractual rights in court | Cannot enforce contractual rights against third parties |

| Image with clients | Builds stronger credibility and trust | Lower legal credibility |

| Right to sue for dissolution | Can file a suit for dissolution and settlement | Faces restrictions in filing suits |

| Compulsory clauses | Extensive and formally structured | Minimal, often informal |

In short, a registered partnership firm enjoys stronger legal protection and greater business credibility than an unregistered firm.

Common Mistakes to Avoid While Drafting Partnership Deed Clauses

Drafting a partnership deed requires attention to detail. Even small errors can create future legal and financial risks. Below are common mistakes you should avoid while adding a partnership deed clause:

- Omitting Important Clauses: Many partners skip essential clauses, such as profit-sharing ratios, capital contributions, dispute resolution, and dissolution terms. Omitting these clauses can lead to disputes in the future.

- Vague Wording: Unclear or generic language creates confusion during disputes. Terms related to decision-making powers, remuneration, or liabilities must remain specific and measurable.

- Not Specifying Clear Exit Mechanisms: A deed should define procedures for retirement, expulsion, death, or dissolution. Without exit clauses, partners may face serious legal and financial complications.

- Failure to Register: Although registration is not compulsory, an unregistered firm faces legal limitations. It cannot enforce contractual rights against third parties in court. Registration strengthens legal protection and business credibility.

Clear clauses and proper registration create a strong legal foundation for your partnership firm.

RegisterKaro can help you draft legally sound partnership deeds and complete Partnership Firm Registration smoothly. Our experts ensure compliance with the Indian Partnership Act, 1932, and protect your business interests. Contact RegisterKaro today.

Frequently Asked Questions

A partnership deed must include the firm name, business purpose, and principal place of business. It should clearly state the capital contribution and the profit-and-loss-sharing ratio. The deed must define the partners’ duties, rights, and decision-making powers. It should also include clauses for admission, retirement, dispute resolution, and dissolution.