What is a Privately Held Company? Examples, Advantages & Features

A small group of individuals, such as founders, family members, or private investors, owns a privately held company, rather than the general public through the stock market.

Unlike public companies, which raise capital by issuing shares to the public, a privately held company enjoys greater flexibility, simpler compliance, with more concentrated ownership. This distinction is especially relevant for Indian startups and SMEs that value agility, confidentiality, and efficient governance.

This blog explains clearly what a privately held company is, including its meaning, key features, and characteristics. We will examine real-world examples of privately held companies in India and globally, highlighting how they differ from public companies and why this structure benefits startups and SMEs seeking growth with control.

Understanding What a Privately Held Company Means

A select group of individuals, such as founders, family members, or private investors, owns a privately held company, rather than the general public. This type of company offers its owners greater control, confidentiality, and operational flexibility, making it an appealing choice for entrepreneurs and investors alike.

1. Global Definition

Globally, private owners hold the shares of a privately held company instead of trading them on stock exchanges, allowing the company to operate with greater control, confidentiality, and agility than public corporations.

2. Indian Context

A company qualifies as private if it has a minimum paid‑up share capital as prescribed and its articles of association restrict certain activities.

A. Restricts the right to transfer its shares.

B. Except in the case of a One Person Company (OPC), it limits the number of its members to two hundred.

- If two or more persons hold one or more shares jointly, the company treats them as a single member.

Provided further that:

- Persons who are in the employment of the company; and

- The company does not include persons who were members while employed and continue as members after their employment ends in the count of members.

C. Prohibits any invitation to the public to subscribe for any securities of the company.

In India, the term “Privately Held Company” typically refers to a Private Limited Company under Section 2(68) of the Companies Act, 2013.

3. Why Entrepreneurs and Investors Prefer It

Privately held companies offer a balance of control, privacy, and flexibility, making them highly attractive for founders and investors.

- Full control: Founders can make strategic decisions without interference from public shareholders

- Privacy: Sensitive business information stays confidential

- Simpler compliance: Fewer regulatory requirements than public companies

- Flexible funding: Companies raise capital privately through angel investors, venture capital funds, private placements, convertible notes (common for startups), and preference shares.

This combination of control, privacy, and flexibility explains why a privately held company remains a preferred structure for startups and SMEs in India and globally.

Indian Examples: Infosys (before its IPO), Zoho Corporation, Zerodha, and Parle Products.

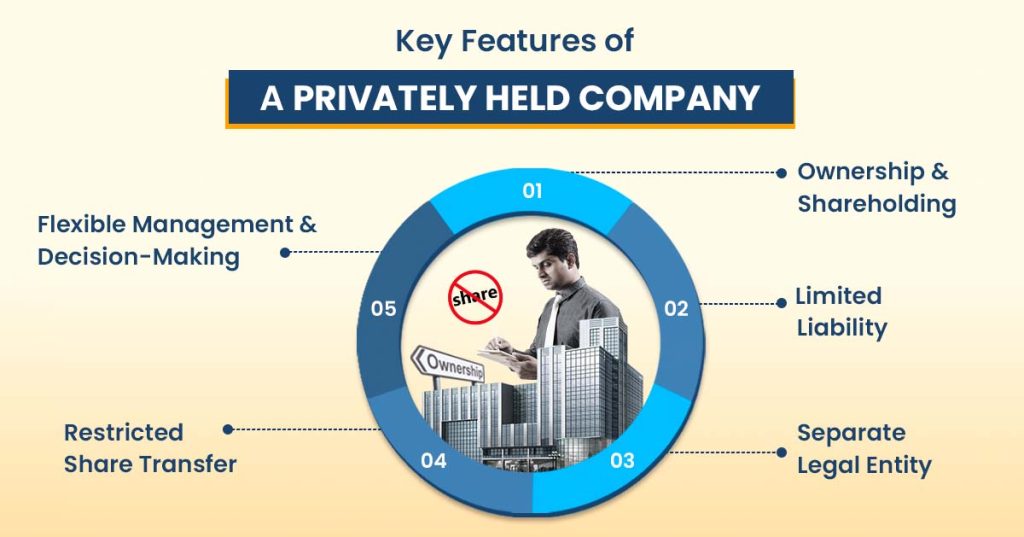

What Defines the Key Features of a Privately Held Company?

Understanding the key features of a privately held company helps explain why this structure is so popular among startups, SMEs, and private investors. Here’s a detailed look at its most important characteristics:

1. Ownership & Shareholding Structure: A small group of individuals, founders, family members, or private investors owns a privately held company. They do not trade their shares publicly, which ensures concentrated ownership and gives stakeholders greater control over business decisions.

