A Section 8 Company is a type of nonprofit organization in India formed under the Companies Act, 2013. It is created to promote charitable activities, education, social welfare, and other initiatives that benefit society. Unlike regular companies, it cannot distribute profits to its members and must reinvest all earnings into its social objectives. Considering the advantages and disadvantages of Section 8 Company, it offers significant benefits such as tax exemptions and enhanced credibility.

Indian business owners, NGOs, and social enterprises can register 12A and 80G to gain fundraising advantages. These registrations recognize them as nonprofit institutions and allow donors to claim tax deductions on their donations. Depending on approval, donors can even reduce their taxable income by 50% to 100% of the amount donated.

In this blog, we will cover the advantages, disadvantages, key legal requirements, and unique features of a Section 8 Company.

What is a Section 8 Company, and its Key Features

Section 8 of the Companies Act 2013 allows the formation of a company with charitable objectives. The Central Government grants a licence to Section 8 Companies to operate legally.

These companies work to promote activities such as education, social welfare, research, environmental protection, or other charitable causes. Their core aim is public benefit and not profit generation.

To register a Section 8 Company, promoters must have the following eligibility:

- The company must have a clear charitable objective.

- It must have a minimum of two directors for a private company and three for a public company.

- They must have a registered office in India and obtain a government licence before incorporation.

Key Features of a Section 8 Company

A Section 8 Company operates as a structured nonprofit entity under the Companies Act, 2013. It combines social objectives with a formal corporate framework. Below are its key features:

- A Section 8 Company has its own legal identity. It can own property, enter into contracts, sue or be sued, and continue to exist even if its members change.

- Members have limited liability, protecting their personal assets.

- Profits cannot be distributed; all income must be reinvested into charitable objectives.

- Must maintain proper accounts, conduct audits, file ITR returns, and follow all compliance requirements of a Section 8 company under the Companies Act, 2013.

- Commonly used by NGOs, social enterprises, educational and research institutions, and charitable organizations for credibility and structured governance.

These features help readers understand how a Section 8 Company functions before evaluating its advantages and disadvantages.

Key Advantages of a Section 8 Company in India

A Section 8 Company offers more than just nonprofit status. It provides legal strength, financial flexibility, and long-term credibility. Here are the key benefits explained clearly:

1. Legal Recognition & Strong Credibility

A Section 8 Company enjoys formal legal status, which strengthens its reputation.

- Registered under the Companies Act, 2013, as a government-recognized entity.

- Builds strong trust among donors, CSR contributors, and government bodies.

- Creates a professional image compared to informal nonprofit structures.

2. Limited Liability Protection

This structure safeguards the personal interests of its members.

- Protects the personal assets of members and directors.

- Limits financial risk to the agreed contribution.

- Encourages responsible governance without personal exposure.

3. Perpetual Succession & Independent Identity

The organization continues to exist regardless of the internal changes.

- Continues to operate even if members or directors change.

- Can own property, open bank accounts, and sign contracts in its own name.

4. Tax Benefits & Exemptions

Tax advantages improve financial sustainability and donor appeal.

- Eligible for income tax exemptions through 12A registration.

- Allows donors to claim tax deductions under 80G.

- Increases fundraising potential and donor confidence.

5. No Minimum Capital Requirement

Starting a Section 8 Company does not require heavy capital investment.

- No fixed capital requirement for incorporation.

- Allows promoters to start with minimal financial burden.

- Makes it accessible for small social initiatives.

6. Zero Stamp Duty & Name Flexibility

The law offers certain incorporation benefits to nonprofit companies.

- Often exempt from stamp duty on incorporation documents.

- Can operate without using “Private Limited” or “Limited” in its name.

- Reflects its nonprofit identity clearly.

7. Better Access to Funding

The structure improves eligibility for diverse funding sources.

- Eligible to receive Corporate Social Responsibility (CSR) funds from companies.

- Can apply for government grants and schemes.

- Can accept foreign contributions after obtaining FCRA approval.

8. Structured Governance & Transparency

A formal governance system enhances accountability and trust.

- Managed by the Board of Directors.

- Requires regular compliance and reporting,

- Promotes transparency and long-term sustainability.

These advantages make a Section 8 Company a reliable and scalable structure for organizations working toward social impact in India.

Key Disadvantages of a Section 8 Company in India

While a Section 8 Company offers many benefits, it also comes with certain limitations under Indian law. These disadvantages include:

1. No Profit Distribution to Members

This structure strictly prohibits sharing profits.

- All income and surplus must be used only for the stated charitable objectives

- Members cannot receive dividends or financial returns

2. Stringent Regulatory Compliance

The company must follow detailed legal procedures under the Companies Act, 2013.

