“In financial and real estate markets, trust is currency, and your brand is the proof.” In these sectors, protecting that brand is just as important as building it. Trademark Class 36 does exactly this, providing a framework that helps businesses organize and safeguard their financial, insurance, and real estate services.

To organize and manage such protections effectively, trademarks are categorized under an internationally recognized system. The most widely used system for trademark classification is the NICE Classification, established by the World Intellectual Property Organization (WIPO). It divides goods and services into 45 different classes of trademark:

- Class 1-34: Classify Goods

- Class 35-45: Includes classification of Services

The clear categorization allows businesses to identify the right class for their services. This ensures accurate trademark protection and long-term brand security.

What is Trademark Class 36?

Trademark Class 36, as per the NICE Classification by WIPO, covers services related to financial, monetary, insurance, and real estate. It protects businesses that operate in areas such as banking, insurance, loans, investment services, property management, and real estate consultancy. Registering under this class ensures exclusive rights to the brand for these services. It prevents their unauthorized use by others in the same sector and provides legal protection in case of trademark infringement.

For example, HDFC Bank, a leading private bank in India, holds a Class 36 trademark to protect its financial services, including banking, loans, credit cards, and investments. This trademark safeguards the brand’s identity and reputation. It prevents other companies from using a similar trademark in the financial sector.

Who Should Choose Class 36 for Trademark Filing?

Any entity that earns revenue by managing money, financial risk, investments, or property transactions should apply under this class. Below is a brief list of businesses and professionals who should register a trademark under this class:

1. Banks and NBFCs: Banks and non-banking financial companies offering deposits, lending, or credit services.

2. Fintech and payment platforms: Fintech companies that operate UPI apps, digital wallets, or online payment systems.

3. Real estate agents and brokers: Real estate professionals involved in buying, selling, or leasing properties.

4. Insurance and wealth advisory firms: Firms offering policy advisory, risk guidance, or asset planning services.

5. Crowdfunding and microfinance platforms: Platforms that arrange funds, enable peer-to-peer lending, or support small borrowers.

When planning brand protection, it’s important to understand how different types of trademarks apply to your business. Choosing the correct type and class early ensures your brand is legally safeguarded, helps maintain credibility in highly regulated sectors, and supports long-term business growth.

What are the Services Covered in Trademark Class 36?

Trademark class 36 is designed specifically to categorize certain professional and transactional services rather than tangible goods. Knowing what this class represents helps businesses choose the correct classification and avoid registration errors. The table below describes the services that class 36 includes in detail:

| Subcategory | Services Covered | Examples / Details |

| Financial and Banking Services | a. Banking Credit/debit card services b. Electronic funds transfer c. Loans Hire-purchase d. Leasing e. Trust and fiduciary services f. Monetary and Foreign Exchange Services | Online payment services, UPI platforms, digital wallets, corporate and retail banking |

| Insurance Services | a. Insurance underwriting b. Risk assessment c. Claims management d. Brokerage and advisory | Life, health, vehicle, and property insurance |

| Real Estate Related Services | a. Property brokerage b. Real estate agency services c. Leasing d. Rent collection e. Property valuation and management | REITs, commercial and residential properties, property appraisal |

| Investment and Wealth Management | a. Fund management b. Asset and portfolio advisory c. Venture capital d. Private equity services e. Escrow Services | Mutual funds, pensions, crowdfunding, and fintech investment platforms |

| Other Related Services | a. Debt collection b. Financial advisory c. Financial appraisal d. Charitable fundraising e. Sponsorship Services | Arranging finance for construction projects, valuation services |

Ensure your financial, insurance, or real estate brand is fully protected with expert trademark registration support. Get professional guidance from RegisterKaro to navigate the process smoothly and avoid costly errors. Contact us for assistance and guidance for registration-related queries.

What is Not Covered in Trademark Class 36?

Applicants often confuse products or services that appear closely connected but legally fall outside this class. The following table explains these differences clearly, helping you avoid objections and costly refiling:

| Item/Category | Items/Services Commonly Confused with Class 36 | Correct Trademark Class |

| Physical Goods | Printed insurance documents, passbooks, cheque books, payment cards | Class 16 (paper goods), Class 9 (cards, smart cards) |

| Software and mobile applications | Banking apps, fintech platforms, accounting software (as products) | Class 9 |

| Advertising and Business Management | Promotion of financial services, client acquisition, and marketing campaigns | Class 35 |

| Legal and Compliance Services | Legal advisory, contract drafting, and regulatory compliance | Class 45 |

| Construction and Infrastructure Services | Building projects, property development, and construction supervision | Class 37 |

| IT and Technical Services | Software development, system maintenance, data hosting | Class 42 |

| Educational and Training Services | Financial training, investment courses, certification programs | Class 41 |

| Consultancy Without Transaction Handling | Business strategy consulting without financial execution | Class 35 or Class 42 |

| Medical and Health Services | Health treatment services linked to insurance providers | Class 44 |

Choosing the right trademark classes by clearly separating Class 36 services from other activities ensures smoother registration. For example, Bajaj Finance holds a trademark class for financial services under class 36. It includes services like lending, insurance, and investment management. It is also registered under Class 35 for business consultancy services and Class 41 for financial education and training programs.

