What is Form 15 LLP: Meaning, Filing Process & Documents

Imagine your LLP has finally settled into a nice office, but after a few months, you find a better place, lower rent, more space, and a better vibe. You pack your things, shift to the new office, and think things are back to business.

But the MCA still doesn’t know your new address. And that’s a major problem.

Whenever an LLP changes its registered office, it must notify the MCA and authorities, as they send all legal notices and documents to that address. Filing Form 15 LLP, under Rule 17(1) of the Limited Liability Partnership Rules, 2009, is the official way to update your registered office address with the government.

It is simply your LLP’s formal way of saying, “We have moved our registered office address.” If the LLP does not file this update, the MCA may issue compliance notices for failing to report the address change, and the LLP may miss important government communications sent to the old location.

Your LLP must report every registered office change through Form 15, whether it moves within the same city or to a different state, to keep MCA records accurate.

When an LLP needs to file Form 15:

- Scenario A: LLP moves to a cheaper office within the same city.

- Scenario B: LLP expands and shifts to another state.

Common errors to avoid include delaying the filing or attaching incorrect or incomplete address proofs. In this blog, we will walk you through each requirement and step clearly, ensuring you can complete the process smoothly and avoid unnecessary hassles.

Definition & Legal Framework for Form 15 of LLP

An LLP files Form 15 with the Ministry of Corporate Affairs (MCA) whenever it changes its registered office. This section covers the Form 15 LLP filing procedure and the legal framework under Section 13 of the LLP Act, 2008, and Rule 17 of the LLP Rules, 2009. The following key provisions govern how the LLP legally carries out this change:

- Section 13 of the LLP Act, 2008: This part of the law says every LLP must always keep its registered office address updated with the government. If the address changes, the LLP must file Form 15. If you haven’t set up your business yet, you can register an LLP to comply with this requirement.

- Rule 17 of the LLP Rules, 2009: These rules tell the exact steps to follow when shifting the office. It explains how to file the form, which documents to submit, and when to publish a notice.

- Registrar of Companies (ROC): The ROC is the authority that checks your Form 15 filing. They confirm the new address and update it in government records.

This simple framework helps every LLP follow the law correctly and avoid any penalties.

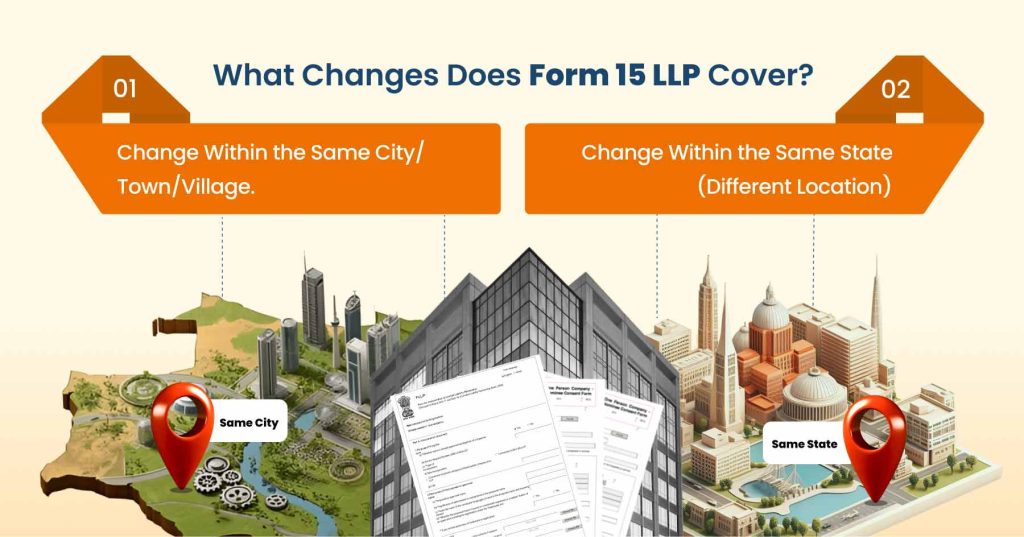

Which LLP Changes Does Form 15 Cover?

