What is LLP Form 4: Purpose, Filing & Compliance Guide

Running an LLP (Limited Liability Partnership) comes with its own set of advantages: flexibility, limited liability, and the ability to easily adjust the partnership structure. But with these benefits comes the responsibility of maintaining legal compliance. One of the most crucial documents for doing so is filing the Form 4 LLP.

Have you ever wondered how changes in the LLPs’ partners or other aspects are officially recorded? Form 4 LLP is the answer. Whether it’s a new partner or an address change, Form 4 LLP keeps your LLP transparent and up-to-date with the Registrar of Companies (ROC). This form is not just a formality; it’s a legal requirement under the LLP Act of 2008, ensuring your business stays compliant and avoids costly penalties.

In this blog, we’ll walk you through what Form 4 LLP is, why it’s important, and the step-by-step process to file it correctly. Let’s dive into how to keep your LLP running smoothly and in line with the law.

What is the Purpose of the LLP Form 4?

The core function of Form 4 LLP is to ensure transparency and maintain updated records. The ROC’s database must reflect the current management and partnership structure. This information is used by banks, investors, and other stakeholders for verification. Filing Form 4 for LLP is mandatory for several specific events, including LLP partner change form submissions.

- It reports the official appointment of a new partner or the addition of a designated partner.

- It formally notifies the ROC about the resignation of a partner.

- It updates the record if a partner ceases due to death or other reasons.

- It notifies a change in a partner’s designation (e.g., from partner to designated partner).

- It is also used to report changes in a partner’s personal details, like a name or address change.

This filing ensures the legal incorporation of an LLP and its partner structure. It is a mandatory requirement for public record-keeping and compliance for LLPs. Accurate records prevent legal disputes regarding the authority of partners.

Who Needs to File LLP Form 4?

Any Limited Liability Partnership (LLP) that undergoes changes in its partners or designated partners must file Form 4 LLP. The responsibility to file this form lies with the LLP itself, not with the individual partners. The form must be submitted by an authorized Designated Partner of the LLP.

This process also involves professional oversight to ensure that the form is accurate and compliant. A Chartered Accountant (CA), Company Secretary (CS), or Cost Accountant (CMA) must digitally sign and certify the form. This certification confirms that the professional has verified the changes and ensures that the filing complies with both the LLP Act and the LLP agreement.

If you’re unsure about how to handle Form 4 or need assistance with the filing process, our expert Chartered Accountants (CAs) are here to help. We offer professional support to ensure your LLP remains compliant and meets all legal requirements. Contact us today for seamless filing support!

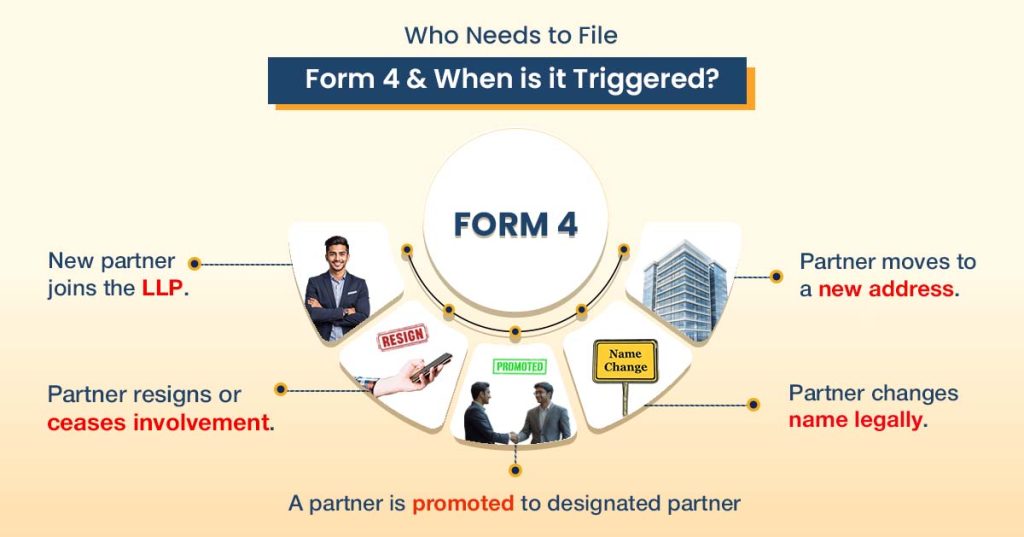

When is Form 4 Triggered?

This form becomes necessary whenever the internal structure of the partnership changes. Several common events trigger the immediate requirement to file Form 4 LLP. The partners must act quickly when these events occur.

Here are the most common triggers:

- A new individual or body corporate joins the LLP as a partner.

- An existing partner chooses to resign, often by providing a formal resignation letter.

- A partner ceases to be involved due to an unfortunate event like death or incapacity.

- The partners collectively decide to promote a partner to a designated partner role.

