In India, starting a new company is an exciting venture, but it begins with a crucial legal process: aka Company Incorporation under the Ministry of Corporate Affairs (MCA). Historically, the cornerstone of this process was a document known as Form INC-7.

This form was the official application submitted to the Registrar of Companies (ROC) for incorporating a new company. The INC-7’s purpose was to provide all the foundational details of the proposed entity. It is important to note its scope: the INC-7 form was specifically used for incorporating companies other than One Person Companies (OPCs).

However, the way companies are registered in India has changed over time. The MCA introduced the SPICe (INC-32) form to make company registration simpler. Later, on 15 February 2020, it launched the web-based SPICe+ (SPICe Plus), which officially replaced SPICe.These new formats have replaced Form INC-7 for most new incorporations. However, a version of Form INC-7 is still used in certain cases, such as when a company has more than seven subscribers.

This blog gives a detailed overview of Form INC-7, its background, and its key components. It serves entrepreneurs and compliance teams dealing with legacy filings or studying the development of company law in India.

What is Form INC-7 & Its Regulatory Basis?

Form INC-7 was not an arbitrary document; its creation and use are rooted directly in Indian corporate law.

The legal foundation for this form lies in Section 7(1) of the Companies Act, 2013, outlining the process and documents required to incorporate a company. The INC-7 of the Companies Act 2013 was the direct application of this law.

Furthermore, the Companies (Incorporation) Rules, 2014, provided the specific procedural details. Rule 12 originally required that any company other than an OPC file its incorporation application in Form No. INC-7 with the Registrar.

For several years after the 2013 Act came into effect, companies used Form INC-7 as the standard incorporation document. The INC-7 MCA portal was the platform for its electronic filing.

The Evolution from INC-7 to SPICe+ Form

The MCA consistently improves the ease of doing business in India. The original process that used Form INC-7 operated in a disintegrated manner. Applicants had to:

- Apply for Director Identification Numbers (DINs).

- Apply for name reservation in Form INC-1.

- File Form INC-7 for incorporation.

- File Form INC-22 for the registered office.

- File Form DIR-12 for directors.

- Apply for PAN and TAN separately.

To simplify this, the MCA introduced SPICe (INC-32), which combined many of these steps.

As of 2025, the MCA made SPICe+ the only mandatory method for incorporating new companies. It officially replaced Form INC-7, which now serves only as a legacy reference form.

Who Should Use Form INC-7 (and Who Should Not)

The original INC-7 purpose was clearly defined by the Companies Act, 2013.

1. Eligible Entities for Form INC-7

During its period of active use, Form INC-7 was the designated application for incorporating the following types of entities:

- Private Limited Companies: The most common business structure, with two or more members.

- Public Limited Companies: Companies that can offer shares to the public.

- Section 8 Companies: Non-profit organizations established for charitable purposes. For these, the applicant first needed to obtain a license in Form INC-12 before filing INC-7.

2. Entities Not Applicable for Form INC-7

This form did not apply to all types of registrations. Businesses mentioned below had to use different forms based on their structure and purpose:

- One Person Companies (OPCs): OPCs had their own dedicated incorporation form (Form INC-2).

- Limited Liability Partnerships (LLPs): LLPs operate under a different law and use separate forms, such as FiLLiP, for incorporation.

- Conversions or Name Changes: Changing a company’s name or converting its type (e.g., private to public) involves other specific forms, not the INC-7 form.

Today, Form INC-7 is rarely used. It is applicable only in limited cases, such as when a company has more than seven subscribers or when the ROC specifically instructs the applicant to use it.

