India’s startup ecosystem is booming, with over 394,000 Limited Liability Partnerships (LLPs) registered by April 2025, a 19.2% jump from the previous year. Among all company structures, an LLP Registration in India offers a unique blend of flexibility and limited liability, making it an attractive choice for entrepreneurs. However, despite their growing popularity, many partners overlook the rights and duties of LLP partners, which can lead to potential risks and disputes down the road.

Understanding your rights and duties as an LLP partner is essential for ensuring a smooth, successful partnership. The LLP Act 2008 and the LLP Agreement clearly outline these rights and responsibilities. By understanding these terms, you can protect your interests and avoid costly mistakes.

In this blog, we’ll break down the crucial rights and duties of LLP partners. By the end, you’ll have a clear understanding of how to protect your interests and ensure a successful partnership. Let’s dive in!

Who is a Partner in an LLP?

Under the Limited Liability Partnership Act, 2008, a “Partner” refers to anyone who joins the LLP in accordance with the LLP agreement. This includes both individuals and corporate entities in India. Therefore, even a private limited company or a foreign company can become a partner in an Indian LLP.

Partners in an LLP hold ownership stakes and share in the profits and losses. However, the specific rights and duties of each partner, including LLP partners’ responsibilities, are largely defined by the LLP agreement. If the agreement doesn’t specify any particular terms, the LLP Act 2008 rights of partners step in with default rules that govern aspects like profit-sharing, management responsibilities, and liabilities.

While all partners play a role in the LLP’s success, designated partners take on additional responsibilities under the law. These designated partner duties in India set them apart from regular partners.

Difference Between a Partner and a Designated Partner in an LLP

While every partner has an ownership stake in the LLP, designated partners take on additional responsibilities under the law. The role of a designated partner in an LLP is crucial, as they are tasked with specific statutory duties outlined in the LLP Act, 2008.

Every LLP must appoint at least 2 designated partners, one of whom must reside in India. These designated partners are responsible for ensuring the LLP’s legal compliance. Their key duties include

- Signing the necessary documents on behalf of the LLP

- Filing:

- LLP Form 8

- Form 11 as part of LLP Annual Compliance

- Ensuring the LLP complies with all statutory obligations under LLP compliance and obligations after registration

In essence, designated partners act as the legal guardians of the LLP, making sure it stays compliant with regulations. Regular partners, on the other hand, are involved in day-to-day business decisions and share profits, but do not bear the legal responsibilities of a designated partner.

The law requires a minimum of 2 partners to form an LLP, but it sets no upper limit. This flexibility allows businesses to scale without the restrictions that private limited companies face regarding the maximum number of shareholders.

Framework Governing Rights and Duties of LLP Partners

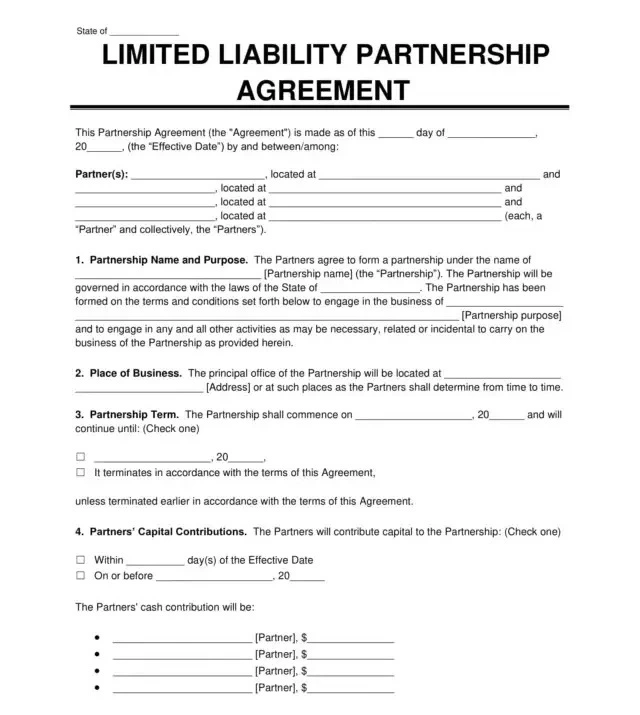

The rights and duties of LLP partners in India depend on two main documents: the LLP Agreement and the LLP Act, 2008. The LLP Agreement serves as the contract that governs the relationship between partners. It allows LLPs to define everything, from how to share profits to who holds the decision-making power and a partner’s exit formalities.

If a partner fails to sign an agreement, or if the agreement lacks clarity, the LLP Act, 2008 steps in with default rules. These statutory provisions automatically fill in any gaps.

For example, if your agreement doesn’t specify profit-sharing ratios, the Act defaults to an equal share for all partners. This may not be ideal, especially if one partner invested a larger portion of the capital. A clear and well-defined LLP Agreement helps you avoid disputes and ensures fair treatment for every partner.

If you’re ready to take the next step and want more personalized guidance on how to register an LLP, or draft LLP Agreement clauses. Contact us for expert support to ensure a smooth and compliant setup.

