What is LLP Form 5? Meaning, Purpose, Fees, and Process

LLP Form 5 notifies the Ministry of Corporate Affairs (MCA) when a Limited Liability Partnership changes its registered name in India. Whenever a partnership decides to change its registered name, it must file this form with the MCA. This ensures that the new name is legally recognized.

The form is filed according to Rule 20(2) of the LLP Rules, 2009, and relates to Section 19 of the LLP Act, 2008.

Changing an LLP’s name is not only a matter of branding. There can be various reasons behind the change, such as business restructuring, mergers, or the need for re-registration. Because an LLP’s name affects legal documents, bank accounts, contracts, and agreements, the LLP must handle the name change process carefully to remain fully compliant with the law.

Why is Form 5 needed? Real-World Examples / Use-Cases

- Example 1: A small LLP rebrands to reflect a shift in its business model, such as moving from IT services to digital marketing.

- Example 2: An LLP merges with another entity and changes its name to represent the new combined business identity.

- Example 3: An LLP corrects spelling errors in its registered name or updates it to a more professional-sounding name for better branding.

This guide helps LLP partners, designated partners, and compliance officers handle name changes smoothly. Understanding Form 5 LLP ensures compliance and avoids legal or operational issues.

Regulatory Background & Legal Framework for Form 5 LLP

When an LLP wants to change its name, it must follow certain legal rules. This section explains the law behind LLP name changes, the MCA rules, and what you need to know before filing.

1. LLP Act, 2008 – Rules for Name Change: LLP Form 5 is governed under:

- Section 19 of the LLP Act, 2008

- Rule 20(2) of the LLP Rules, 2009

This law tells LLPs how to apply for a name change legally (explained in detail later in this blog). It ensures that the new name is unique and not similar to other LLPs or companies.

2. Legal Requirements for Choosing a New Name: Before filing Form 5, you must follow the legal requirements to ensure your LLP remains compliant. This includes checking the availability of the new name, obtaining approval from the MCA, and meeting all other legal conditions.

When choosing a name:

- Follow MCA rules for name availability.

- Avoid prohibited words, reserved names, or names similar to existing companies or LLPs.

- Use the MCA portal or our company name check tool before filing the LLP name change form.

3. MCA’s Instruction Kit: The Ministry of Corporate Affairs (MCA) provides an instruction kit for LLP Form 5. The guide explains the process step by step, lists the required documents, and provides information about the fees to be paid. Following it carefully reduces mistakes in filing.

4. Recent Updates: The MCA updates its rules from time to time. Recent changes include faster online filing, updated naming rules, and simpler procedures for Form 5 LLP. Always check the latest instruction kit before filing.

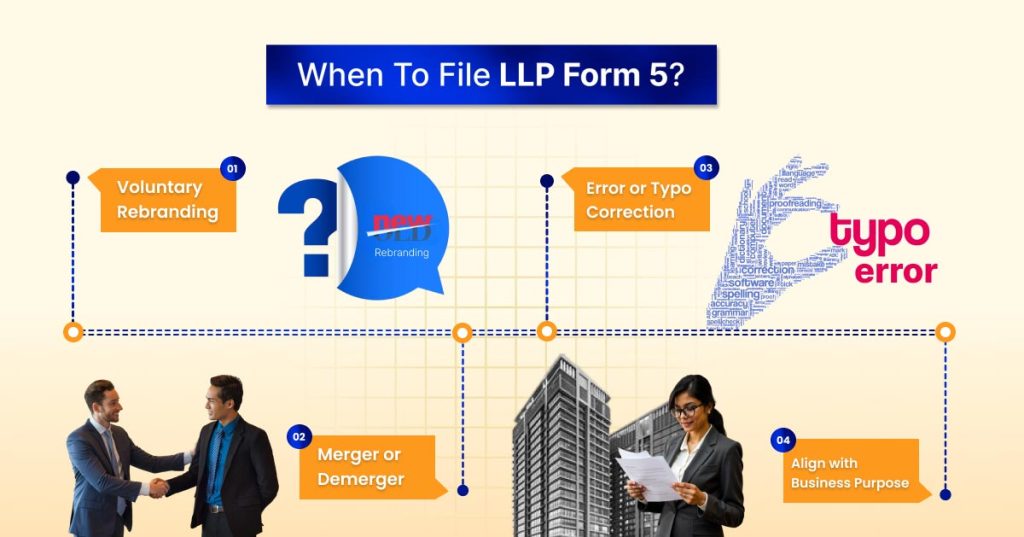

When to File LLP Form 5?