Key Components of Form INC-7

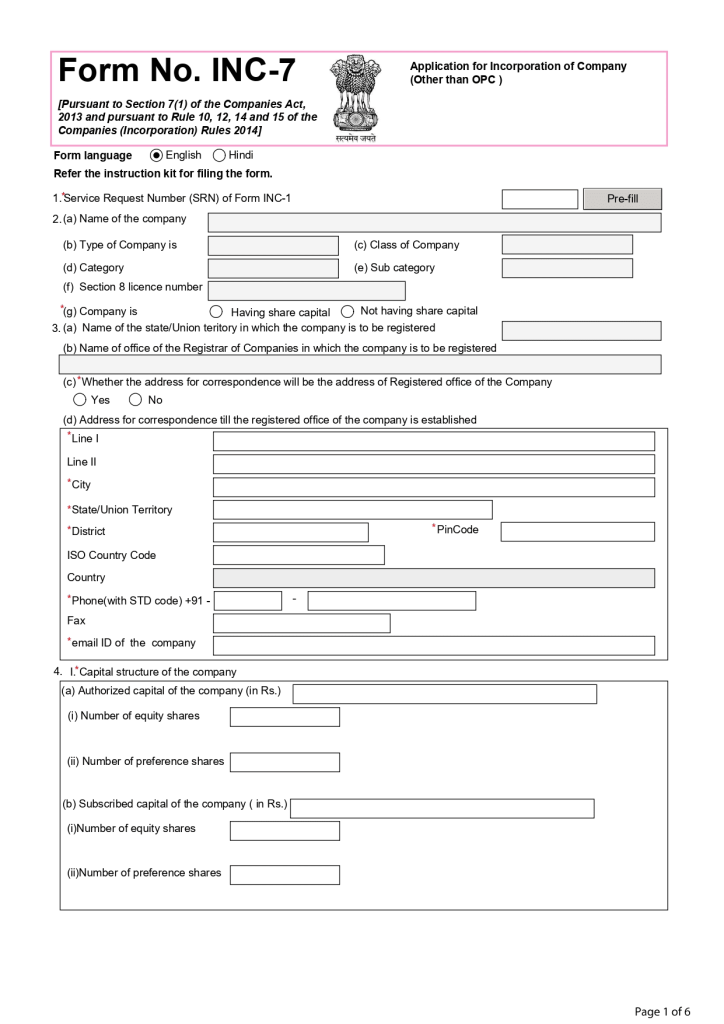

Form INC-7 served as an official e-form under the Companies Act, 2013. Applicants used it to register a new company by providing complete details about promoters, capital, and business structure.

The major fields included:

- Name Reservation (SRN): The form required the Service Request Number (SRN) of a pre-approved company name. Applicants obtained this name reservation through Form INC-1 or later through the RUN (Reserve Unique Name) web service.

- Company Type and Structure: The applicant had to specify the company’s class (public, private), category (limited by shares, limited by guarantee), and sub-category.

- Section 8 License: A field to enter the SRN of the license (Form INC-12) if the company was a Section 8 entity.

- Capital Structure: This was a critical section. It required a detailed breakdown of the:

- Authorized Share Capital: The maximum capital the company could raise. The system calculated INC-7 fees based on this amount.

- Subscribed Share Capital: The amount of capital the founders (subscribers) commit to in the Memorandum of Association.

- Registered Office Details: The applicant has to provide the proposed “Address for Correspondence” and specify the state where the registered office will be located.

- Promoters and First Directors: Details of all subscribers (promoters) and the first directors of the company. This included their names, addresses, and Director Identification Numbers (DINs) if they already had them.

- Activity Code: The main industrial activity code (NIC code) of the business.

- Sectoral Regulator Approval: If the company’s proposed activities required approval from a sectoral regulator such as the RBI, SEBI, or IRDAI, the applicant entered the SRN or reference number of that approval.

- Attachments and Declarations: The form included a list of mandatory attachments and declarations, which were the core of the application.

Step-by-Step Filing Process for Form INC-7

Filing the INC-7 was a multi-step process. This historical process highlights how the introduction of SPICe+ has simplified and digitized company incorporation in India.

Step 1: Pre-Filing Requirements

Before an entrepreneur could even open the INC-7 form, they had to complete several prerequisites:

- Obtain Digital Signature Certificates (DSC): All proposed directors and subscribers need a valid Class 2 or Class 3 DSC.

- Obtain Director Identification Numbers (DIN): All proposed directors need to apply for and receive a DIN using Form DIR-3.

- Reserve the Company Name: The applicant had to file Form INC-1 or use the RUN service to apply for a company name. Only after the ROC approved the name and issued an SRN could the applicant proceed.

Step 2: Filing Form INC-7

- Download the Form: The applicant would download the INC-7 form from the MCA portal (mca.gov.in). It was an electronic PDF form that had to be filled out offline.

- Fill in All Details: The applicant had to enter all the information mentioned in the “Key Components” section, including the approved name’s SRN, details of the company’s capital structure, and information about promoters and directors.

- Attach Documents: The applicant attaches all required supporting documents (listed in the next section) to the e-form.

- Sign and Submit: A proposed director and a practicing professional (CA, CS, or CWA) digitally sign and submit the form.

- Pay Fees: The applicant would upload the form to the MCA portal and pay the required INC-7 fees.

The form INC-7 fees consisted of the ROC filing fee and the Stamp Duty, which varied based on the authorized capital and the state of incorporation.

Step 3: Post-Filing and Approval

- ROC Review: An officer from the Registrar of Companies would examine Form INC-7 and all its attachments.

- Queries (Resubmission): If there were any errors or omissions, the ROC would mark the form for resubmission, and the applicant would have to correct the errors and re-upload the form.