Rights of LLP Partners: Guide to LLP Management

Partners hold certain rights that help them protect their investments and actively shape the business. The following partner rights in LLP are crucial for the smooth running of any LLP:

a. Right to Participate in Management

Each partner has the right to participate in management. Unlike company shareholders who only vote on major matters, LLP partners directly influence day-to-day operations. You can attend meetings, make suggestions, and vote on decisions that drive the direction of the business.

b. Right to Share in Profits

Each partner has the right to share in the LLP’s profits. The LLP Agreement typically specifies how profits will be split. If the agreement doesn’t define the profit-sharing ratio, all partners share profits equally, regardless of their capital contribution. This is one of the key rights and liabilities of partners in an LLP.

c. Right to Access Information

Transparency is vital for trust. Every partner has the right to access information and inspect the LLP’s books and records. This includes reviewing financial statements, bank records, and other important documents. You must have full access to ensure the business operates transparently.

d. Right to Indemnity

If you incur personal expenses while conducting business on behalf of the LLP, the firm must indemnify (reimburse) you. The LLP must cover any expenses or liabilities you personally bear during regular business operations or emergencies.

e. Right to Transfer Economic Interest

You have the right to transfer your economic interest in the LLP. This means you can transfer your share of the profits and losses of the business. However, transferring this right does not automatically make the transferee a partner.

They only gain the economic benefits (profits/losses), unless the existing partners agree to admit them as a partner, giving them the rights of a partners in the LLP. The transferee cannot access the LLP’s books or participate in management.

Duties and Obligations of LLP Partners

With great power comes great responsibility. The duties of partners in an LLP establish a balance that ensures the firm remains ethical, compliant, and successful. Each partner’s duty contributes to the overall functioning of the business.

a. Duty of Good Faith

Good faith forms the foundation of any partnership. You must always act honestly and faithfully toward both the LLP and fellow partners. Secret profits or actions against the firm’s interests are strictly prohibited. This aligns with the rights and duties of partners in an LLP, ensuring fairness and integrity within the business.

b. Duty to Contribute Capital

Each partner must contribute the agreed-upon capital as specified in the LLP Agreement. This contribution can include money, property, or services, as long as the agreement values them appropriately. This duty is part of the rights and liabilities of partners in an LLP, ensuring all partners contribute fairly.

c. Duty to Disclose Information

You must share accurate accounts and complete information regarding the business with your partners or their representatives. Hiding critical business information from fellow partners undermines trust and violates your duty. Transparency is crucial for maintaining the mutual rights and duties of partners in an LLP.

d. Duty to Act Within Authority

You can only act within the scope of authority granted to you by the LLP Agreement. If you act outside your authority and cause harm, the LLP may bear the liability, but you will personally face the consequences. Your actions must always align with the rights and duties of LLP partners.

e. Duty to Avoid Fraud

If you engage in fraudulent activities, you forfeit the limited liability protection. Your personal assets may become liable for any debts or obligations incurred due to the fraudulent actions. This emphasizes the importance of upholding the role of a designated partner in an LLP, as the designated partner carries additional compliance responsibilities to prevent such actions.

Role of LLP Agreement in Defining Rights and Duties of Partners

A well-drafted LLP Agreement is essential for a smooth-running business. It defines the rights and duties of LLP partners, preventing conflicts and confusion. The agreement takes precedence over the default rules of the LLP Act, 2008, ensuring that all partners are aligned on key aspects of the partnership.

Any required changes to the LLP Agreement must follow the procedures outlined in the agreement, usually through majority votes, to maintain harmony and compliance.

Common clauses to include in LLP Agreement are:

- Profit-Sharing Ratio: Clearly state how you will divide profits and losses. This ensures all partners understand their share, reducing potential disputes.

- Capital Contribution: Specify how much each partner will invest and set a clear timeline for contributions. This defines the rights and liabilities of partners in an LLP, making each partner’s responsibilities clear.

- Decision Making: Identify which decisions require a majority vote and which need unanimous consent. This clause outlines the mutual rights and duties of partners in an LLP, ensuring smooth governance.

- Exit Strategy: Include a detailed procedure for a partner’s resignation, retirement, or expulsion. Clearly define how to handle transitions, protecting the interests of all partners.

- Dispute Resolution: Add an arbitration clause to resolve internal disputes efficiently. This keeps the partnership focused on business rather than legal battles.

A vague LLP Agreement invites problems. For instance, if you neglect to specify salary or remuneration for working partners, the LLP Act will not require payment. Without clear terms, working partners may end up working without compensation. A well-crafted agreement helps avoid these pitfalls and ensures the role of the designated partner in the LLP is understood and upheld by all. It also ensures compliance with LLP Annual Compliance requirements to maintain the firm’s legal standing.

Key Takeaways

A Limited Liability Partnership (LLP) offers a flexible and secure business structure for entrepreneurs. However, its success depends on how well partners understand their roles and responsibilities. The rights and duties of LLP partners establish the legal framework, while the LLP Agreement ensures smooth operations by defining key aspects of the business.

Designated Partners bear the primary responsibility for compliance, while all partners must act in good faith and uphold transparency. Avoid relying on verbal agreements; always draft a detailed LLP Agreement to address potential issues. Seek professional guidance to ensure your agreement protects your interests and the firm’s future.

Frequently Asked Questions

No, partners cannot be forced to contribute more than the agreed amount. The LLP Agreement defines the capital contribution. Unless the agreement includes a clause for additional funding, a partner’s financial liability remains limited to their initial contribution.