2. Limited Liability of Shareholders: One major advantage is that limited liability protects shareholders’ personal assets from business debts or legal actions. This protection is especially crucial for entrepreneurs taking risks in the early stages.

3. Separate Legal Entity & Perpetual Succession: The law recognizes a privately held company as a separate legal entity, distinct from its owners. This allows the business to enter into contracts, own property, and continue operating even if ownership changes, ensuring perpetual succession.

4. Transferability of Shares: Shares in a privately held company usually have restricted transferability. This prevents unwanted parties from becoming shareholders and helps founders retain control.

5. Reporting & Disclosure Obligations: Privately held companies typically face fewer and less comprehensive reporting requirements compared to public companies, making compliance simpler, more flexible, and less time-consuming.

6. Capital Raising: Unlike public companies, which raise funds through stock markets, privately held companies raise capital through venture capital, private equity, internal accruals, or loans. This allows growth without exposing sensitive financial information to the public.

7. Flexibility in Management & Decision-Making: With fewer shareholders, a privately held company enjoys greater flexibility in management and decision-making. Shareholder approvals are less cumbersome, enabling faster strategic moves and operational changes.

These features collectively make a privately held company an ideal choice for entrepreneurs and investors who want to maintain control, safeguard information, and scale their business efficiently.

Advantages and Disadvantages of a Privately Held Company

A privately held company can provide several benefits to founders and investors, but it also comes with certain limitations. Knowing the privately held company advantages alongside potential drawbacks is essential for entrepreneurs and investors in India before deciding on this business structure.

| Advantages | Disadvantages |

| Less Public Disclosure: Private companies in India are not required to publicly disclose financials like public companies, ensuring confidentiality. | Limited Access to Capital: Raising funds is mostly restricted to private investors or promoters; public markets are off-limits. |

| Control by Founders/Promoters: Founders can maintain majority control without interference from public shareholders. | Lower Liquidity for Shareholders: Shares cannot be freely traded on stock exchanges, making exits harder. |

| Flexibility & Easier Pivoting: Decisions can be made quickly as fewer shareholders are involved. | Stricter Share Transfer Rules: Companies often restrict share transfers under the Companies Act, 2013. |

| Limited Liability: Shareholders’ personal assets are protected; liability is limited to the value of shares held. | Regulatory Compliance Still Required: Annual filings like MGT-7, AOC-4, and GST/PF compliance are mandatory. |

| Credibility with Customers & Investors: Being a private limited company enhances trust among clients, suppliers, and lenders. | Scaling Challenges: Raising large-scale capital for expansion is slower than for public companies. |

| Simpler Management Structure: Fewer directors and stakeholders lead to streamlined operations. | Perception Limits: Some investors or large clients may prefer public companies due to transparency. |

Closely Held Company vs Private Company

When comparing a closely held company and a private company, it’s important to understand that the two terms are related but not identical. A small group of people owns a closely held company, whereas the Companies Act, 2013, legally recognizes a private company with defined rules on membership, share transfer, and public funding.

| Feature | Closely Held Company | Private Company |

| Definition | Owned by a small group (family, friends, partners) with restricted share transfers. | Defined under Section 2(68) of the Companies Act, 2013, it restricts share transfers, limits members, and prohibits public share subscription. |

| Legal Status | Not a separate legal category; descriptive term only. | Legally recognized entity with specific compliance and governance rules. |

| Membership Limit | Typically small, no legal cap. | Legally limited to 200 members (excluding employees/former employees). |

| Share Transfer | Usually restricted to a small group. | Explicitly restricted by law via articles of association. |

| Public Funding | Cannot raise capital from the public; relies on private sources. | Prohibited from inviting the public to subscribe to shares or debentures. |

| Examples | Family businesses, small startups with limited investors. | Private Limited Companies, small tech startups, and family-owned companies. |

For entrepreneurs or business owners with questions about company structures, membership limits, or compliance requirements, RegisterKaro offers expert guidance. They also provide free consultations to help you choose the best structure for your business.

Privately Held Company Examples: Successful Indian & Global Private Companies

Looking at examples of privately held companies shows how staying private can give founders greater control over strategy, funding decisions, and long-term growth.

1. Global Examples

- Cargill (USA): Family-owned, allowing long-term investments in agribusiness without pressure from quarterly results.

- Koch Industries (USA): Private ownership enabled diversification into multiple industries while maintaining control.

- Deloitte (Global): A private partnership structure enables flexibility in leadership and decision-making across multiple countries.

2. Indian Examples

- Tata Sons: The company group made strategic decisions and investments privately, allowing it to expand across industries without immediate public scrutiny.

- Flipkart: Staying private allowed the founders to focus on logistics and customer growth before attracting global investors like Walmart.

- Reliance Retail (Initially): Founder-led expansion enabled rapid retail growth across India without shareholder pressures.

