LLP Form 3: Filing Process, Agreement & Compliance Steps

In the fiscal year 2023–24, 58,990 new entrepreneurs chose the LLP incorporation business structure, as it offers freedom, low risk, and strong legal protection. But here’s the surprising part: many of these LLPs run into trouble within the first few months, not because of poor planning or bad management, but because they ignore one crucial compliance requirement: Filing Form 3 LLP. Sounds unexpected, doesn’t it? Yet this one filing determines whether your LLP Agreement holds any legal power, and many entrepreneurs overlook its importance.

The LLP agreement forms the backbone of the business. It specifies how partners share profits, handle duties, manage disputes, and run the business. However, the agreement remains incomplete and legally ineffective until you file it with the Ministry of Corporate Affairs (MCA). This is where Form 3 LLP comes in. It acts as the official seal, turning your private partnership rules into a legally recognized public document. Without this filing, the agreement has no legal standing.

Surprisingly, to fill this form, you only have 30 days from incorporation. If you miss this deadline, the MCA imposes a late fee of ₹100 per day, with no upper limit. Many LLPs end up paying more in penalties than their actual compliance costs, which is a completely avoidable mistake.

This blog explains everything you need to know about Form 3 LLP, what it is, why it matters, how to file it, and how to avoid costly late fees. Let’s break down this critical LLP Compliance step to ensure your LLP stays compliant and avoids unnecessary penalties.

Legal Significance and Applicability of Form 3 LLP

The LLP Agreement Form 3 holds immense legal significance for the entire business. It officially governs all partners within the LLP. Filing Form 3 of LLP converts this private agreement into a public record. In short, this step gives the agreement its legal power before all authorities.

You must use this e-form in two main situations for an LLP:

- Immediately after incorporation, partners must file Form 3 as soon as the new LLP is successfully incorporated.

- After amending the agreement, partners must file Form 3 whenever they make a change to the LLP agreement.

Form 3 covers changes to partners, capital contributions, business activities, and other material amendments. Without this filing, the ROC does not legally recognize any internal amendments. This lack of recognition can create serious LLP compliance issues later. The filed agreement serves as the final reference for all partners and regulators.

Key Components of LLP Form 3

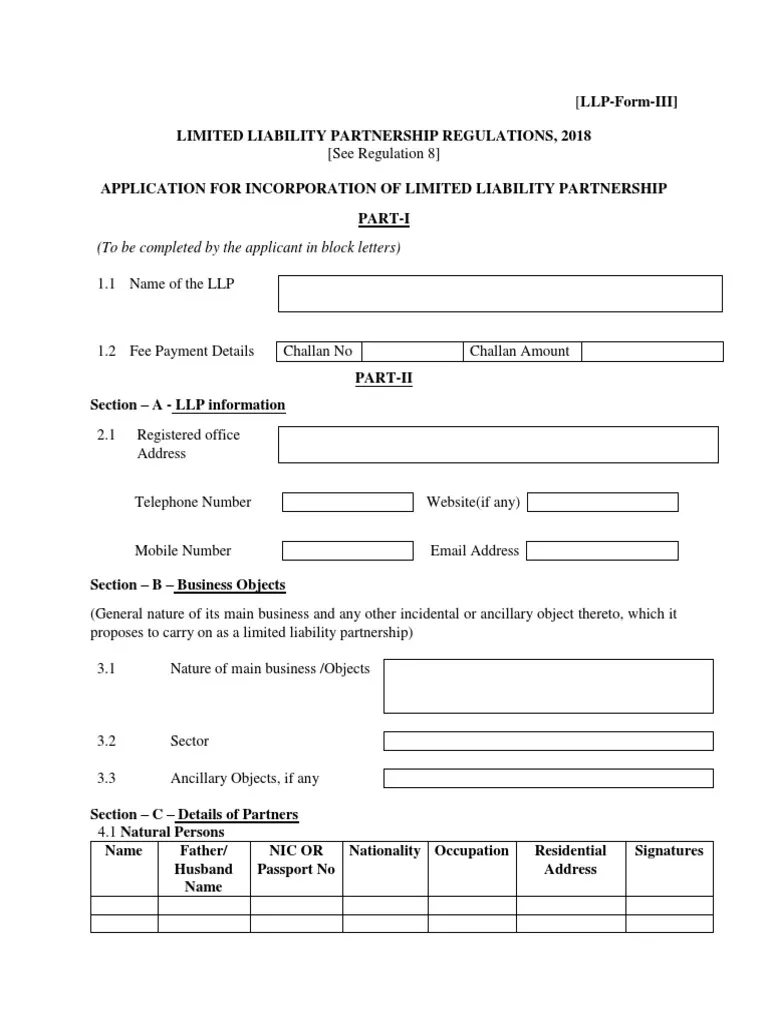

Form 3 LLP is a structured e-form capturing the agreement’s key details. Filers must first provide the LLP’s name, LLPIN, and registered office address. Form 3 LLP requires the full, accurate details of all partners and designated partners.

The form and the Form 3 LLP Agreement include the following key components:

- A core section outlines the total capital contribution of all partners.

- It also clearly defines the profit-sharing ratios agreed upon by everyone.

- The agreement must detail all the rights, duties, and obligations of partners.

- Form 3 LLP specifically asks for the date of the agreement and its location.

- The LLP includes its management structure and any dispute resolution clauses.

