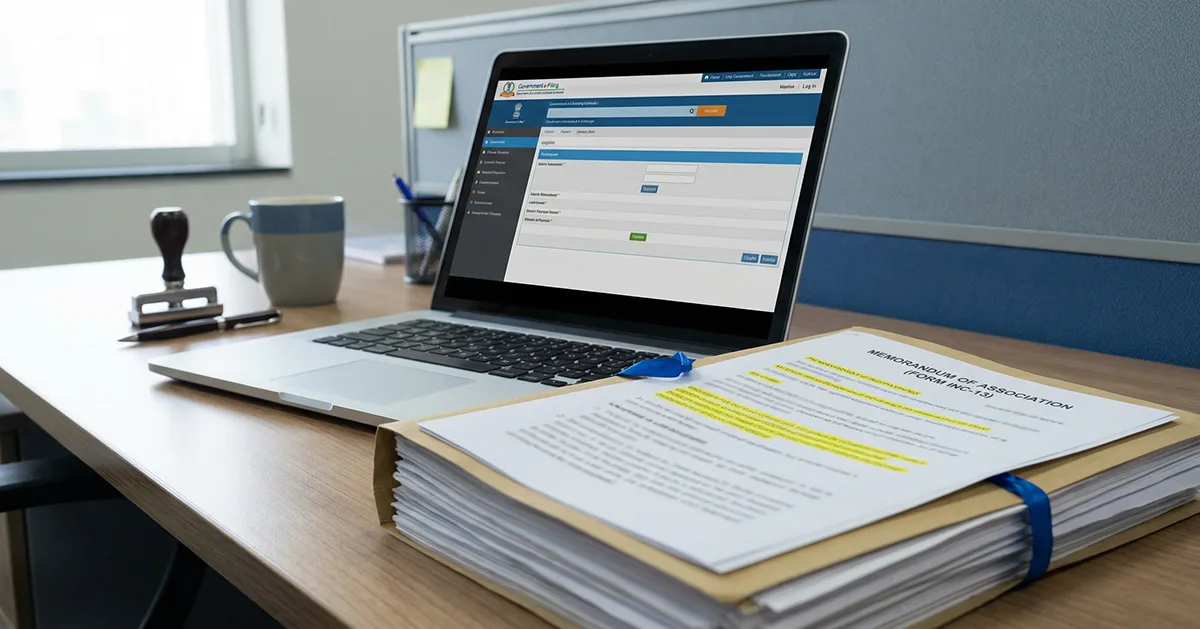

A Section 8 Company is a non-profit organization registered under the Companies Act, 2013, to promote charitable objectives such as education, science, art, sports, social welfare, research, environment protection, religion, and similar causes.

Unlike regular companies, a Section 8 Company cannot distribute profits as dividends to its members. Instead, all income is reinvested into achieving its objectives. Members enjoy limited liability, and the company itself has a separate legal identity, allowing it to own property, enter into contracts, and manage funds in its own name.

There is no minimum capital requirement, and these companies often use names like Foundation, Association, Forum, or Council instead of “Ltd.” or “Pvt. Ltd.” Their transparent structure, strict compliance, and government recognition make them ideal for NGOs.

Understanding Non-Profit Organizations in India

In India, non-profits can be registered as a Trust, Society, or Section 8 Company. Out of these, a Section 8 Company is considered the most credible form because it is incorporated under the Companies Act, 2013, and regulated by the Ministry of Corporate Affairs (MCA).

While Trusts and Societies are governed by local state laws, a Section 8 Company offers national-level recognition and stronger legal standing. This makes it the most suitable option for organizations in Bangalore aiming for CSR funding, government grants, and international donations.