LLP Form 5 is filed after your new LLP name is approved through the Reserve Unique Name – LLP (RUN-LLP) service. Only once the Ministry of Corporate Affairs (MCA) grants name approval, you must submit Form 5 to officially update the name in the LLP’s legal records. Here are the common situations:

1. Voluntary Rebranding: LLPs may file Form 5 of LLP when they want a new name for branding purposes. This helps make the business name more attractive or relevant to customers.

2. Merger or Demerger: If a merger or demerger affects the LLP’s name, filing LLP Form 5 is necessary. This step updates the registered name to reflect the new business structure.

3. Error or Typo Correction: Sometimes the LLP’s name may have errors or typos in the MCA records. LLP Form 5 can be filed to correct such mistakes.

4. Change to Align with Business Purpose: LLPs may change their name to better represent their business activities. Filing Form 5 ensures that the name legally matches the LLP’s purpose.

When is it Mandatory or Recommended?

The law requires LLPs to file Form 5 in certain situations, while in other cases, businesses file it for strategic reasons. Knowing the difference helps LLPs stay compliant and make smart decisions.

1. Regulatory or Compliance Reasons: Filing Form 5 LLP is mandatory if the current name violates MCA rules or is too similar to another LLP or company.

2. Strategic Business Decision: Even if not required by law, LLPs often file Form 5 for strategic reasons like expansion, partnership changes, or marketing goals.

What You Need Before Filling Form 5? Pre-Filing Checklist:

Before you file Form 5 LLP, make sure your LLP exists legally. If you haven’t set up your business yet, you can register an LLP to comply with MCA requirements. This makes the filing process smooth and avoids delays.

Documents Required

- LLP Identification Number (LLPIN): Every LLP must have its unique identification number.

- Copy of LLP Agreement: A copy of the registered LLP agreement is needed for reference.

- Board / Partner Resolution Approving Name Change: The partners or designated partners must pass a formal resolution.

- DSC: Digital Signature Certificates (DSC) of designated partners are required to sign and submit Form 5 online.

- Supporting Documents: Any additional documents required for the specific name change (if applicable).

Approval from Partners / Designated Partners

- Draft a partner resolution approving the new name.

- Maintain proper minutes of the meeting to document the decision.

How to File Form 5 LLP on the MCA Portal?

Filing Form 5 LLP (Notice for Change of Name) is the official way to tell the MCA that your LLP is changing its registered name. Below is a clear, step-by-step look at how to do it:

- Use your MCA login credentials.

- Go to MCA Services → E‑Filing → LLP Forms Download → Change in Name → Notice for Change of Name (Form 5).

- If your LLPIN is not already filled, you can look it up.

Once logged in, you can proceed to fill out the web form.

- Enter details like your LLPIN, existing LLP name, proposed new name, the reason for the change, and partner details.

- You can save as a draft if you’re not ready to submit yet.

After completing the form, gather the necessary documents for submission.

- Obtain a certified copy of the consent from all partners for the name change.

- Attach required documents, including certified consent and the partner resolution or meeting minutes.

- After attaching all documents, affix your Digital Signature Certificate (DSC) to the generated PDF. This step is mandatory.

- After signing, upload the DSC-signed PDF to the MCA portal. Make sure this upload is completed within 15 days of SRN generation, as per the MCA instruction kit.

Once the documents are successfully uploaded, the fee payment can be made.

Step 4: Pay the Required Fee

Check the correct fee for filing Form 5 under the latest MCA schedule.

- Standard filing fee: ₹200–₹250 (depending on the government fee schedule at the time of filing).

- Late filing fee: If you file after the deadline, an additional ₹250–₹400 per day of delay may apply.

The instructions require LLPs to complete the fee payment after uploading the DSC-signed form.

If you miss the upload or payment deadlines, MCA may cancel your SRN (Service Request Number).

Step 5: Submit & Get Acknowledgement

- Once payment is done, MCA will issue an SRN. This acts as your reference number.

- Keep this SRN carefully. You’ll need it for any follow-up or for checking the status.

Step 6: Get the New Certificate

- Once MCA approves, the Registrar will issue a fresh Certificate of Incorporation(COI) in the new LLP name.

- The changed name becomes effective from the date on this new certificate.

RegisterKaro makes the entire process easy and stress-free. From preparing documents to online submission and follow-up, our experts handle every step of the process. The services complete your LLP name change quickly, accurately, and in full compliance with MCA rules.

Form 5 LLP Fees

The fee for Form 5 LLP depends on the specific action being taken. Typically, it is ₹1,000 for filing a form, notice, or document. For a foreign Limited Liability Partnership (LLP), the fee for filing a document under Rule 34(1) is ₹5,000.

Fees may vary depending on the type of filing, so it is important to check the latest MCA fee structure before submission.