- Filers must define clear procedures for any future changes in the partnership.

The form also captures the main business activities conducted by the LLP. These details must exactly match the executed and notarized LLP Agreement Form 3. Any discrepancy between the form and the attachment can lead to rejection.

What is the Filing Process for Form 3 LLP?

The filing process for Form 3 LLP involves several precise steps for legal compliance.

Here is the step-by-step procedure:

1: Draft and Notarize the LLP Agreement

- All partners must draft the LLP Agreement (Form 3) on appropriate stamp paper.

- The value of the stamp paper depends on the state where the LLP is registered.

- The agreement must be notarized to ensure its full legal validity.

2: Access the MCA V3 Portal

- Once the agreement is ready, a designated partner logs into the MCA V3 portal (mca.gov.in) to access the e-form.

3: Fill Out the Form 3 LLP

- The filer enters the LLP’s SRN or LLPIN to auto-populate the basic company data.

- They must carefully fill in the agreement date and the specific place of execution.

4: Attach Supporting Documents

- Attach all mandatory supporting documents in the required PDF format. This ensures completeness and compliance.

5: Affix Digital Signatures

- A designated partner must affix their valid Digital Signature Certificate (DSC).

- A practicing professional (CA or CS) must also digitally sign the form to verify that all details are correct.

6: Submit and Pay the Filing Fees

- After filling out the form, submit it on the MCA portal (mca.gov.in).

- Form 3 LLP filing fees are based on the LLP’s total capital contribution and must be paid during submission.

This professional certification verifies that all details are correct and fully compliant. The form is then submitted on the MCA portal with the applicable Form 3 LLP fees. These LLP Form 3 filing fees are based on the LLP’s total capital contribution.

Documents Required for Form 3 LLP

A successful Form 3 LLP filing depends entirely on attaching the correct documents. The following documents are mandatory for the filing:

- Notarized LLP Agreement (Form 3): The primary attachment is the fully executed and notarized Form 3 LLP Agreement. You must clearly scan this document after completing all stamping and signing.

- Original Agreement (if amended): If you amend the LLP agreement, attach a copy of the original agreement along with the amended deed.

- Partner Consent Letters (if applicable): The system may require attaching partner consent letters in specific cases, particularly if there are changes in the partnership structure.

- Additional Approvals or Resolutions: If applicable, include any other relevant approvals or resolutions. These documents may include resolutions for changes in capital contributions, new partners, or business activities.

- Additional Supporting Documents: Attach any other documents that the MCA or your LLP may require. These documents could include proof of address, ID proofs of partners, and more.

Due Dates and Timeline for Form 3 LLP

Partners must file the form within exactly thirty days of the company’s incorporation. This 30-day countdown begins from the date printed on the Certificate of Incorporation.

This Form 3 LLP due date also applies to any future amendments. This rule applies to any change made to the LLP Agreement through a new deed. Missing this 30-day deadline leads to significant late fees and legal consequences. There is no provision for any extension of this initial filing timeline.

Penalties for Late Filing of Form 3 LLP

Failure to file Form 3 of LLP on time results in significant financial penalties. The MCA imposes a standard LLP Form 3 late fee for delayed filings. This late fee is a fixed amount of ₹100 per day of delay. There is no upper cap or limit on this accumulating late fee amount. The penalty for late filing of Form 3 of LLP can become very large quickly.

Here are the consequences of non-filing:

- A delay of one year could result in a penalty of over ₹36,000 (100 x 365 days).

- Furthermore, the LLP is considered non-compliant in the MCA’s official records.

- This non-compliance can block the filing of other important annual forms, like Form 8.

- It can also lead to the LLP being marked as “defunct” or put into strike-off.

Therefore, timely filing is crucial for the LLP’s financial health and legal standing.

Recent Amendments and MCA Guidelines

The Ministry of Corporate Affairs has introduced several key changes in recent years. The most significant change was the complete move to the new MCA V3 portal (mca.gov.in). All LLP forms, including Form 3 LLP, are now filed on this new web-based portal.

This V3 portal uses online forms instead of the old offline PDF e-forms. An LLP Form 3 download is no longer the primary method of filing. The filer must now fill in all the details directly on the website itself. This change aims to streamline the process and reduce data entry errors. The basic legal requirements and the Form 3 LLP due date remain unchanged. Partners must ensure their DSCs are properly registered on the V3 portal. This Form 3 LLP help guide is based on these current V3 portal requirements.

Conclusion

Form 3 LLP is much more than just an administrative formality for entrepreneurs. It is the legal process of recording the LLP’s foundational agreement with the government. The LLP Agreement Form 3 defines the rights and duties of all partners.

Filing it on time is the first step in good corporate governance. The heavy penalty for late filing of Form 3 of LLP highlights its legal importance. All businesses must prioritize this filing to maintain their good legal standing. Seeking professional help can ensure this process is smooth, compliant, and error-free. This protects the LLP and its partners from future disputes and financial penalties.

Contact us if you want expert support with drafting or filing your LLP agreement. A compliance professional will guide you through the entire Form 3 process and ensure your LLP stays fully compliant without delays or penalties.

Frequently Asked Questions

Yes, it is a mandatory filing. What is LLP Form 3? It is the e-form filed with the Ministry of Corporate Affairs to submit the Limited Liability Partnership (LLP) Agreement. This form places the partners’ agreement on the official government record.