Form 15 covers all types of changes related to the registered office address of an LLP. Whether the LLP shifts within the same city or to another state, Form 15 must be filed to update its registered office with the Ministry of Corporate Affairs (MCA). The changes covered under Form 15 fall into three main categories, listed below:

1. Change of Registered Office Within the Same City/Town/Village

This is the simplest type of address change. The LLP only shifts to another office in the same local limits.

Key Points:

- Only basic approvals are needed.

- Partners must agree to the shift.

- File Form 15 with address proof and partner consent.

The LLP does not need to publish a newspaper notice or obtain extra approvals because it remains within the same municipal limits.

2. Change of Registered Office Within the Same State (Different Location)

This applies when the LLP shifts to a different area within the same state but outside the existing city/town/village limits.

Required Process:

- Check the LLP Agreement to see if it mentions how to change the registered office.

- If no clause exists → take consent of all partners.

- File Form 15 within 30 days of shifting the office.

Attachments:

- Consent of all partners

- New registered office proof

- Execute a supplementary LLP Agreement updating the address.

- File Form LLP-3 to update the agreement officially.

Attachment:

- Supplementary Agreement

This is a formal change and must follow the complete filing process, even though the state remains the same.

3. Change of Registered Office From One State to Another

This is the most detailed and compliance-heavy shift because the LLP moves to a different state jurisdiction.

Required Process:

- Check the LLP Agreement for any clause on changing the registered office.

- If no clause exists → take consent of all partners.

- Publish a newspaper notice at least 21 days before filing Form 15.

- One English newspaper

- One newspaper in the local (vernacular) language

- One English newspaper

- File Form 15 only after the 21-day notice period.

Attachments:

- Consent of all partners

- New registered office proof

- Copies of both newspaper publications

- Execute a supplementary LLP Agreement with the updated state address.

- File Form LLP-3 with:

- Supplementary Agreement

This change also shifts jurisdiction from one ROC to another. Therefore, the LLP must issue a public notice and follow strict timelines.

How to File Form 15 for an LLP?

Here is a clear and simple breakdown of everything an LLP must do before and after filing Form 15 when changing its registered office. This covers both within-state and inter-state shifts, so you don’t miss any compliance step.

Step 1: Review the LLP Agreement for a Change-Office Clause

First, check whether your LLP Agreement already has a clause that allows shifting the registered office.

- If yes, follow the process mentioned in the Agreement.

- If not, partner approval and a supplementary agreement become necessary.

Step 2: Pass a Resolution or Obtain Consent From All Partners

- All partners must give written consent or pass a resolution approving the change.

- This step is compulsory for any type of shift, small or big.

Step 3: Prepare a Supplementary LLP Agreement (If Needed)

- If the original LLP Agreement does not support the change, draft a supplementary agreement.

- This document updates the clauses and adds the new registered office address.

Step 4: Publish a Public Notice (Only for State-to-State Shifts)

If your LLP is moving to a different state, publish a notice in:

- One English newspaper, and

- One local-language newspaper

The LLP must publish the notice 21 days before filing Form 15 to inform the public and creditors.

Step 5: File Form LLP-15 Within 30 Days of the Shift

File Form 15 online on the MCA portal within 30 days of the office shift, attaching partner consents, proof of the new office, and newspaper advertisements (for inter-state moves). This ensures proper ROC approval for Form 15 and prevents compliance issues. Attach:

- Partner consents

- Proof of new office address

- Newspaper ads (for interstate moves)

Step 6: File Form LLP-3 Within 30 Days to Update the LLP Agreement

After executing the supplementary agreement, file Form LLP-3 to officially update the LLP Agreement on MCA records.

Step 7: Update All Official Documents & Signboards

Once MCA approves the change:

- Update letterheads, invoices, and website

- Change the signboards at the new office

- Update GST, bank records, licenses, and registrations

This keeps all communication clear and compliant.

