Partnership firm registration in Gwalior is completed online through the MPOnline portal (rfs.mponline.gov.in) under the Government of Madhya Pradesh. Follow these steps to register your partnership firm legally and efficiently:

Step 1: Choose a Name for Your Partnership Firm

Pick a unique name for your Partnership Firm. Ensure it:

- Reflects your business activities

- Is not identical or confusingly similar to existing firms in Gwalior or Madhya Pradesh

- Avoids prohibited or misleading words

- Does not resemble the name of any government authority

Check name availability on the MPOnline portal and keep 2–3 alternative names ready.

Timeline: 1–2 days

Step 2: Draft the Partnership Deed

Prepare a detailed partnership deed covering:

- Names and addresses of all partners

- Nature and scope of business in Gwalior

- Capital contribution of each partner

- Profit and loss sharing ratio

- Roles, rights, and duties of partners

- Duration of the firm and rules for admission or retirement of partners

Execute the partnership deed on non-judicial stamp paper as per Madhya Pradesh stamp laws. Notarization is recommended for legal validity.

Note: A written partnership deed is mandatory for registration and legal clarity. All partners must sign the deed in the presence of witnesses.

Timeline: 2–3 days

Step 3: Apply for a PAN Card for the Firm

Apply for a firm PAN card through the NSDL or UTIITSL portal (pan.utiitsl.com). PAN is required for tax compliance and opening a bank account.

Timeline: 7–10 working days

Step 4: Fill Registration Application (Form No. 1)

Download and complete Form No. 1 from the MPOnline website. Include:

- Firm name and nature of business

- Principal place of business in Gwalior

- Names and addresses of all partners

- Date of joining of each partner and duration of the firm

All partners or authorized representatives must sign the form.

Timeline: 1 day

Step 5: Submit Documents to the Registrar of Firms

Submit the following documents along with Form 1:

- Original partnership deed (signed and notarized)

- Prescribed registration fee

- Copy of the firm’s PAN card

- Office address proof (rent agreement, utility bill, etc.)

- PAN and address proof of all partners

- Affidavit confirming the correctness of details

Timeline: 1–2 days

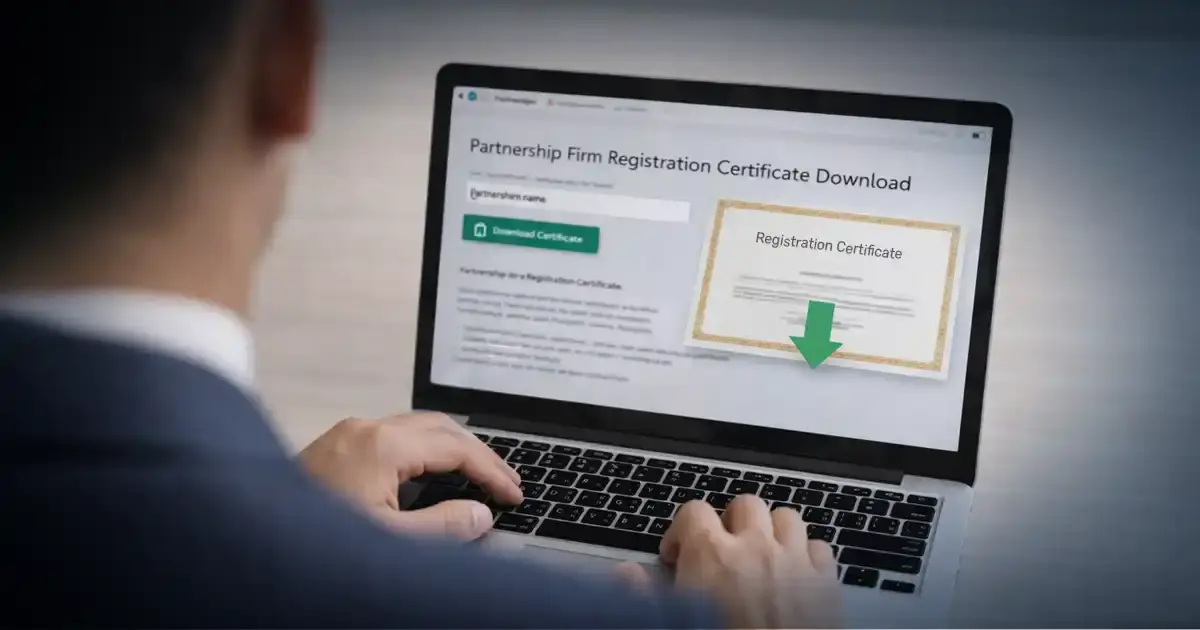

Step 6: Receive the Registration Certificate

After verification, the RoF Madhya Pradesh issues the Certificate of Registration with a unique firm number. This certificate serves as legal proof of registration in Gwalior.

Timeline: 10–15 working days

Step 7: Open a Current Bank Account

Use the firm’s PAN and registration certificate to open a current bank account in the firm’s name. This account is essential for business transactions.

Timeline: 1–2 days

Note: Partnership firm registration in Gwalior has lifetime validity. No renewal is required. However, any change in partners, office address, or firm details must be reported to the RoF Madhya Pradesh.

Don’t leave your business unprotected. Complete your partnership firm registration in Gwalior with RegisterKaro and benefit from expert guidance, fast online filing, and end-to-end support at every stage. Contact us today!