- Certificate of Incorporation (COI): Once the ROC finds the form complete and compliant, the officer approves it and issues the Certificate of Incorporation (COI). This certificate included the company’s Corporate Identity Number (CIN) and was the official proof of its existence.

- Follow-up Filings: After incorporation through Form INC-7, the new company must file additional mandatory forms:

- Form INC-22: To notify the ROC of the permanent registered office address (if not filed with INC-7).

- Form INC-20A: A mandatory declaration confirming that the subscribers have paid their share of money and the company has filed its registered office.

- Separate applications for PAN, TAN, and a bank account.

Documents Required with Form INC-7

The attachments to Form INC-7 were the legal backbone of the incorporation. Failure to attach these documents correctly was one of the most common reasons for ROC rejection.

The mandatory attachments for Form No. INC-7 were:

- MOA: All subscribers must sign the MOA document physically, and a witness must attest each signature.

- AOA: The Articles of Association served as the internal rulebook of the company. All subscribers must sign the document, and a witness must verify the signatures.

- Form INC-8 (Declaration): A declaration from a professional (a Chartered Accountant, Company Secretary, or Cost Accountant in practice).

- Form INC-9 (Affidavit): An affidavit in Form INC-9 had to be submitted by each subscriber and first director. In this form, they declared that they were not convicted of any offense, not found guilty of fraud, and that all documents filed with the ROC were true and correct.

- Form INC-10 (Verification): An affidavit from a subscriber verifying the correctness of the “Address for Correspondence” provided in the form.

- Identity and Address Proof: Scanned copies of the PAN card (mandatory for Indian nationals) and address proof (like a bank statement, utility bill, or passport) for all subscribers and directors.

- Consent from Directors: Each individual proposed as a first director submits Form DIR-2, which confirms their consent to act as a director of the company.

- Proof of Registered Office (if filed): If the applicant provides the permanent registered office address with Form INC-7, they must attach:

- A tenancy agreement or ownership deed.

- A No Objection Certificate (NOC) from the property owner.

- A recent utility bill (electricity or water bill) for the premises.

- Sectoral Approvals: A copy of the approval or in-principle letter from a regulator like the RBI or SEBI, if the company’s objects required such approval.

INC-7 vs SPICe+ (INC-32): What’s the Difference?

The shift from Form INC-7 to SPICe+ represents one of the biggest leaps in India’s corporate services. This comparison shows the clear advantages of the new system.

| Feature | Form INC-7 (The Old Way) | SPICe+ (INC-32) (The New Way) |

| Filing Mode | Offline e-form (download, fill, upload). | Fully integrated web-based form. |

| Name Reservation | A separate step (Form INC-1 or RUN). The SRN was mandatory before starting. | Integrated. Part A of SPICe+ is for name reservation. |

| MOA and AOA | Required physical drafting, signing, and scanning. | Fully electronic (e-MOA and e-AOA) with digital signatures. |

| DIN Application | A separate application (Form DIR-3). | Integrated. DINs are allotted to new directors within the SPICe+ form. |

| PAN and TAN | Separate applications filed after incorporation. | Auto-generated. PAN and TAN are allotted along with the COI. |

| Bank Account | A separate process after incorporation. | Integrated. The AGILE-PRO-S form opens a bank account automatically. |

| Applicability | Legacy/Historical. No longer used for new incorporations. | Mandatory for all new company incorporations in India. |

The Ministry of Corporate Affairs replaced Form INC-7 to eliminate redundancy and simplify the incorporation process. Under the earlier system, promoters had to file several separate forms, such as INC-1, DIR-3, INC-22, and PAN/TAN applications. The introduction of the SPICe+ system consolidated these steps into a single integrated application, thereby reducing processing time and overall compliance costs.

Form INC-7 remains a milestone in India’s corporate regulatory history. It was the original, comprehensive application under the Companies Act, 2013, that defined the legal birth of a company. The INC-7 purpose was to consolidate all promoter, capital, and director information for the ROC’s review.

While the INC-7 form itself is now obsolete for new registrations, its spirit lives on. The legal requirements it embodied, the need for a clear MOA, verified directors (INC-9), and professional certification (INC-8), are all still mandatory.

The Ministry of Corporate Affairs has simply put these requirements into the far more efficient, fast, and integrated SPICe+ system. Understanding the journey from INC-7 to SPICe+ helps entrepreneurs and professionals appreciate the streamlined nature of modern incorporation and the government’s clear focus on making it easier to do business in India.

Frequently Asked Questions

No, for all new company incorporations in India, Form INC-7 is obsolete (no longer useful). The mandatory form to use is the integrated web-based SPICe+ (INC-32) application. The INC-7 form is now only relevant for historical reference or legacy filings.