- An existing partner legally changes their name (e.g., after marriage).

- A partner moves to a new residential address.

The LLP Act, 2008, sets a strict timeline for this compliance. The Form 4 LLP due date is within thirty days of the event. This 30-day countdown begins from the effective date of the change. For example, if a partner’s resignation is effective on June 1st, the LLP must file Form 4 LLP by June 30th.

How to File Form 4 of LLP: Step-by-Step Guide:

Knowing how to file Form 4 of LLP on the MCA V3 portal (mca.gov.in) is essential. The process mentioned below is completely digital and requires a registered user account.

- Preparation is First: The LLP must first complete all internal documentation. This includes passing a resolution or getting a resignation letter. The new partner must have a valid DPIN.

- Login to MCA V3 Portal: The designated partner or professional logs into their MCA account (mca.gov.in). They must navigate to the “LLP Forms” section to find the form.

- Fill the Web-Based Form: Form 4 LLP is now a web-based form on the V3 portal. The user fills in all required information directly in their browser.

- Form 4 Attachments: The filer must attach all the required scanned documents. The list of Form 4 LLP attachments is crucial for approval.

- Digital Signatures: One of the LLP’s designated partners must digitally sign the form. It must also be certified by a practicing professional (CA, CS, or CMA).

- Pay Government Fees: After signing, the filer submits the form and pays the standard government filing fee.

- Receive SRN: Upon successful submission, a Service Request Number (SRN) is generated. This SRN is used to track the status of the Form 4 of LLP filing.

Note: The old Form 4 LLP download (the PDF version) is no longer used for filing. The entire process now occurs on the web portal.

Form 4 LLP Attachments and Required Documents

The ROC will not approve Form 4 LLP without the correct supporting documents. The list of Form 4 LLP attachments varies based on the reason for filing:

- For Appointment of a New Partner:

- A copy of the consent letter from the new partner to act as such.

- A copy of the resolution passed by the LLP approving the appointment.

- Evidence of the new partner’s identity and residential address (PAN and Aadhaar).

- For Resignation or Cessation:

- A copy of the partner’s formal resignation letter.

- Proof of the cessation, such as a death certificate if the partner has passed away.

- A copy of the resolution or agreement accepting the resignation.

- For Change in Name/Address:

- Official proof of the change, like a marriage certificate or gazette notification.

- A new utility bill or bank statement as proof of the new address.

All attachments must be clear, legible, and properly scanned before uploading. Inaccurate or blurry attachments are a common reason for application resubmission.

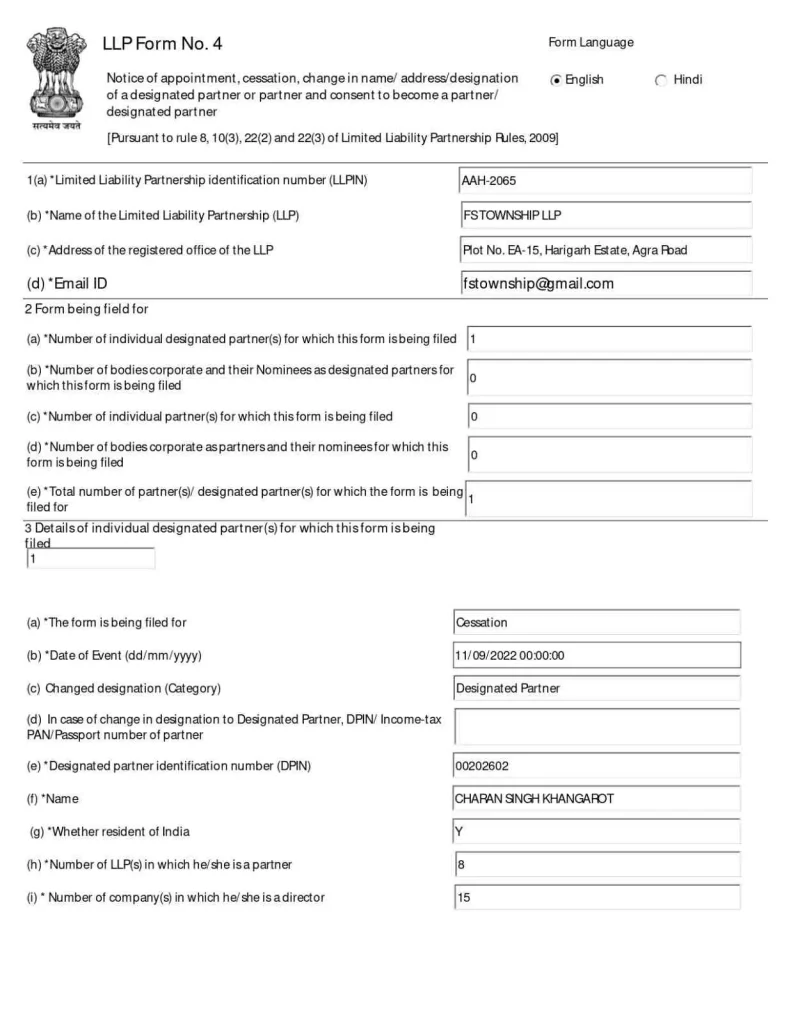

Key Components of LLP Form 4

The Form 4 LLP e-form is structured to capture all details of the change. The first section requires the LLP’s Limited Liability Partnership Identification Number (LLPIN). This number auto-populates the LLP’s name and its registered office address. The filer must then select the primary reason for filing the form. This could be an appointment, a resignation, or a change in details.