Why These Examples Matter to Entrepreneurs

- Strategic Flexibility: Private companies can make long-term decisions without public scrutiny.

- Funding Choices: Access to private equity or angel investment is easier to manage.

- Control & Vision: Founders retain greater control over growth, culture, and operations.

What is the Process to Incorporate a Privately Held Company in India?

Starting a privately held company in India requires following a structured legal process. Understanding the following steps helps entrepreneurs avoid mistakes and ensures smooth registration:

Step 1: Get Digital Signature Certificates (DSC)

Every proposed director and shareholder must have a Class 3 DSC to sign registration documents electronically.

- Validity: 2 years

- Cost: ₹1,000 – ₹2,000 (depends on the provider)

- Common Providers: eMudhra, NIC, or other MCA-approved agencies

Note: Foreign applicants must notarize and apostille their identity proofs.

Step 2: Apply for Director Identification Number (DIN)

Each director needs a unique Director Identification Number (DIN). When using the SPICe+ form, DINs are automatically issued during incorporation; no separate application is required.

- Validity: Lifetime

- Foreign Directors: Can apply using a valid passport and overseas address proof

Step 3: Reserve Your Company Name

For new companies, name reservation is now mainly done through SPICe+ Part A, while the Reserve Unique Name (RUN) service is primarily for LLPs or name changes.

Guidelines:

- The name must be unique and follow MCA rules

- It cannot match existing registered names or contain restricted words

Processing Time: 1–2 working days

Authorities reserve approved names for 20 days.

RegisterKaro Advantage: We conduct a thorough name check to increase approval chances and suggest alternate options if required.

Step 4: Prepare & Draft Essential Documents

This step includes drafting key legal documents for your company. Our experts ensure accurate and compliant documentation, including:

- Memorandum of Association (MOA) defines the company’s main objectives

- Articles of Association (AOA) specify internal rules and management structure

- Director’s Consent & Declaration Forms

- Registered Office Proofs, rent agreement, latest utility bill, and owner’s NOC

Applicants must digitally sign all documents and format them according to MCA guidelines.

Step 5: File the Incorporation Form (SPICe+)

Applicants submit the SPICe+ form online along with all documents and government fees based on their authorized capital. This single form includes:

- Company incorporation

- PAN and TAN allotment

- EPFO & ESIC registration

- Bank account setup

Ensure all documents are in PDF format, self-attested, and that director details are accurate before submission to avoid rejection.

Step 6: Receive Your Certificate of Incorporation (COI)

Once verified by the Registrar of Companies (ROC), you’ll receive the Certificate of Incorporation (COI), your official proof of registration. It includes:

- Corporate Identity Number (CIN)

- Company’s PAN

- Company’s TAN

At RegisterKaro, we complete most company registrations within 7–10 working days, depending on document accuracy and government processing time. Once you get your COI, your company is legally ready to start operations and open a business bank account.

For details on the timeline for your business, check out How Long Does It Take to Register a Company in India.

Eligibility Criteria for Privately Held Company

To register a Privately Held Company in India, you must meet the following eligibility requirements:

- The company must have at least two directors to begin the registration process.

- Out of these directors, at least one must be an Indian resident, meaning they must have stayed in India for 182 days or more in the previous financial year.

- A privately held company can have up to 15 directors by default. The company can increase this limit by passing a special resolution approved by the shareholders.

- You must have at least two shareholders to incorporate the company. The same individuals can also act as directors.

- The total number of shareholders cannot exceed 200, excluding current and former employees who hold shares under an employee stock option or similar plan.

- The company must have a registered office address in India. This is the official address for all government communication. If the property is rented, you must provide address proof and a No Objection Certificate (NOC) from the property owner.

You can also check our guide on how to get NOC for a business address to understand the process and required documents.

- You must select a unique and valid company name that follows the MCA naming guidelines. Understanding how to choose a proper company name before applying is very important.

- The company does not need a minimum paid-up capital, but it must declare its authorized share capital and pay the government fee during registration.

- Every director must have a Director Identification Number (DIN), issued by the Ministry of Corporate Affairs (MCA).

- All proposed directors must also get a Class 3 Digital Signature Certificate (DSC), used to digitally sign the registration documents.

Eligibility conditions can vary depending on the business type, region, and authority requirements, so it’s important to verify everything before moving to the documentation stage.

