How to Use the FiLLiP Form for LLP Incorporation in India?

Starting a business in India requires the right structure. An LLP incorporation gives flexibility like a partnership and protects partners’ personal assets. Using the FiLLiP Form for LLP makes the registration process simple and efficient. An LLP is easier to manage than a private limited company and suits startups and small businesses perfectly.

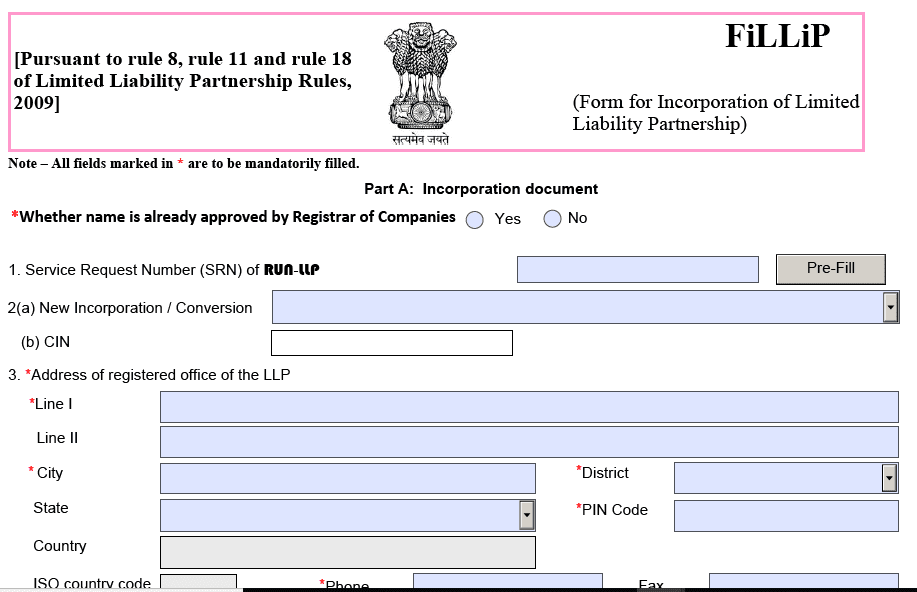

The FiLLiP Form is the first step to register an LLP. This single online form lets you apply for name approval, add partner details, and Director Identification Numbers (DINs) in one go.

In this blog, you will learn what the FiLLiP LLP Form is, which documents you need, and how to file it step by step. By the end of this blog, you will clearly understand how to set up your LLP easily and correctly.

What is Form FiLLiP?

Form FiLLiP’s full form is “Form for Incorporation of Limited Liability Partnership.” Essentially, it is the official online form to register a new LLP in India. Introduced under MCA’s 2020 reforms, Form FiLLiP replaced the earlier separate forms: Form 1, Form 2, and Form 3.

These were used individually for name reservation, LLP incorporation, and partner details. The integrated form simplifies the process by combining all these steps into a single digital submission.

The form combines multiple steps into one. You can:

- Reserve the LLP name

- Provide incorporation details

- Apply for DIN/DPIN for designated partners all at once

This streamlines the process and reduces multiple filings.

Form FiLLiP follows the Limited Liability Partnership Act, 2008, and the LLP Rules, including updates from the Second Amendment Rules, 2022. Filing it correctly ensures that your LLP is legally recognized and ready to operate.

Why Form FiLLiP Matters?

Filing Form FiLLiP gives your LLP incorporation process a significant boost. You benefit in multiple ways, such as:

- Simplified process: It combines name reservation, LLP incorporation, and DIN or DPIN allotment into one form.

- Faster registration: Since the single‑form approach and online filing remove the requirement for separate filings, your LLP can get registered quickly.

- Fully digital & paperless: The form is filed online via the Ministry of Corporate Affairs portal (mca.gov.in), aligning with the latest e‑governance push.

- Up to five designated partners at filing: The Limited Liability Partnership (Second Amendment) Rules, 2022, allow up to five designated partners to apply for DIN/DPIN while filing the form. The limit of five designated partners allows the MCA to streamline the filing process. Additional partners can apply for DIN/DPIN separately after incorporation.

- PAN & TAN allotment along with incorporation: The amendment allows the system to allot PAN and TAN along with the Certificate of Incorporation (COI) when Form FiLLiP is approved. After approving the LLP, the system automatically generates the PAN and TAN through integration with the Income Tax Department, eliminating the need for separate applications.

- Reduced scope for errors and follow‑ups: With a single integrated form, you avoid juggling multiple forms and reduce the chances of rejections due to missing filings.

Get your LLP registered quickly and hassle-free with RegisterKaro. File your Form FiLLiP accurately and confidently with our expert guidance and start your business on a solid legal foundation today. Contact us today.

