A Section 8 Company is a non-profit organization registered under the Companies Act, 2013, to promote charitable activities like education, art, science, sports, social welfare, research, religion, charity, or environmental protection.

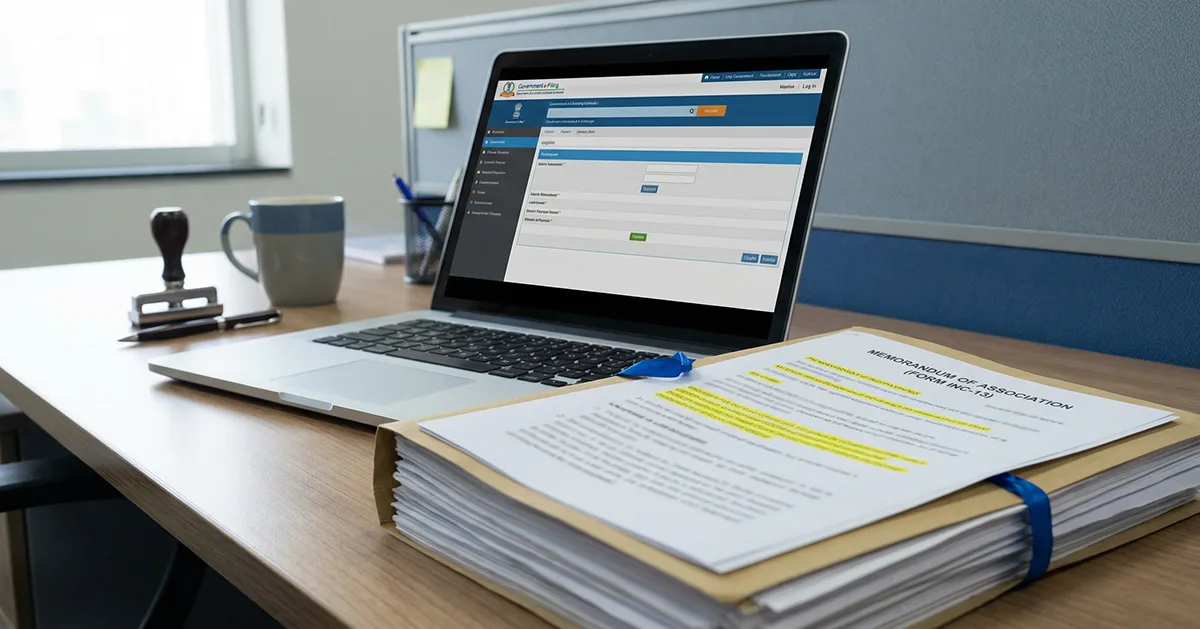

It operates with a non-profit motive, where income is used solely for its objectives and not shared as dividends. You can complete the online registration for Section 8 Company in Delhi, making the process faster, convenient, and fully compliant with government regulations.

Key features of Section 8 Companies are:

- Non-Profit Motive: All income and profits must be used solely for the company's charitable purposes and cannot be distributed to its members.

- Limited Liability: The liability of the company's members is limited to the unpaid amount of their shares.

- Perpetual Succession: The company has a perpetual existence, meaning it continues to exist even if its members change.

- No Minimum Capital: There is no minimum capital requirement to incorporate a Section 8 Company.

- No Suffix Required: Unlike other companies, a Section 8 Company is not required to add suffixes like "Limited" or "Private Limited" to its name. Instead, it can use words like "Foundation," "Association," "Forum," or "Council."

Its structure ensures credibility, transparency, and compliance, making it ideal for NGOs and non-profits.

Understanding Non-Profit Organizations in India

In India, non-profit organizations can be registered in three primary ways: as a Trust, a Society, or a Section 8 Company. A Section 8 Company is incorporated under the Companies Act, 2013, specifically for promoting charitable objects.

Unlike other companies, its main goal is not to earn profit but to use any income or profits for the advancement of its objectives. These objectives can include promoting commerce, art, science, sports, education, research, social welfare, religion, charity, and environmental protection. You can complete the online registration for Section 8 Company in Delhi to start your non-profit efficiently and legally.