Tip: Use RegisterKaro’s Free Trademark Class Search Tool to identify the right class for your services.

How to Register a Trademark under Class 36 in India?

Registering a trademark under Class 36 involves a detailed process. Following the correct process reduces rejection risk and also saves time and cost.

Step 1: Pre-Registration Steps

- Trademark Search: Conduct a thorough search in Class 36 using the IP India Trademark Public Search or RegisterKaro’s Trademark Name Availability Check for secured identification.

- Draft Service Specifications: Clearly define your services, e.g., banking, insurance advisory, real estate brokerage, and fund management. Avoid vague terms.

Timeline: 1-2 days for search and specification drafting.

Step 2: Filing the Application

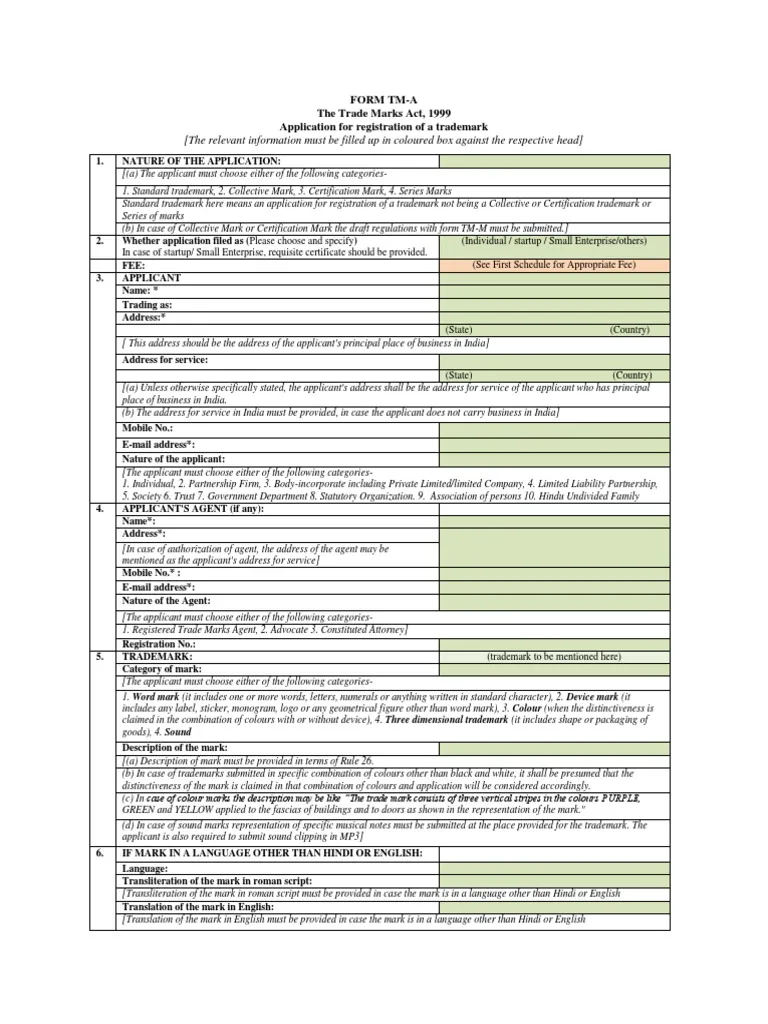

- Form to Use: Submit Form TM-A online through the IP India Trademark Portal.

- Fees (Approximately):

- Individuals/Startups/MSMEs: Rs. 4,500 per class

- Companies/Other entities: Rs. 9,000 per class

- Multi-class vs Single-class:

- Single-class: Only Class 36 services listed.

- Multi-class: Add other service classes if your business spans multiple areas.

Timeline: Filing is instant; the application number is issued immediately.

Step 3: Examination & Publication

- Examination: The Trademark Office checks classification, distinctiveness, and conflicts.

- Responding to Objections: If a Trademark Objection is raised and an Examination Report is issued, you must reply within 30 days.

- Journal Publication: Once cleared, your mark is published in the Trademark Journal for a period of 4 months. This period also remains open for Trademark opposition for the public.

Timeline: Examination usually takes 6–12 months, depending on backlog; publication takes 4 months.

Step 4: Post-Registration

- Renewals: Valid for 10 years; renew the trademark every 10 years to maintain protection.

- Infringement Monitoring: Regularly check for unauthorized use of your mark and take legal action if needed.

This structured approach ensures smooth Class 36 trademark registration, legal protection, and long-term brand security. RegisterKaro helps you get it right from the start. Contact us for more information.

Frequently Asked Questions

No, Trademark Class 36 in India does not cover only banks. It protects a wide range of financial and monetary services, including insurance, investment management, real estate, and financial consultancy. Businesses offering financial solutions, credit services, or fund management can register under Class 36. The class safeguards the brand name and logo, preventing competitors from using similar marks in the financial sector. Proper classification strengthens legal protection for all financial-related offerings.