Difference Between Form FiLLiP and RUN‑LLP

Many entrepreneurs confuse RUN‑LLP and Form FiLLiP. Here’s the simple distinction:

- RUN‑LLP: Use this service if you want to reserve your LLP name before incorporation.

- Form FiLLiP: If you are directly incorporating the LLP, you can apply for name approval within the form itself, along with all other incorporation details.

This keeps the process streamlined and avoids filing separate forms unnecessarily.

Who Should Use Form FiLLiP?

You should apply for Form FiLLiP if you are:

- Incorporating a new LLP: Whether your partners are Indian residents or foreign nationals/NRIs, you can seamlessly register your LLP using this form. It streamlines the process by approving the name, incorporating the details, and processing the DIN/DPIN applications in one go, helping you save time and avoid multiple submissions.

- Converting an existing entity into an LLP: If you plan to convert a partnership firm or a private/unlisted company into an LLP, note that you cannot use Form FiLLiP for the conversion.

- For a partnership firm, Form 17 must be filed to convert it into an LLP.

- For a private or unlisted company, Form 18 is required to complete the company-to-LLP conversion.

Form FiLLiP primarily facilitates new LLP incorporations, while these separate forms ensure the converted entity complies with LLP regulations from day one.

Eligibility & When Form FiLLiP Is Not Applicable

To use Form FiLLiP, your LLP must meet certain minimum eligibility requirements set by the Ministry of Corporate Affairs. These requirements ensure legal compliance of the LLP and make all partners properly identified and accountable.

Minimum Requirements

The minimum requirements for using Form FiLLiP for LLPs include:

- At least two designated partners: Every LLP must have a minimum of two designated partners at the time of incorporation. These partners are responsible for compliance with the LLP Act, 2008, and act as the primary contact points with the Registrar of Companies (ROC).

- One resident Indian partner: At least one designated partner must be a resident of India. A person qualifies as a resident if they have stayed in India for 182 days or more in the preceding financial year. This ensures that there is a local partner available for legal and regulatory communications.

- Valid Digital Signature Certificates (DSCs): All designated partners must possess DSCs to sign the Form FiLLiP electronically. The DSC authenticates the application and enables you to complete the entire filing online without any physical paperwork.

When Form FiLLiP Is Not Applicable?

Form FiLLiP suits most new LLP incorporations and certain conversions, but some situations prevent its use. These are:

- Complex conversions: Certain conversions, such as restructuring under other regulatory Acts or merging multiple entities into an LLP, may require specific e‑forms or approvals beyond Form FiLLiP. In these cases, using FiLLiP alone is not sufficient, and additional regulatory steps must be followed.

- Filing post-incorporation changes: You cannot use Form FiLLiP for updates after incorporating the LLP, such as adding or removing partners, changing the address, or amending the capital contribution. You must use separate MCA forms like Form 3, Form 4, or Form 24 for these changes.

- Resubmission after incorporation-related modifications: If you need to make any corrections or updates after incorporation, you cannot use Form FiLLiP. You must file the relevant post-incorporation e-forms to record these changes legally.

By understanding these eligibility criteria and limitations, entrepreneurs can ensure they file Form FiLLiP correctly the first time, avoiding rejections, delays, and additional compliance hassles. Proper preparation at this stage helps streamline the LLP registration process and guarantees legal recognition from day one.

What’s Included in Form FiLLiP?

Form FiLLiP gathers all the key information needed to incorporate an LLP. It is divided into sections that cover different aspects of the LLP’s formation. Here’s what you need to include:

1. Name Reservation / RUN-LLP / Integrated Name Section

This section lets you propose the name(s) for your LLP during incorporation. It also handles name reservation:

- Checks if the name is already taken or conflicts with existing companies/LLPs.

- Allows validation of previously reserved names using SRN (Service Request Number).

- Let’s propose alternative names in case the first choice is unavailable.

2. Registered Office & Business Activity Details

- Registered office address: Official address for all legal and regulatory communications.

- Nature of business: Includes the NIC code and a brief description of the main business activity to classify your LLP correctly.

3. Partners / Designated Partners Details

- Full names, addresses, DIN/DPIN, and PAN of all designated partners.

- Consent of partners is required via Form 9, which must be attached.

4. Capital Contribution & Profit Sharing

- Capital contribution of each partner (cash, assets, or other forms).

- Profit-sharing ratio, if applicable.

- Even if no capital is contributed, indicate the agreed-upon terms among partners.

5. Attachments / Supporting Documents

- Proof of registered office (rent agreement, utility bill, or No Objection Certificate (NOC).

- Identity and address proofs of partners (PAN, Aadhaar, passport, voter ID).

- Corporate body partner resolution, if a body corporate is a partner.

- Any additional declarations or consent forms as required.

6 Digital Signatures & E-Filing

- All designated partners must sign the form digitally using a Digital Signature Certificate (DSC).