- Mandatory board meetings and Annual General Meetings (AGM)

- Annually file with the Registrar of Companies (ROC)

- Statutory audits and proper maintenance of books of accounts

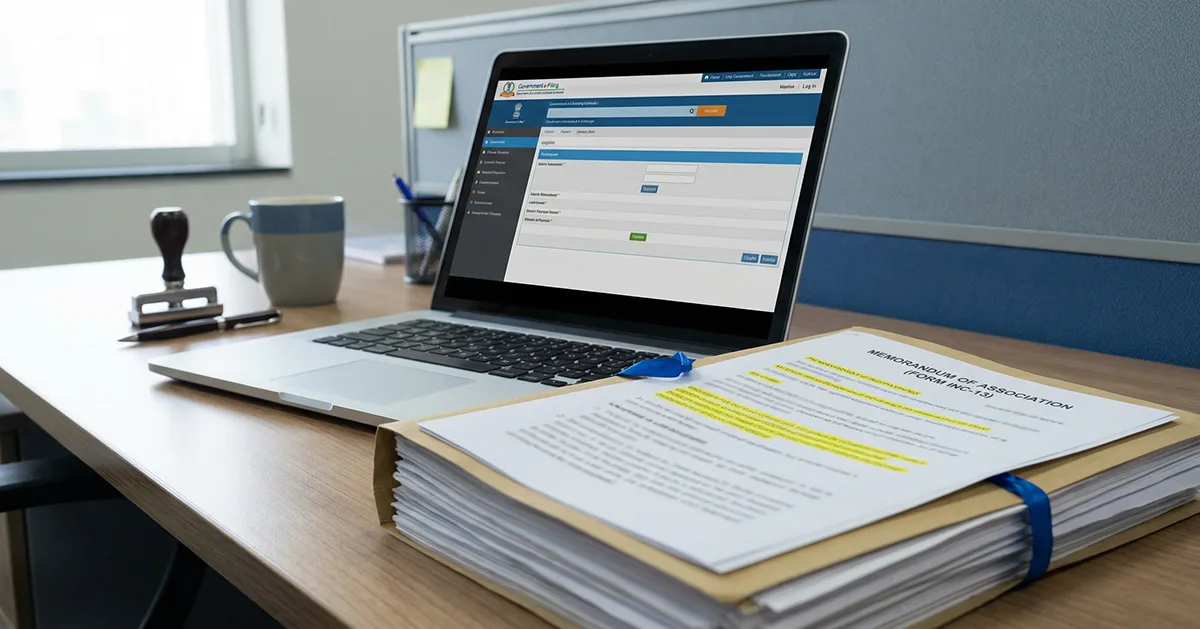

3. Longer & More Complex Registration

Incorporation involves detailed documentation and approvals.

- Requires licence approval from the ROC

- Subject to the scrutiny of the Memorandum and Articles of Association (AoA)

- The registration timeline may be longer than for Trusts or Societies

4. Limited Operational Flexibility

Operational changes require formal approval.

- Alterations in MOA or AOA need government approval

- Cannot easily change core objectives once registered

5. Higher Formation & Maintenance Costs

Compliance and professional support increase expenses.

- Professional fees for incorporation and filings

- Ongoing statutory compliance costs

- It may be more expensive than forming a Trust or Society

6. Restrictions on Fundraising

The company cannot raise funds like a commercial entity.

- Cannot issue equity shares for profit

- Cannot offer profit-linked returns to investors

7. Greater Regulatory Scrutiny

Authorities closely monitor nonprofit activities.

- Non-compliance may lead to penalties

- Serious violations can result in licence cancellation

These disadvantages highlight the importance of careful planning before choosing a Section 8 Company structure.

Section 8 Company vs Other Legal Structures

This comparison helps you decide if a Section 8 Company is the right choice for you or not based on tax, funding, and governance:

| Feature | Section 8 Company | Trust | Registered Society | Private Limited Company |

| Objective | Nonprofit, social impact | Charitable, nonprofit | Charitable, nonprofit | Profit-driven |

| Legal Identity | Separate legal entity | Not always a separate legal entity | Separate legal entity | Separate legal entity |

| Profit Distribution | Not allowed | Not allowed | Not allowed | Allowed |

| Tax Benefits | Eligible for 12A/80G registration | Eligible under certain conditions | Eligible under certain conditions | Standard corporate tax applies |

| Compliance | High (ROCs, filings, audits) | Low to moderate | Moderate | High |

| Governance | Board of Directors | Trustees | Governing body | Directors & shareholders |

| Funding Options | CSR funds, grants, FCRA funds | Donations, grants | Donations, grants | Equity, loans, investors |

This table clearly highlights the differences, making it easier to choose the best legal structure for your organization.

Conclusion

A Section 8 Company combines credibility, tax benefits, and structured governance, making it ideal for organizations focused on social impact. While it requires strict compliance and cannot distribute profits, it also has various advantages. It can access CSR funding, perpetual succession, and donor trust. These factors often outweigh the challenges companies face.

If you wish to start your nonprofit on a strong legal foundation, RegisterKaro can help you with a Section 8 Company registration. We handle compliance, documentation, and approvals so you can focus on creating social impact. Contact us now to get started!

Frequently Asked Questions

Yes, a Section 8 Company pays salaries. It is one of the key advantages of a Section 8 company is that it can legally pay salaries to directors, employees, and staff involved in its operations. The salaries must be reasonable and directly related to the work performed for the nonprofit. While profits cannot be distributed to members, compensating employees ensures smooth functioning and professional management.