Changing your LLP’s registered office may look complex, but with the right support, it becomes simple. RegisterKaro can help you file Form 15, Form 3, draft agreements, and manage the entire process smoothly. Want expert assistance? Just ask by filling the form!

Attachments for Form 15 for LLP

Here’s the list of documents required for Form 15 LLP to ensure smooth filing and ROC approval for Form 15:

1. Proof of the New Registered Office Address: You need to attach valid evidence of the new office location, such as:

- Latest utility bill (not older than 2 months)

- Rent/lease agreement

- No Objection Certificate (NOC) from the property owner

2. Resolution or LLP Agreement Extract: A copy of:

- The minutes or written resolution passed by partners, or

- Relevant extract from the LLP Agreement allowing the address change

This shows that the decision was approved internally.

3. Public Notice (Only for Inter-State Change): If the LLP is shifting from one state to another, attach:

- Newspaper advertisement published in one English and one local-language newspaper

This notice must have been published at least 21 days before filing Form 15.

4. Consent from Secured Creditors (If Any): If the LLP has secured loans, attach the written consent from those creditors. This ensures that lenders have no objection to the office change.

5. Optional Attachments: You may include any extra supporting documents, such as:

- Additional address proofs

- Clarification notes

- Supplementary letters

What is the Fee Structure and Additional Fee for Form 15 LLP?

The cost of filing Form 15 depends on the LLP’s contribution amount. The MCA charges an additional fee based on the number of delay days if the LLP files the form late.

Normal Filing Fee (Based on LLP Contribution)

Below is the MCA fee structure for filing Form 15:

| Contribution Amount (₹) | Normal Filing Fee (₹) |

| Up to ₹1,00,000 | ₹50 |

| ₹1,00,001 – ₹5,00,000 | ₹100 |

| ₹5,00,001 – ₹10,00,000 | ₹150 |

| ₹10,00,001 – ₹25,00,000 | ₹200 |

| ₹25,00,001 – ₹1,00,00,000 | ₹400 |

| Above ₹1,00,00,000 | ₹600 |

Additional Fee for Late Filing

If an LLP does not file Form 15 on time, it can face financial penalties and other risks. Following LLP compliance procedures helps avoid these issues.

| Delay Period | Additional Fee for Small LLPs | Additional Fee for Other LLPs |

| Up to 15 days | 1× normal filing fee | 1× normal filing fee |

| 16–30 days | 2× normal filing fee | 4× normal filing fee |

| 31–60 days | 4× normal filing fee | 8× normal filing fee |

| 61–90 days | 6× normal filing fee | 12× normal filing fee |

| 91–180 days | 10× normal filing fee | 20× normal filing fee |

| 181–360 days | 15× normal filing fee | 30× normal filing fee |

| More than 360 days | 25× normal filing fee | 50× normal filing fee |

How to Download Form 15 LLP Online?