- Practicing professionals (CA, CS, CMA) may also affix their DSC to certifying documents.

- Digital submission ensures the process is secure, paperless, and traceable.

How to File Form FiLLiP?

Filing Form FiLLiP is a straightforward online process if you know the steps and have all documents ready. Follow this guide to register your LLP smoothly:

1. Obtain DSC

Every designated partner must have a valid DSC to sign the Form FiLLiP electronically. The DSC ensures the authenticity and security of your submission. You can obtain it from government-authorized certifying agencies.

2. Apply for DIN/DPIN (if not already available)

All designated partners need a Director Identification Number (DIN) or Designated Partner Identification Number (DPIN). If they don’t already have one, Form FiLLiP allows you to apply for DIN/DPIN during the filing process, saving time.

3. Choose and Validate LLP Name

Propose your LLP name and check its availability on the MCA portal (mca.gov.in). You can submit up to two alternative names. If you have already reserved a name using an SRN, you can validate and link it in this section.

4. Fill in LLP Details in Form FiLLiP

Provide complete information about all partners and designated partners, including names, addresses, DIN/DPIN, and PAN. Add details about the registered office, business activity (NIC code and description), capital contribution, and profit-sharing ratio. Attach partner consent forms (Form 9) and other required documents.

5. Upload Attachments & Supporting Documents

Attach all necessary documents, such as proof of the registered office (rent agreement, utility bill, or NOC), identity and address proofs of all partners, and corporate resolutions if a body corporate is a partner. Ensure all documents are clear and properly scanned.

6. Review, Sign Digitally, and Submit

Double-check all information to avoid errors. All designated partners must sign digitally using their DSCs. Practicing professionals (CA, CS, CMA) may also affix their DSC if certifying the form. Submit the form online via the MCA portal.

7. Pay Fees

Pay the prescribed MCA filing fees based on the LLP’s capital contribution. After payment, you will receive an Acknowledgment Receipt confirming submission.

8. Receive COI

Once approved, the Registrar issues the Certificate of Incorporation (COI) along with LLPIN (Limited Liability Partnership Identification Number). The MCA dashboard usually auto-generates PAN and TAN, which you can download directly.

9. Track Application Status

After submission, you can monitor your Form FiLLiP application status on the MCA portal using the Acknowledgment Number. This helps you stay updated on approvals, rejections, or any additional requirements, ensuring a smooth and timely incorporation process.

Remove the hassle from LLP registration by filing every detail correctly. RegisterKaro guides you through the Form FiLLiP submission process and incorporates your LLP quickly and accurately.

Common Mistakes to Avoid While Filing Form FiLLiP

Filing Form FiLLiP correctly the first time is crucial. Simple errors that are easy to avoid cause many delays and rejections. Here are the most common mistakes:

- Incorrect or incomplete partner details: Filing the form with wrong names, addresses, PAN, or DIN/DPIN can lead to rejection. Always double-check all partner information before submission.

- LLP name issues: Proposing a name that is already in use, identical, or similar to an existing LLP or company can cause rejection. Always verify name availability on the MCA portal and provide alternatives.

- Missing or incorrect attachments: Failing to upload required documents, such as office proof, identity proofs, or partner consent forms, is a common reason for delays. Ensure all attachments are clear, accurate, and in the required format.

- Errors in capital contribution or profit-sharing details: Incorrectly entering partners’ capital contributions or profit-sharing ratios can create legal complications later. Confirm these details with all partners before filing.

- Not validating previously reserved names (SRN): If you have a reserved name, forgetting to validate it in the form can lead to unnecessary delays. Always link the SRN during filing.

- Using non-standard document formats: Ensure all documents are in PDF format and under the size limits specified by the MCA. Non-standard formats may cause rejections.

- Incorrectly signed attachments: Only the designated partner or authorized professional should digitally sign attachments. Unsigned PDFs or signatures by unauthorized persons often lead to form rejection.

- Incomplete business activity details: Providing vague or incorrect NIC codes or business descriptions can affect MCA classification. Ensure the main division of industrial activity is accurate.

By avoiding these mistakes, you can ensure faster approval and a smooth issuance of the Certificate of Incorporation (COI).

Conclusion

Form FiLLiP is the backbone of LLP registration in India. By understanding its sections, eligibility criteria, and common pitfalls, entrepreneurs can file accurately and avoid delays. Using this form correctly ensures a fast, paperless, and legally compliant incorporation process, helping your LLP start on a strong foundation.

Frequently Asked Questions

You can use RUN-LLP for Name Reservation Utility to check and reserve a proposed LLP name on the MCA portal. Form FiLLiP, on the other hand, is the incorporation form that collects all details for LLP registration, including partner information, registered office, capital contribution, and DIN/DPIN allotment. RUN-LLP focuses only on name approval, while FiLLiP completes the full registration.