The form has distinct sections for different types of changes:

- Section A: This part is for the appointment, cessation, or change in designation. It requires the Director/Partner Identification Number (DPIN) of the partner. It also needs their name, address, and the effective date of the change.

- Section B: This part is used to update the details of existing partners. This is where a change of name or change of address is recorded.

- Section C: This section details the total number of partners and designated partners after the change.

The form also requires the filer to state the total monetary value of the contribution. This information must be consistent with the LLP’s official records.

Penalties and Consequences for Late Filing

Failing to file Form 4 LLP on time can lead to serious financial penalties. For small LLPs, the filing fee is ₹50, and for others, it is ₹150. But if you miss the deadline, you’ll face extra late fees depending on how long the delay lasts.

| Delay Period | Small LLPs | Other LLPs |

| Up to 15 days | ₹50 (one-time) | ₹150 (one-time) |

| 15 to 30 days | ₹100 (2x regular fee) | ₹300 (2x regular fee) |

| 30 to 60 days | ₹200 (4x regular fee) | ₹600 (4x regular fee) |

| 60 to 90 days | ₹300 (6x regular fee) | ₹900 (6x regular fee) |

| 90+ days | ₹500 (10x regular fee) | ₹1500 (10x regular fee) |

| 180+ days | ₹750 (15x regular fee) | ₹2250 (15x regular fee) |

| 360+ days | ₹1250 (25x regular fee) | ₹3750 (25x regular fee) |

For example, if you file Form 4 LLP 90 days late, the penalty could reach ₹500 for small LLPs and ₹1500 for others. After 180 days, the penalty for small LLPs rises to ₹750, while for others, it could go up to ₹2250.

The longer the delay, the more the fees increase, and they can quickly add up. A six-month delay could cost over ₹18,000 in penalties.

Additionally, if Form 4 LLP remains pending, the MCA portal may block other filings. This can prevent you from submitting important forms, such as the annual return (Form 11), which may mark the LLP as “non-compliant.” This can damage the business’s reputation with banks, investors, and clients.

Form 4 vs Form 3: A Quick Comparison

Business owners often confuse Form 3 and Form 4 for LLPs. Both forms are mandatory, but they serve completely different purposes.

- Form 3 (LLP Agreement): You file this form to submit the LLP’s original agreement. It details the partners’ rights, duties, and profit-sharing ratios. You file it once at the beginning (within 30 days of incorporation). You must also file it again if the agreement itself is amended.

- Form 4 (Partner Changes): You file this form to notify the ROC of a change in the partners. It doesn’t relate to the agreement but to the people. You file it every time a partner joins, leaves, or changes their details.

In many cases, you file both forms together. When a new partner joins, you must update the LLP agreement (Form 3). You must also notify the ROC about the new partner (Form 4).

Why is Form 4 Important?

Filing Form 4 LLP is a critical legal requirement, not just a simple administrative task. Its importance is tied directly to an LLP’s legal and financial health. The primary reason is that non-compliance attracts significant financial penalties. The LLP Act imposes a significant penalty for each day the filing is delayed. These penalties can add up quickly, creating a large financial burden for the LLP.

This form’s filing also impacts other essential compliance, such as the annual return (Form 11). The MCA portal often blocks the filing of annual returns if partner details are not current. This can cause the LLP to fall into a state of continuous non-compliance.

Filing Form 4 of LLP on time ensures the public records are correct. This accuracy is vital for maintaining the LLP’s good legal standing. Banks and investors rely on this MCA data for due diligence before offering loans or investments.

Conclusion

Form 4 LLP is the official document for managing an LLP’s partnership records. It is the single mechanism to inform the government about partner appointments, resignations, or detail changes. The LLP Act mandates this filing to ensure transparency and accountability.

The 30-day deadline for filing Form 4 of LLP is strict. Missing the LLP Form 4 due date leads to high daily penalties. This can damage the LLP’s compliance status. Therefore, designated partners must ensure they file this form promptly after any change. This simple step protects the LLP from fines and maintains its good legal standing.

Frequently Asked Questions

Form 4 of LLP is an official e-form that Limited Liability Partnerships use to notify the Registrar of Companies (ROC) about any changes in the partners or designated partners. It is a mandatory compliance document that ensures the LLP’s partnership details remain accurate and up-to-date.