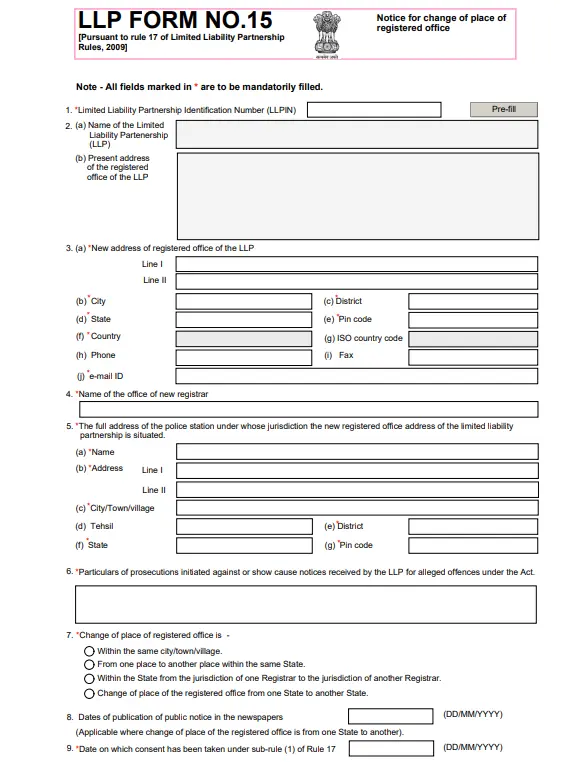

Downloading Form 15 LLP from the MCA portal ensures you have the correct and official form ready for filing. Here are the steps to do it:

- Step 1: Visit the MCA (Ministry of Corporate Affairs) official website.

- Step 2: Go to the ‘LLP Forms’ section under MCA Services.

- Step 3: Scroll down to locate Form 15 – Notice for Change of Place of Registered Office.

- Step 4: Click on the form name to download the official PDF/XBRL form.

- Step 5: Save the form to your system and open it using the MCA-supported PDF utility.

What are the Penalties for Not Filing Form 15 on Time?

Failing to submit Form 15 within the timeline can lead to a penalty for not filing Form 15, additional late fees, and even a non-compliance status in MCA records. Following the LLP Form 15 filing procedure carefully avoids these risks. Here’s a simple breakdown:

1. Penalty for Late Filing: If the LLP delays filing Form 15, it must pay additional fees based on the number of delay days. The longer the delay, the higher the penalty (up to 25–50 times the normal filing fee).

2. Non-Compliance Risks: Not filing Form 15 on time can lead to:

- The registered office details are becoming outdated in the MCA records

- Difficulty in receiving legal notices or communication from authorities

- Risk of being flagged as a defaulting LLP

- Issues during audits, bank processes, or future filings

3. Possible Legal Implications: Consistent non-compliance may result in:

- Penalties on designated partners

- Trouble during inspections or inquiries

- Rejection of future MCA forms until the address is corrected

What Should an LLP Do After Filing Form 15: Post-Compliance Checklist

After filing Form 15, the LLP must complete a few simple but important updates to reflect the new registered office address everywhere. Here’s a short and clear checklist to follow:

- Get SRN / Acknowledgement: Save the SRN issued by the ROC as official proof of filing.

- Update LLP Agreement: Draft the supplementary agreement and file it through Form LLP-3.

- Inform Stakeholders: Notify banks, clients, vendors, and regulatory bodies about the address change.

- Update All Official Details: Update the new address on letterheads, invoices, signboards, website, and statutory registers.

How Can RegisterKaro Help You with Form 15 LLP?

Changing your LLP’s registered office can feel confusing, but RegisterKaro makes the entire process smooth and hassle-free. Here’s how we support you:

- Drafting Partner Resolution & Supplementary LLP Agreement: Our team prepares the required partner resolution and the updated supplementary LLP agreement, ensuring everything follows MCA rules.

- Professional Filing of Form 15 LLP: We handle Form 15 filing end-to-end on the MCA V3 portal, reducing errors, delays, or rejections.

- Compliance Tracking & Post-Filing Updates: RegisterKaro keeps track of deadlines, helps you file Form LLP-3, and assists with updating documents, stationery, and stakeholder communication.

Conclusion

Changing your LLP’s registered office may seem routine, but the LLP registered office change process requires precise steps, timely filings, and document submission. By following the Form 15 LLP filing procedure and attaching the correct documents required for Form 15 LLP, you can ensure timely ROC approval for Form 15 and avoid any penalty for not filing Form 15.

Need assistance? Contact RegisterKaro today and get your Form 15 filed quickly and stress-free.

Frequently Asked Questions

No, an LLP cannot change its registered office address without a formal resolution or consent. The partners must approve the change, and the LLP must properly record this approval. The MCA requires proof of the partners’ decision before accepting Form 15. Without this resolution, the ROC will reject the form, and the official records will not reflect the change.