If you are planning to start your own business as a single owner, registering a One Person Company (OPC) is one of the best ways to begin. The process is completely online and can be completed by following a few simple steps.

Step 1: Apply for DSC and DIN

You require these two before starting the registration process:

Step 2: Choose and Reserve a Company Name

Your company name must be unique and comply with the Companies Act, 2013.

- Check availability: Use the MCA portal (mca.gov.in) to search for name availability.

- Reserve name: Use the RUN (Reserve Unique Name) service or directly apply through SPICe+.

You can also use our company name checker to verify the availability of your chosen name.

Step 3: Draft MOA and AOA

Two key legal documents are required for incorporation:

- Memorandum of Association (MOA): Defines the main business objectives, scope of activities, and powers of the company. MOA reflects the company’s relationship with the outside world.

- Articles of Association (AOA): Specifies the internal rules, governance framework, and management of the company. AOA also covers decision-making, director powers, and shareholder rights.

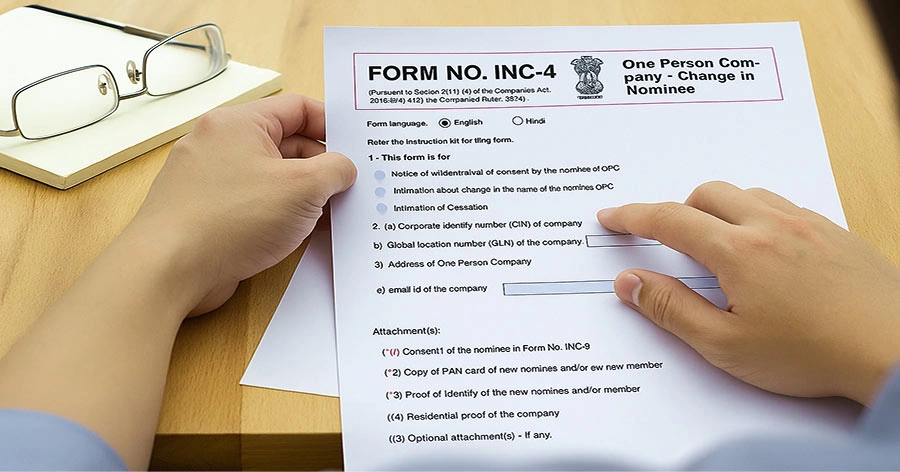

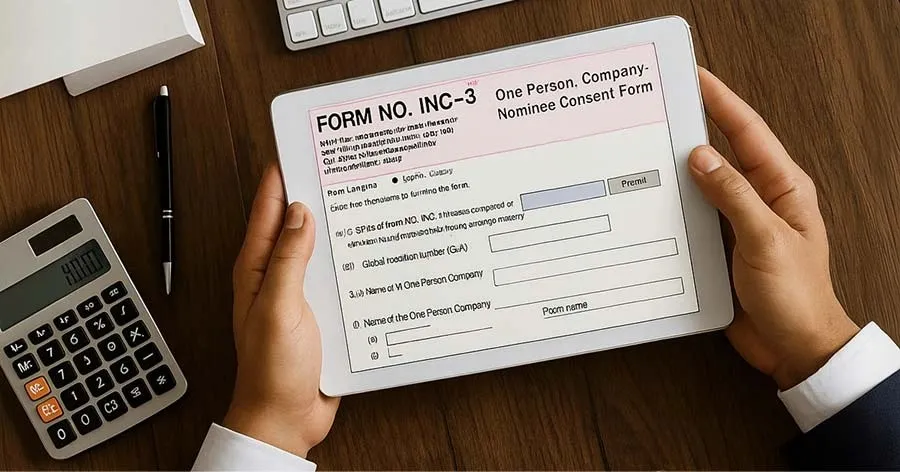

Step 4: Appoint a Nominee

As an OPC can have only one director and shareholder, it is mandatory under Section 3(1)(c) of the Companies Act, 2013, to appoint a nominee. The nominee will step in to manage the company if the sole member dies or becomes incapacitated.

- File Form INC-3 with nominee consent and KYC documents.

Step 5: File the Incorporation Forms

Once the name is approved, proceed with Form SPICe+ (INC-32) for OPC incorporation:

- Attachments required: DSC, DIN, MOA, AOA, proof of registered office, ID, and address proof of the director and nominee.

- Pay fees: Includes filing fees and stamp duty (calculated based on authorized share capital and state rules).

Step 6: Get the COI

After approval, the ROC issues the Certificate of Incorporation (COI), which includes the company’s Corporate Identity Number (CIN).

- The company’s PAN and TAN are usually allotted automatically upon incorporation.

- COI also provides legal recognition and confirms the company’s separate legal status.

Step 7: Open a Bank Account

After receiving the incorporation certificate and PAN, open a current bank account in the name of the OPC. This account will handle all business transactions.

Since 2020, the MCA introduced the AGILE-PRO form (INC-35) alongside SPICe+, which allows you to apply for the following simultaneously:

- EPFO – Employees’ Provident Fund Organisation

- ESIC – Employees’ State Insurance Corporation

- GSTIN – Goods and Services Tax Identification Number

- Professional Tax (if applicable)

- Bank Account

Once these steps are completed, your OPC will be legally registered, and you can begin operations with full compliance.