Form 5 LLP Documents Required

Key documents required for filing Form 5 LLP include:

- LLP Identification Number (LLPIN)

- Copy of the LLP agreement

- Partner resolution or minutes of the meeting approving the name change

- Certified consent of all partners

- Any additional supporting documents requested by MCA

LLPs must upload all documents digitally using the Digital Signature Certificate (DSC).

What Happens After Filing Form 5 LLP?

After submitting Form 5 LLP, the MCA reviews your application and approves the name change if everything is correct. Here is what happens next and the actions you need to take.

- MCA Review and Approval: After submission, MCA checks your application for compliance with the LLP Act, 2008, and naming rules. They also verify supporting documents. Approval usually takes 1 to 3 weeks.

- Issuance of New Certificate: Once approved, MCA issues a new Certificate of Incorporation (CoI) with the updated LLP name. This certificate is the official proof of the name change.

- Update LLP Agreement: You need to amend your LLP Agreement or create a Supplementary Agreement to reflect the new name.

- Update Legal and Business Documents: Change the LLP name on bank accounts, contracts, invoices, GST registration, stationery, and other statutory records.

- Notify Stakeholders: Inform all stakeholders, including clients, vendors, partners, and regulatory authorities, about the new LLP name to avoid confusion.

What are the Common Mistakes While Filing Form 5 LLP and How to Avoid Them?

Changing an LLP’s name involves more than just submitting Form 5. Mistakes or delays can lead to legal, financial, and operational issues. Filing the form incorrectly or after the deadline can attract penalties under the LLP Act, 2008. Using an outdated or wrong LLP name can confuse clients, partners, and vendors, and may trigger contract disputes or increase rebranding costs.

Some common mistakes to watch out for and how to avoid them are:

- Incorrect LLPIN or Name Details: Entering the wrong LLPIN or LLP name can cause the MCA to reject the form.

How to Avoid: Always double-check the LLPIN and current LLP name from official records before filling the form.

- Failing to Affix DSC or Upload Signed PDF on Time: The Digital Signature Certificate (DSC) must be attached and uploaded on time. Delays can cancel your SRN.

Prevention: Ensure the DSC is valid and upload the signed PDF within the MCA-specified timeline.

- Missing the Partner / Designated Partner Resolution: MCA requires a formal resolution approving the name change.

How to Avoid: Draft and get the resolution signed by partners or designated partners before filing Form 5 LLP.

- Not Paying the Correct Fee or Missing the Payment Window: Wrong or delayed payment can lead to penalties.

Tip: Check the latest MCA fee schedule and pay within the required timeline.

- Forgetting to Update LLP Agreement & Bank / Operational Details Post-Approval: After MCA approval, update your LLP agreement, bank accounts, contracts, GST, and other records.

How to Avoid: Immediately update your LLP agreement, bank accounts, contracts, GST registration, and other operational documents after MCA approves the new name.

Failing to file Form 5 correctly can lead to penalties. To stay on top of all obligations, always follow proper LLP compliance procedures.

What are the Related LLP Compliance and Forms?

LLPs have to follow both annual compliance and event-based compliance rules. Annual compliance includes yearly filings such as financial statements and annual returns. Event-based compliance happens when specific events occur, such as changing the LLP name, partners, or registered office. Form 5 LLP is an event-based form for name changes.

Other Relevant LLP Forms:

- Form 3 LLP allows LLPs to make changes in their agreement, such as adding or removing clauses.

- Form 4 LLP allows LLPs to update their partnership details, such as adding a new partner or removing an existing one.

- Form 15 LLP allows LLPs to notify the MCA about a change in their registered office.

Annual Filings Summary

LLPs also have routine filings to stay compliant each year:

- Form 8 LLP (Statement of Account & Solvency) must be filed by 30 October every year. It includes financial statements along with a solvency declaration.

- Form 11 LLP (Annual Return) is due by 30 May every year. It provides general information about the LLP and its partners.

- Taxpayers must file Income-tax Return (ITR-5) annually, and they may need an audit if their turnover exceeds the limits specified under the Income Tax Act.

By understanding these forms and deadlines, LLPs can ensure smooth compliance and avoid penalties from the MCA or tax authorities.

Final Thoughts

Changing an LLP’s name through Form 5 is an important process that requires careful attention to legal requirements, approvals, and MCA rules. Following the correct steps ensures your LLP stays compliant, avoids penalties, and updates all business and statutory records smoothly.

For stress-free filing and expert guidance, RegisterKaro can handle your Form 5 LLP process from start to finish. Our team completes your LLP name change quickly, accurately, and fully in line with MCA regulations.

Frequently Asked Questions

Form 5 LLP is a statutory form under the LLP Act, 2008, used to officially change the registered name of a Limited Liability Partnership (LLP). Once the RUN-LLP service approves the new name, LLPs file Form 5 with the MCA to update all official records, making the name legally valid for contracts, banking, GST, and other business purposes.