Post-Incorporation Compliance Requirements for a Privately Held Company

After registration, every Privately Held Company in India must follow certain annual compliance requirements. These compliances include filing annual returns, holding meetings, and maintaining company records. Fulfilling them ensures your company stays legally protected and avoids penalties or legal issues.

| Compliance Area | Details |

| Annual Filings | |

| Form MGT-7 (Annual Return) | – Must be filed within 60 days of the Annual General Meeting (AGM) – Includes details of shareholders, directors, and any shareholding changes |

| Form AOC-4 (Financial Statements) | – Must be filed within 30 days of the AGM -Contains the Balance Sheet, Profit & Loss Account, and Cash Flow Statement – Needs to be signed by directors and verified by auditors |

| Board & General Meetings | |

| Board Meetings | – The first board meeting should be held within 30 days of incorporation – At least 4 board meetings must be held every year – Proper notices and meeting minutes must be maintained |

| Annual General Meeting (AGM) | – Should be conducted within 6 months of the financial year-end – The first AGM must be held within 9 months of incorporation |

| Statutory Requirements | |

| Mandatory Registers | – Register of Members – Register of Directors – Register of Charges – Minutes of Board and General Meetings |

| Taxation Compliance | |

| Income Tax | – File the Income Tax Return (ITR) every year – Pay advance tax if applicable – Tax audit required if turnover is above ₹1 crore (or ₹5 crore for digital businesses) |

| GST (if applicable) | – File monthly or quarterly GST returns – GSTR-9 Filings – Generate E-way bills for goods movement |

| TDS (if applicable) | – Deduct and deposit TDS on time – File quarterly TDS returns – Issue TDS certificates to deductees |

It’s always best to consult professionals like RegisterKaro for guidance on post-registration compliance. You can also refer to the TDS Compliance Checklist for Privately Held Companies to ensure full compliance with legal norms.

How to Value a Privately Held Company?

Understanding how to value a privately held company is essential for attracting investors, negotiating deals, or planning business exits. Since private firms don’t have a public share price, valuation relies on financial data and industry comparisons.

- Asset-Based Valuation: Determines the company’s worth by subtracting liabilities from total assets. Suitable for firms with significant physical or financial assets.

- Income (Discounted Cash Flow) Method: Estimates the present value of future earnings or cash flows. Commonly used for growth-oriented startups with predictable revenue.

- Market (Comparable Companies) Method: Compares your firm to similar businesses in the market. Adjustments are made for differences in size, risk, and liquidity.

- Earnings or EBITDA Multiples: Applies industry valuation multiples to profits or EBITDA. Offers a quick, benchmark-based estimate of company worth.

- Strategic Premiums: Adds extra value for control, synergies, or market advantage in potential acquisitions. Often used in merger or investor negotiations.

How a Privately Held Company Complies with Legal & Regulatory Requirements

Before setting up a privately held company, it’s important to understand the legal framework that governs its formation, operation, and compliance. The Companies Act, 2013, lays down specific provisions that define and regulate private companies in India.

- Legal Definition (Section 2(68) of the Companies Act, 2013): A private company restricts the transfer of its shares, limits the number of members to 200, and cannot invite the public to subscribe to its securities.

- Limited Number of Shareholders: The total number of shareholders cannot exceed 200, ensuring ownership remains closely held and decisions stay within a smaller group.

- Restrictions on Share Transfer: Shares are not freely tradable; transfers usually require approval from existing shareholders, preserving control within the company.

- No Public Invitation for Shares: The law prohibits private companies from offering their shares to the general public, which differentiates them from public limited companies.

- Tax Benefits & Compliance Requirements: Private limited companies can benefit from a lower corporate tax rate of about 22% under the new regime. However, they must meet annual compliance, such as audits, board meetings, and MCA filings.

- Recent Legal Updates: The Ministry of Corporate Affairs (MCA) has simplified compliance with online systems like SPICe+ for incorporation and AGILE-PRO for GST and EPFO registration.

- Conversion Between Company Types: A private company can convert to a public company for raising funds through an IPO, while a public company can revert to private status to regain control, subject to MCA and NCLT approval.

Understanding these regulations helps business owners stay compliant and choose the right structure efficiently.

Summary

A privately held company offers the perfect balance of control, flexibility, and confidentiality, making it the preferred structure for startups, SMEs, and family-run businesses in India. With benefits like limited liability, simpler compliance, and tax efficiency, it allows entrepreneurs to focus on long-term growth without the constant pressure of public scrutiny or investor expectations.

However, success in running a private limited company depends on staying compliant with legal and regulatory requirements under the Companies Act, 2013. Whether you’re incorporating a new business, managing annual filings, or planning a company conversion, RegisterKaro provides expert assistance every step of the way. Get in touch with RegisterKaro today to incorporate your privately held company seamlessly and ensure full compliance with Indian corporate laws.

Frequently Asked Questions

A small group of individuals, such as founders, family members, or private investors, owns a privately held company, rather than the public. It does not trade shares on the stock exchange, offering more control, privacy, and flexibility to its owners while ensuring limited liability and simpler compliance requirements compared to public companies.